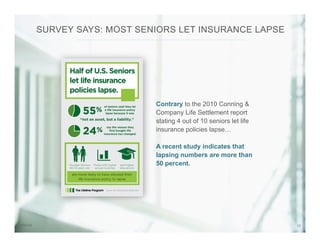

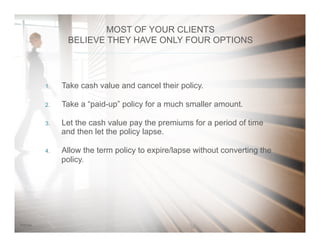

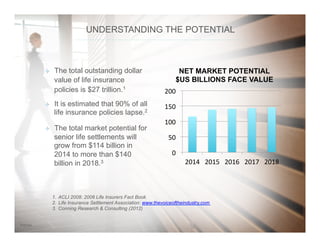

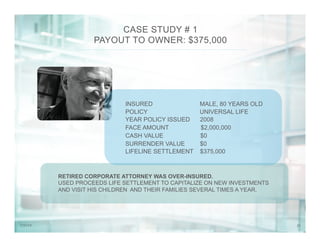

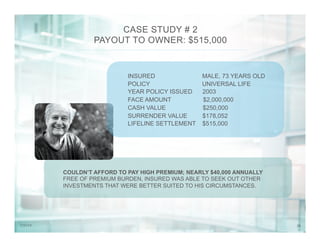

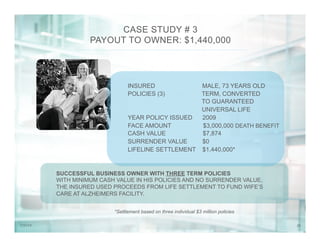

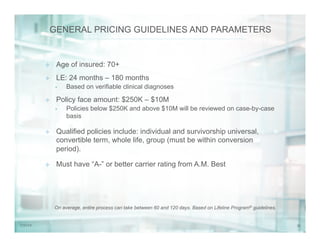

The document discusses life settlements, which involve selling existing life insurance policies for fair market value that often exceeds the insurance company's cash value offer. It highlights the legal framework, financial implications, and the growing acceptance of life settlements as a valuable financial planning tool, especially in light of increasing longevity and the financial needs of seniors. Key points include the potential for life settlements to alleviate unnecessary premium payments and serve as an alternative funding source for long-term care.