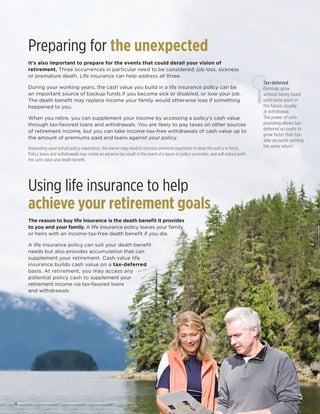

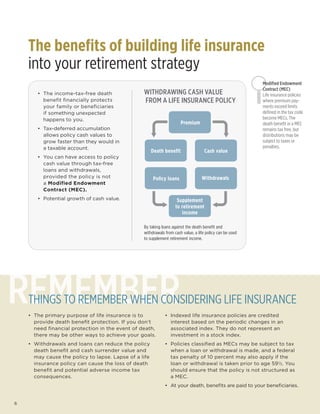

This document discusses how life insurance can help achieve retirement goals by providing tax advantages. It notes that life insurance builds cash value on a tax-deferred basis that can supplement retirement through tax-favored loans and withdrawals. The document provides an example of a couple using policy withdrawals in retirement to lower their taxes while funding special expenses. It highlights the benefits of leveraging a life insurance policy for retirement through its death benefit, tax-deferred growth, and potential access to cash values.