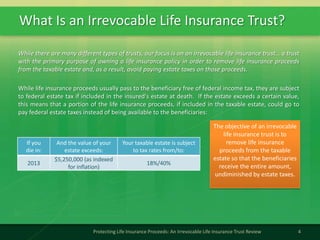

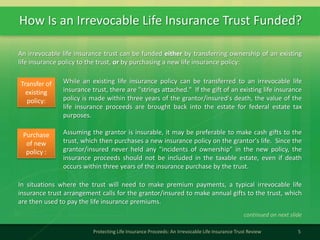

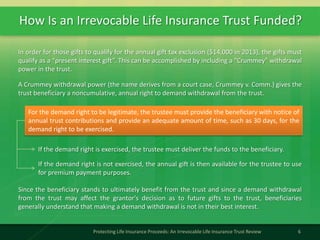

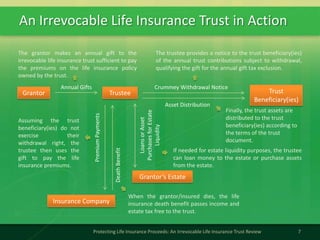

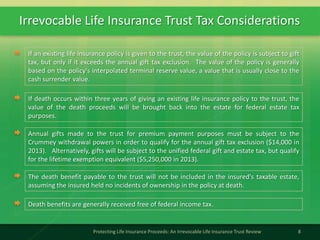

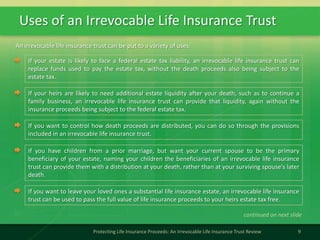

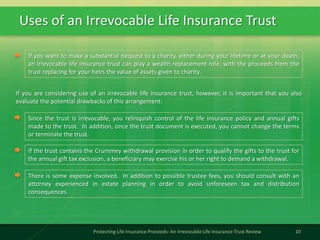

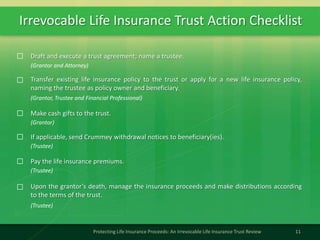

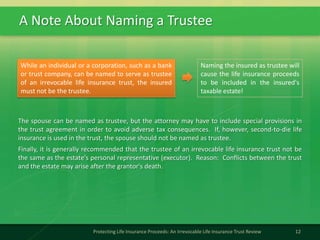

An irrevocable life insurance trust can be used to protect life insurance proceeds from estate taxes and provide benefits to heirs. The trust is funded by purchasing a new life insurance policy or transferring an existing one. The grantor makes annual gifts to the trust, subject to beneficiaries' withdrawal rights, to pay premiums. Upon the grantor's death, proceeds pass estate and income tax-free to trust beneficiaries for uses like replacing income or funding a family business.