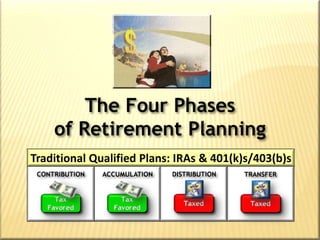

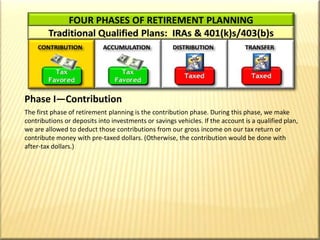

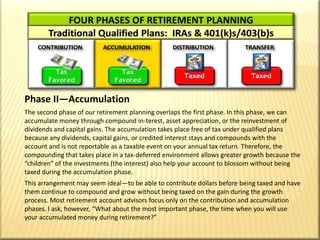

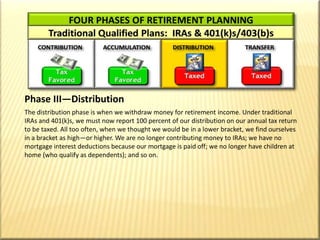

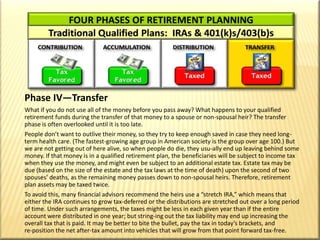

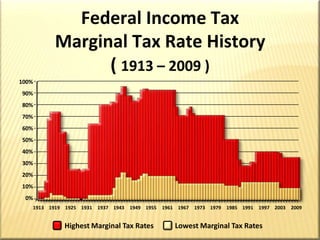

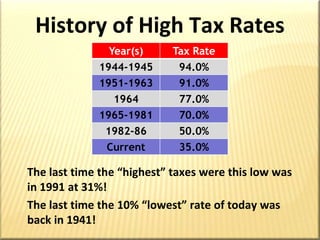

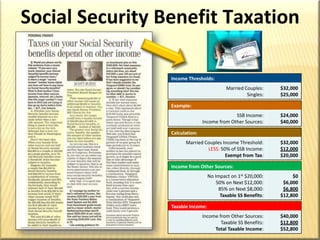

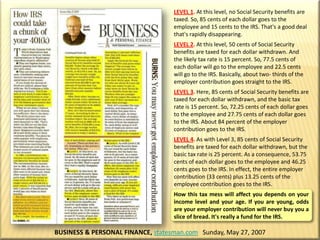

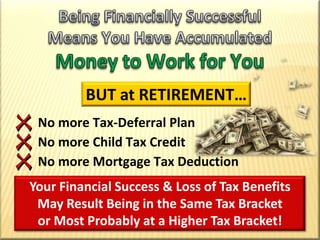

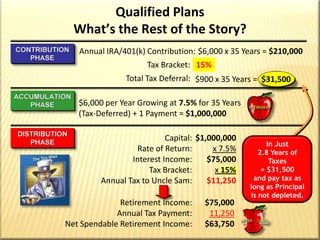

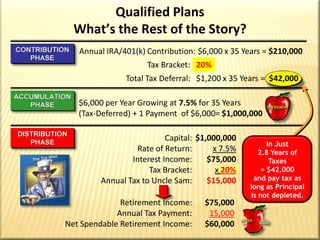

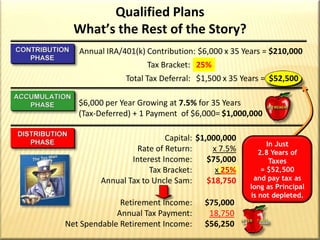

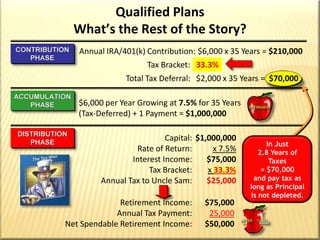

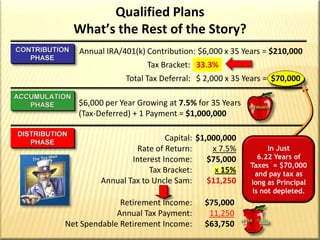

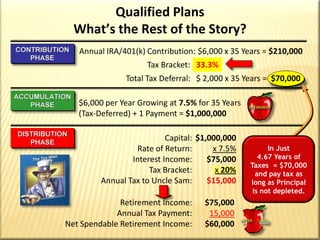

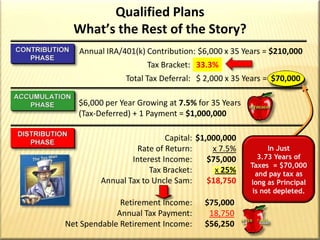

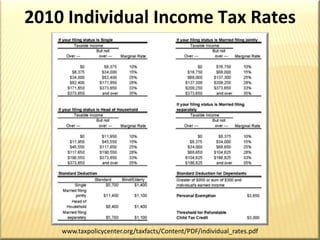

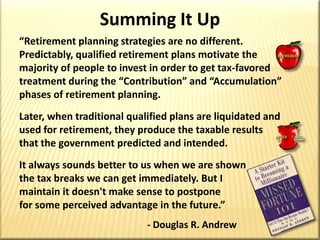

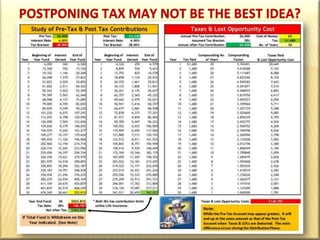

The document discusses the four phases of retirement planning: contribution, accumulation, distribution, and transfer. During the contribution phase, contributions are made to retirement accounts with pre-tax dollars. In the accumulation phase, money grows tax-deferred through compound interest. In the distribution phase, withdrawals in retirement are taxed as ordinary income, often at a higher rate than during working years. In the transfer phase, inherited retirement funds may be taxed twice, upon distribution to heirs and as part of the estate. The document argues that higher taxes in retirement can reduce the purchasing power of savings.