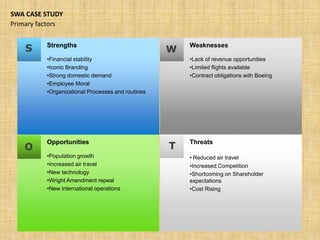

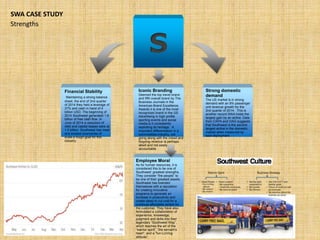

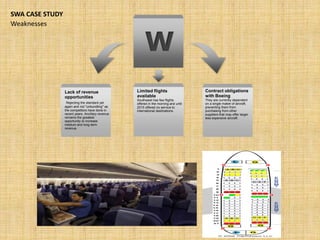

Southwest Airlines has experienced strong financial stability and growth since 1971 through their low cost leadership strategy. They have strengths in their iconic branding, strong domestic demand, and high employee morale. However, they face weaknesses in limited revenue opportunities and flight availability, as well as threats from increased competition and rising costs. Going forward, Southwest should look to capitalize on opportunities presented by population growth, new technology, and their 2015 international expansion, while addressing weaknesses and threats through diversifying revenue streams and controlling costs.