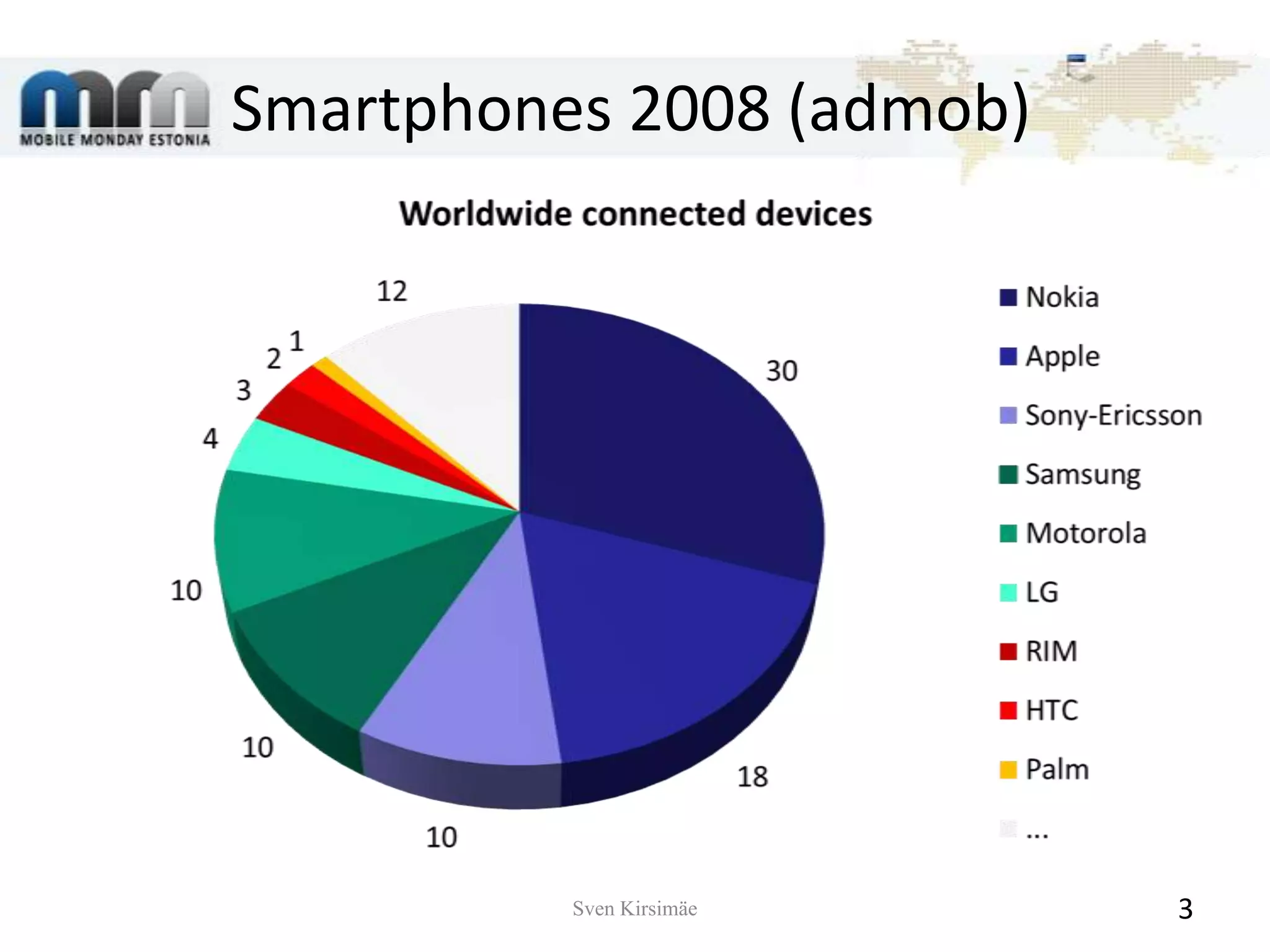

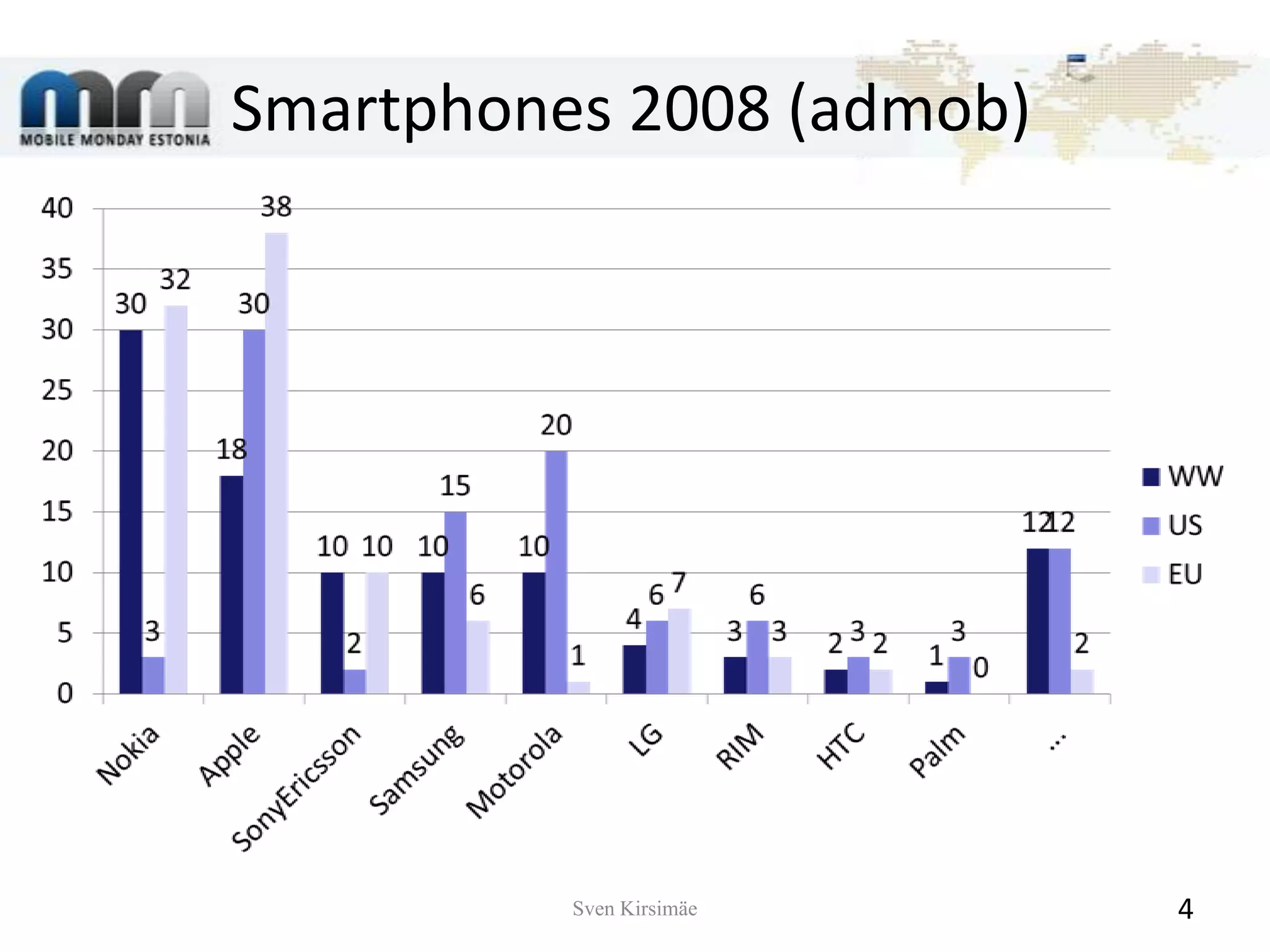

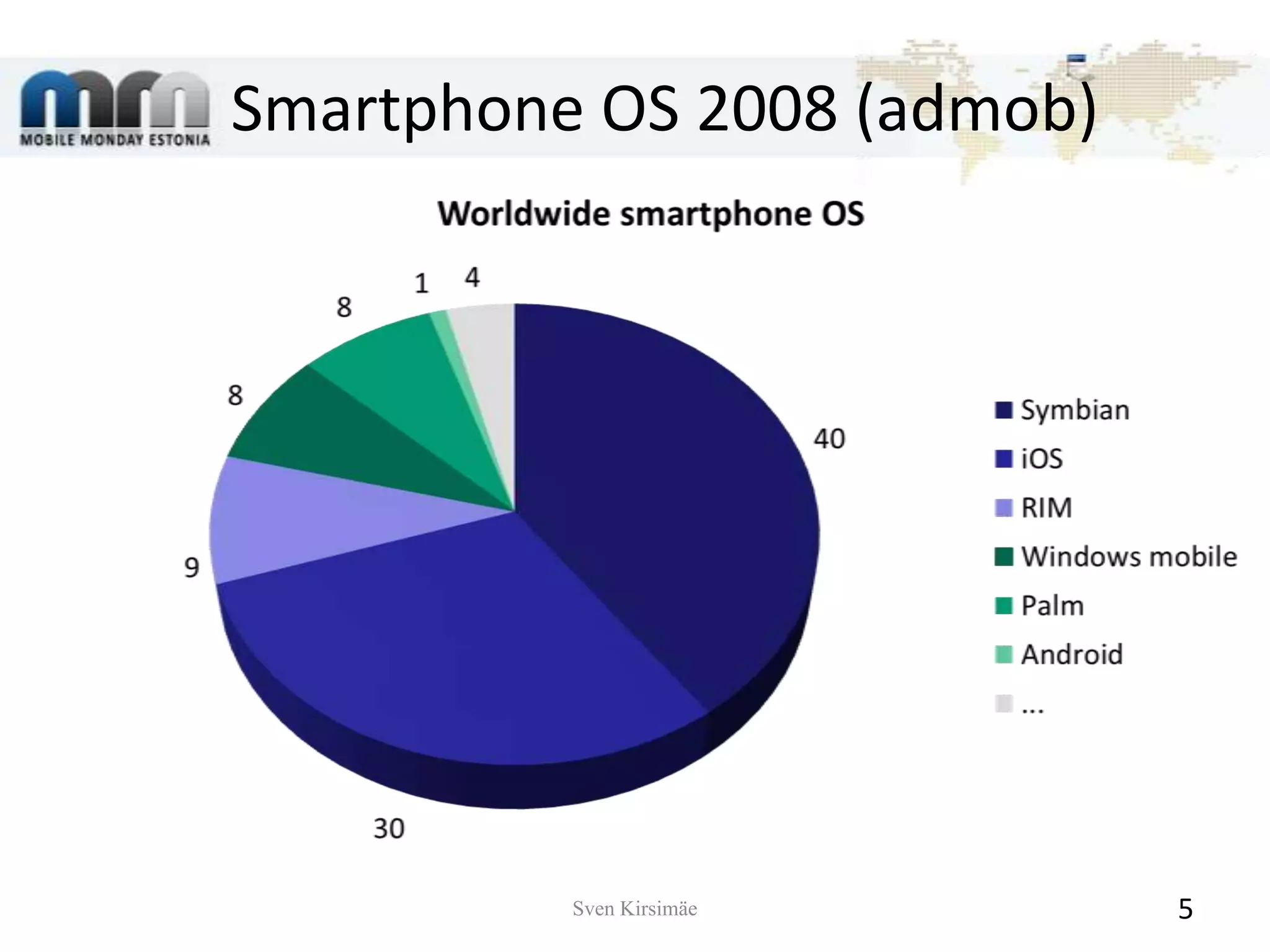

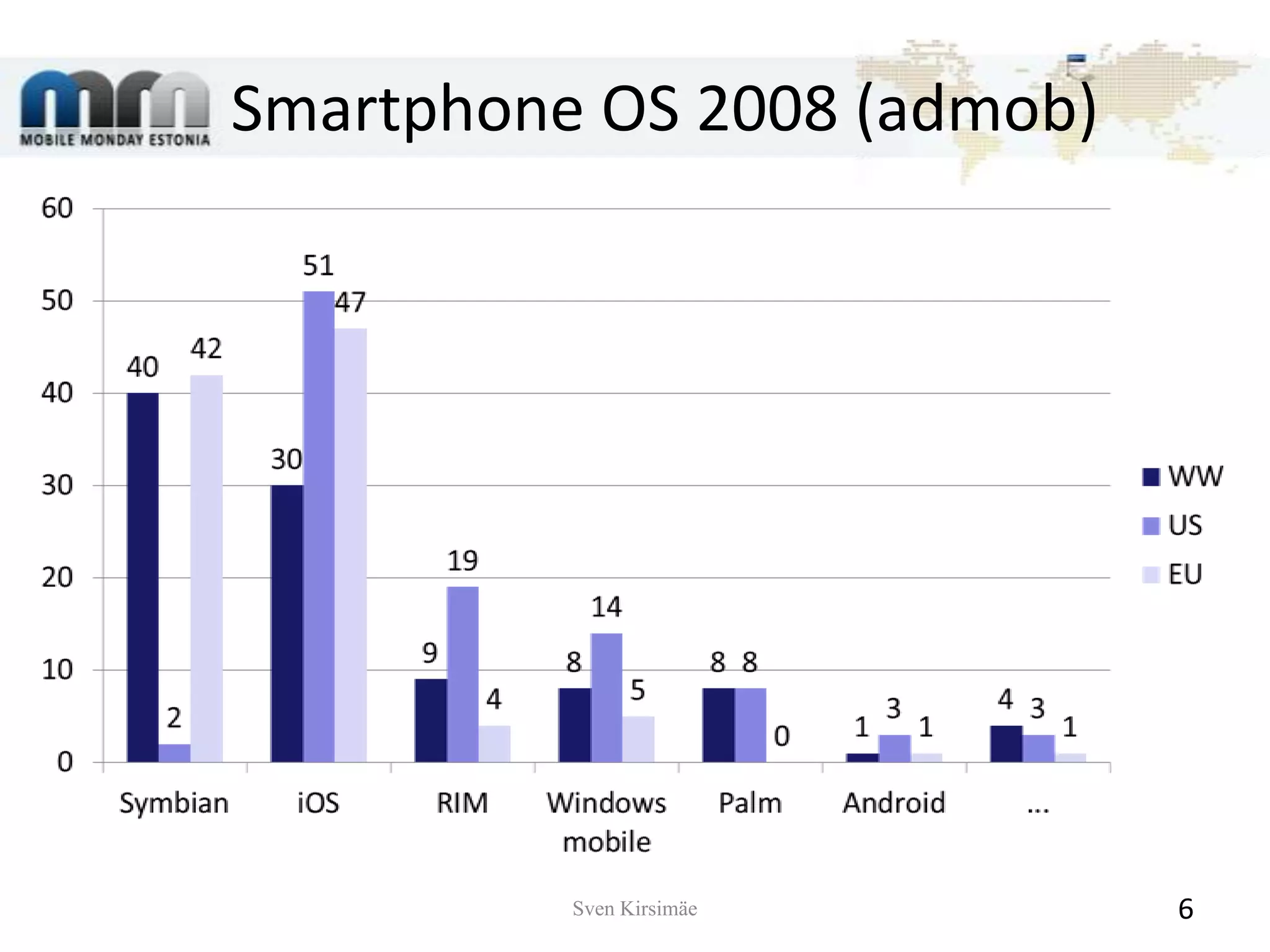

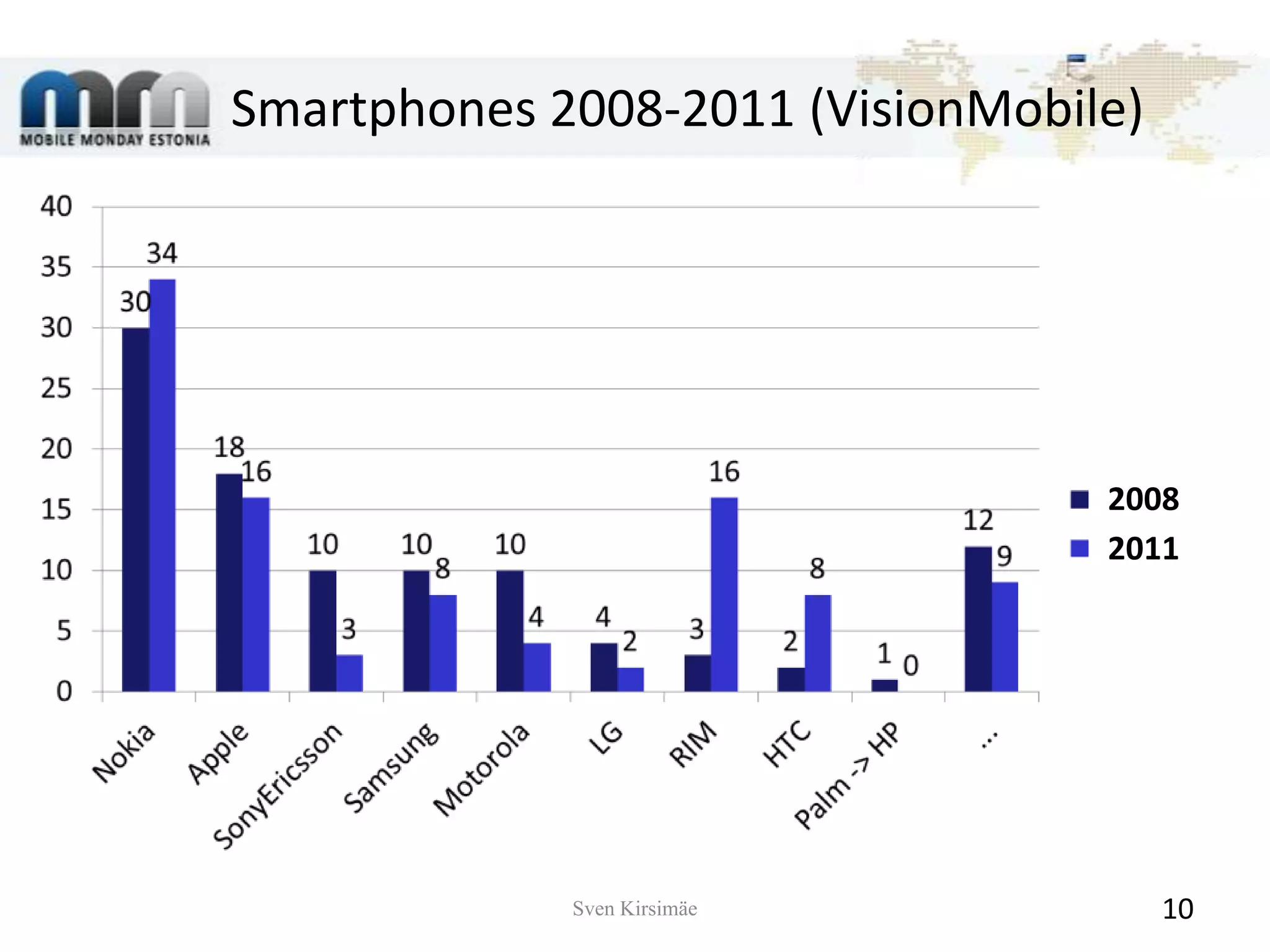

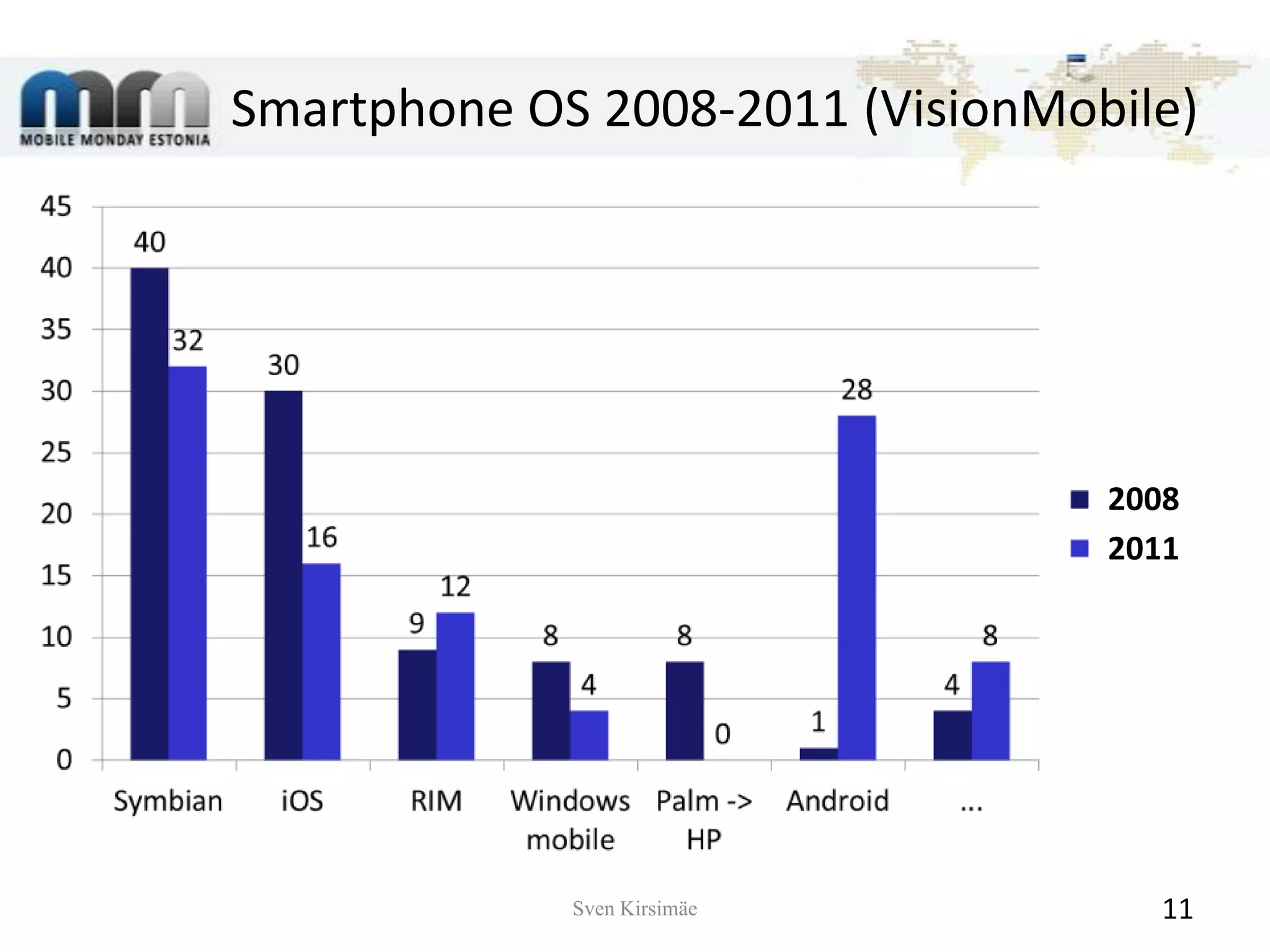

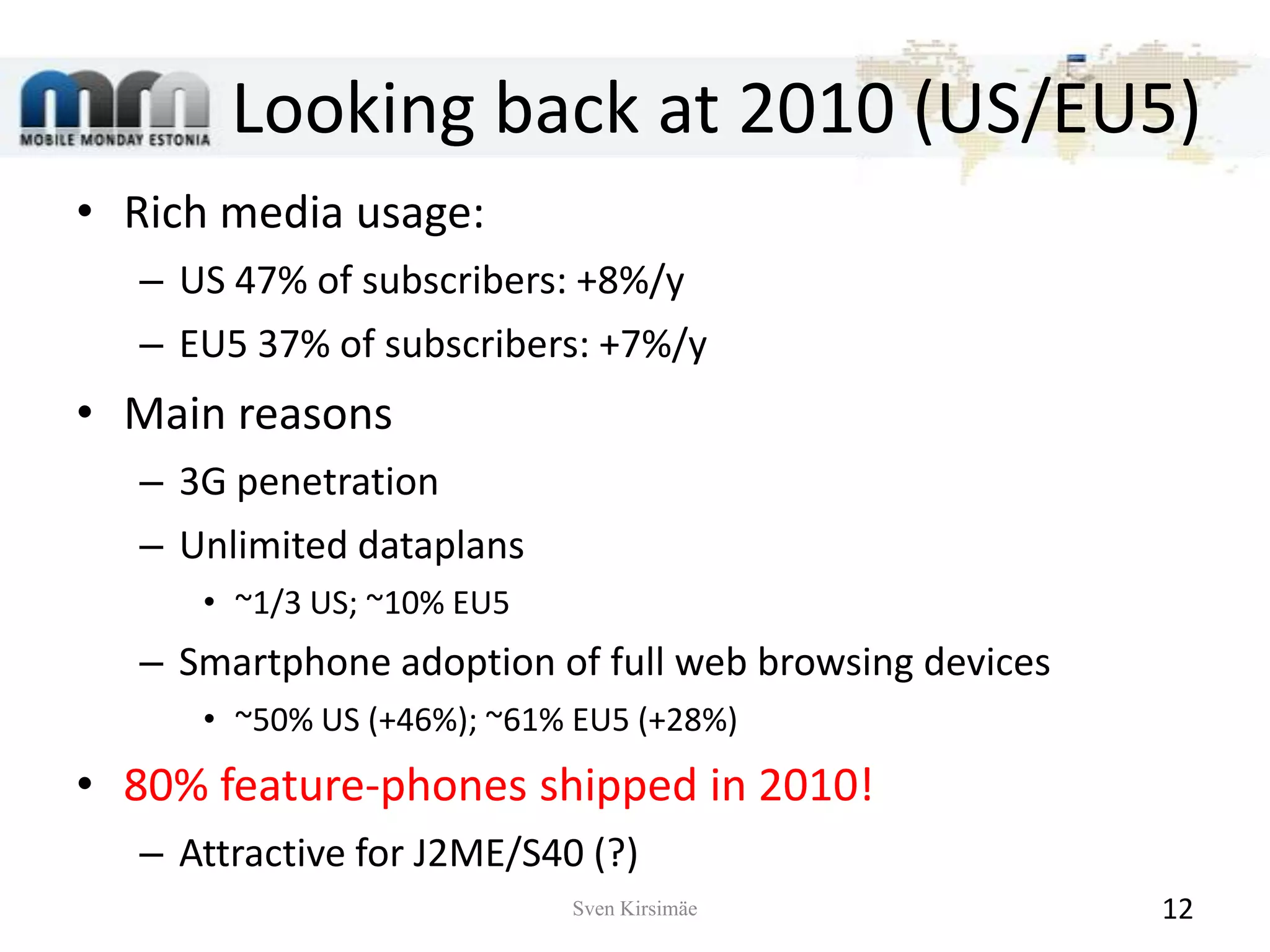

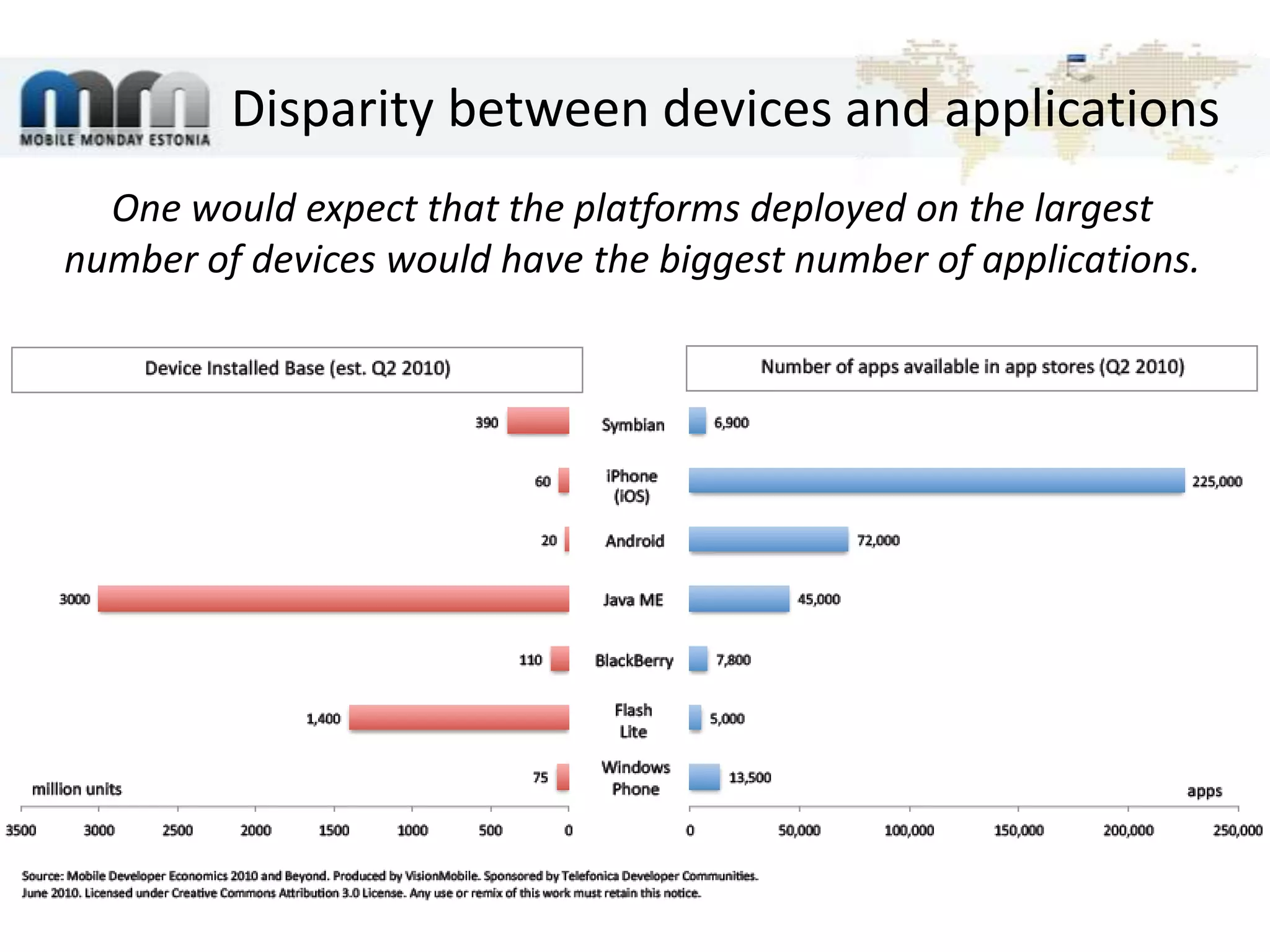

Sven Kirsimäe worked in mobile software development from 2008 to 2011. During this period, the market share of iOS increased by 30% while Symbian declined by 20%. Smartphones made up around 25% of total mobile traffic worldwide in 2008, with iPhone traffic accounting for around 25% of smartphone traffic. By 2011, tablets had emerged as a new form factor with around 40 models on the market, while mobile cloud computing and the challenges of 3G network overload led to the development of 4G networks. Estonia saw the rise of disruptive technologies like Skype's mobile client and the increased adoption of e-voting and mobile ID from 2007 to 2011.