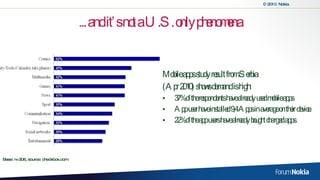

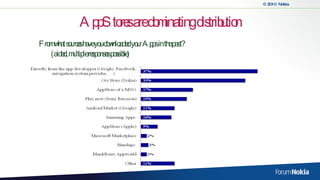

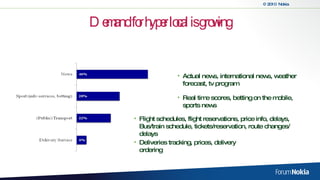

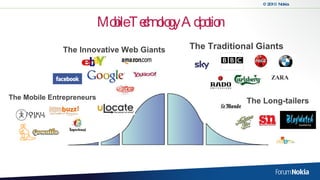

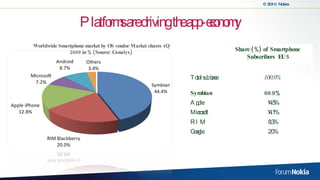

The document discusses the growth and impact of mobile applications on the economy, highlighting statistics on mobile app usage and trends in Serbia and the U.S. It covers the types of applications, their distribution through app stores, and the evolving mobile technology landscape. Challenges such as fragmentation and billing are also addressed, emphasizing the need for a strategic approach to mobile services.

![Thank you! [email_address] http://www.forum.nokia.com #forumnokia #ovi](https://image.slidesharecdn.com/juresustersic-mobileappsandinternet-100610122704-phpapp02/85/Mobile-apps-and-internet-25-320.jpg)