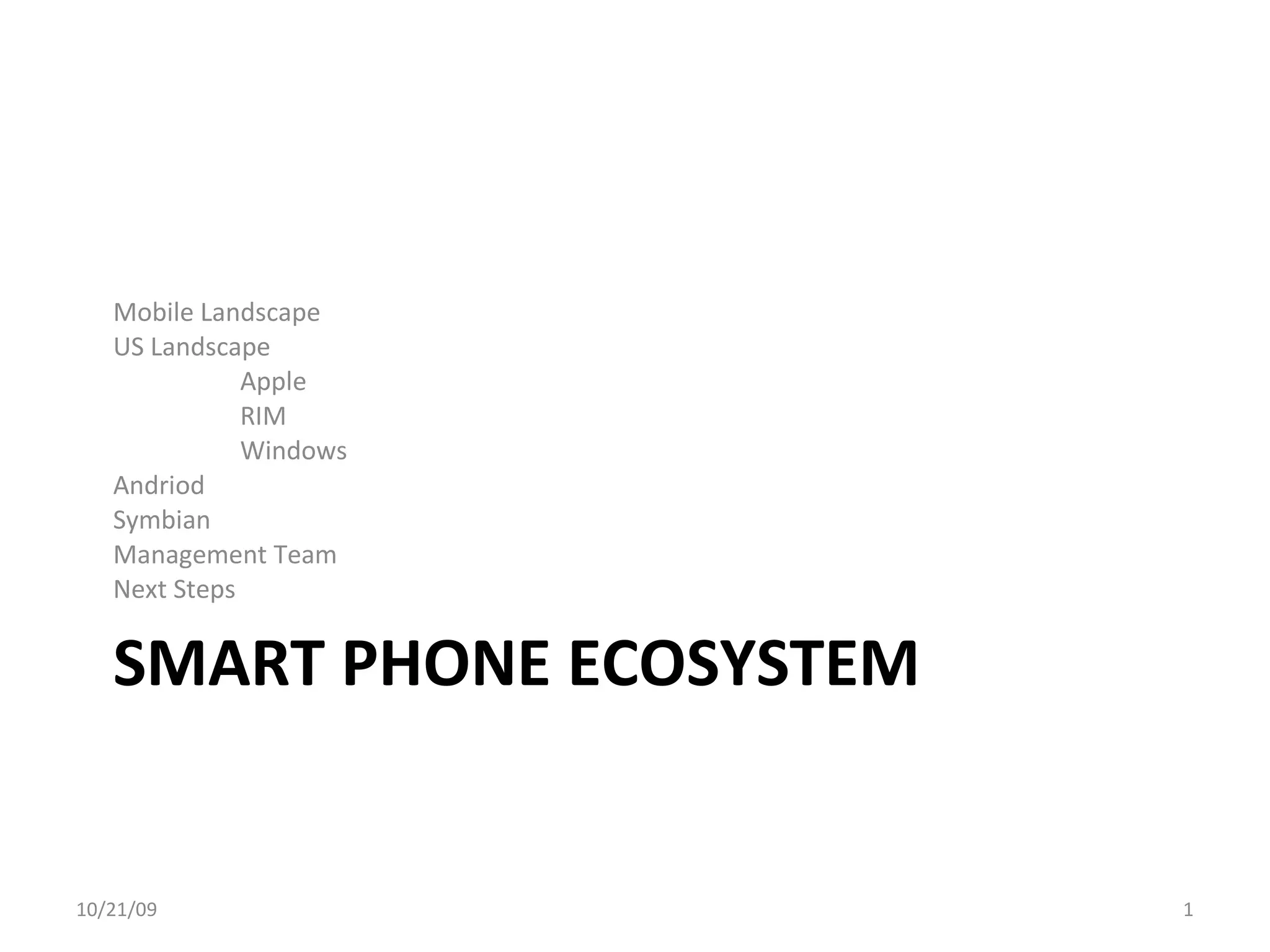

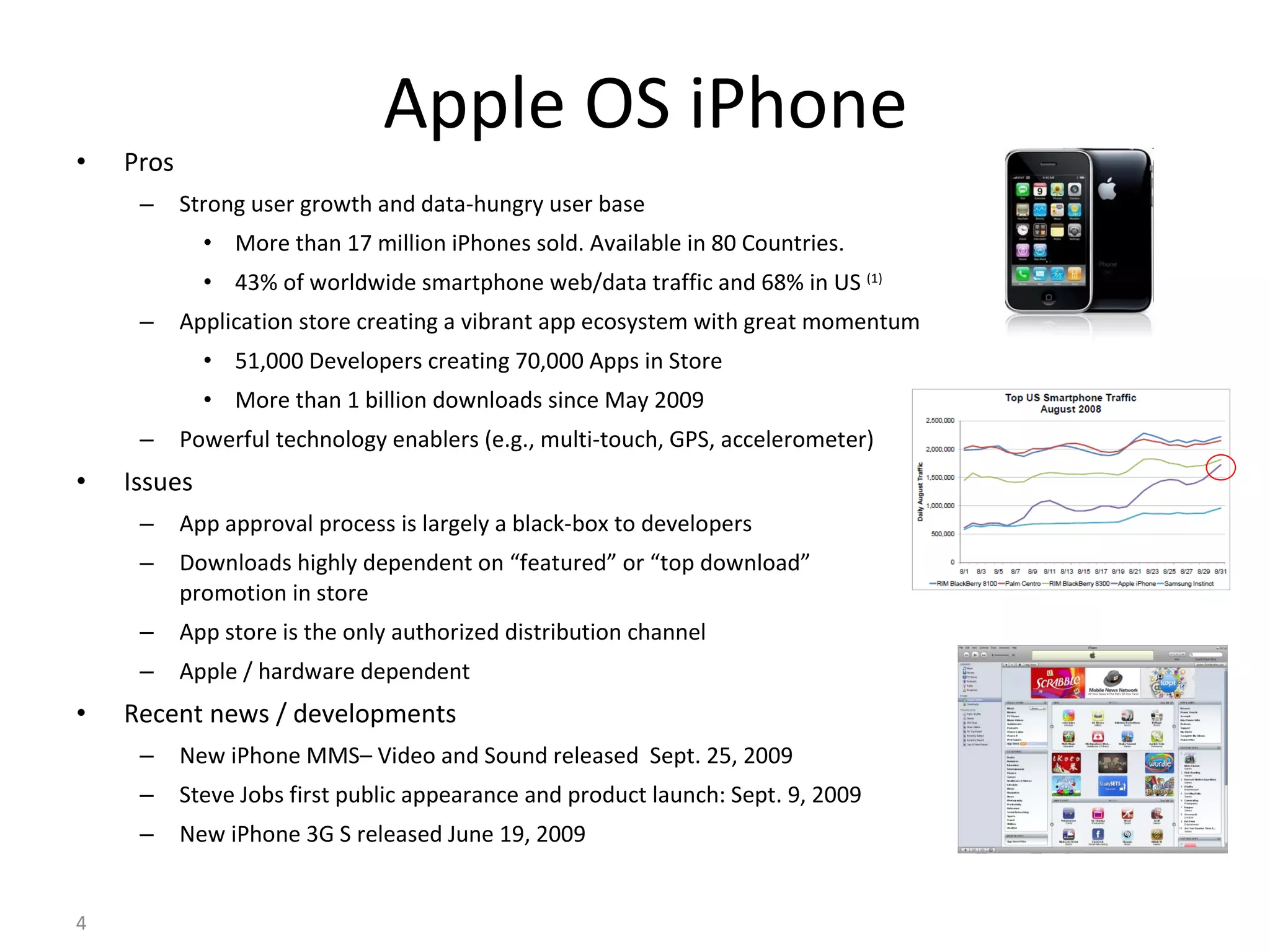

This document summarizes the mobile operating system landscape, comparing Apple (iPhone OS), RIM (BlackBerry OS), Microsoft (Windows Mobile), Google (Android), and Nokia (Symbian). It outlines each platform's market share, pros, issues, and recent developments. Key points of competition include application selection, developer support, and technology support like touchscreens and GPS.

![Contact The Team Stewart Dixon [email_address] 312-497-8995 Co-Founder and Managing Partner Mark Hahs [email_address] 661-703-9700 Co-Founder and Managing Partner Stephanie Piche [email_address] 310-729-2997 Vice President of Marketing Kyle Porter [email_address] 773-230-7117 Vice President of Business Development 10/21/09](https://image.slidesharecdn.com/part2-12560509925884-phpapp02/75/Part-2-9-2048.jpg)