This document discusses common TDS violations found during surveys conducted by the Income Tax Department. It outlines several types of common violations:

1) Non-deposition of taxes deducted, which is often seen in struggling businesses.

2) Failure to apply the normal deduction rates, as seen in an insurance business.

3) Failure to make any TDS deductions for a TPA (third party administrator) business.

4) Not treating non-refundable rent advances as attracting TDS under section 194I.

5) Misclassifying professional fees paid to guest lecturers as salary.

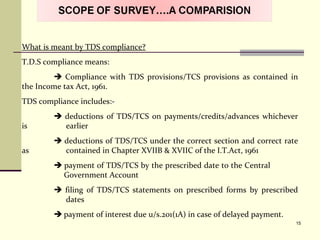

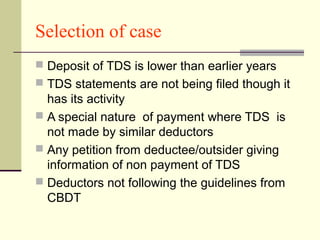

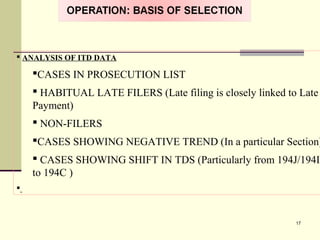

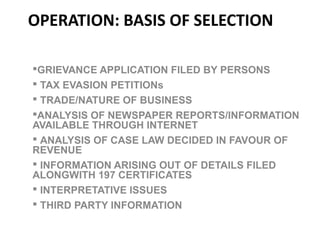

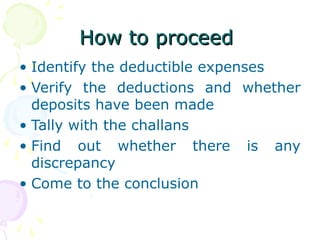

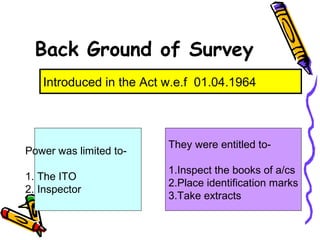

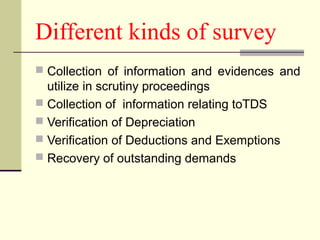

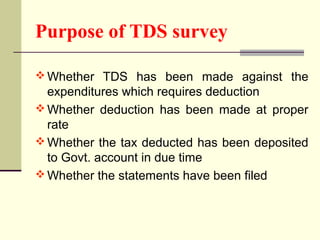

The document provides guidance on purpose, selection, operation, and procedures for conducting TDS surveys

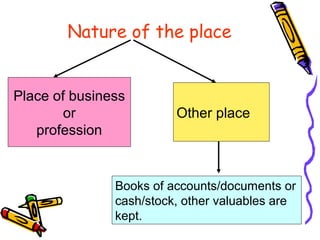

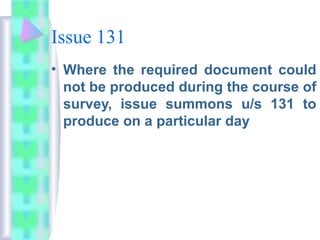

![•Survey is possible even to enquire about tax deducted at source

: Reckitt and Colman of India Ltd. vs. ACIT [2001] 251 ITR 306

(Cal).

•‰Residential premises can also be covered if some

business/professional work/document is being done / kept

there.

•‰Business or residential premises of third parties, including a

Chartered Accountant, a pleader, or Income Tax Practitioner, of

whom the assessee may be a client, are not places which could

be entered into for the purpose of section 133A. (Circular no.

7- D dt 3/5/1967)

14](https://image.slidesharecdn.com/surveyverification-130514033213-phpapp02/85/Survey-verification-14-320.jpg)