1) The document discusses the service of notices under the Income Tax Act of 1961 and how it draws from the Code of Civil Procedure of 1908.

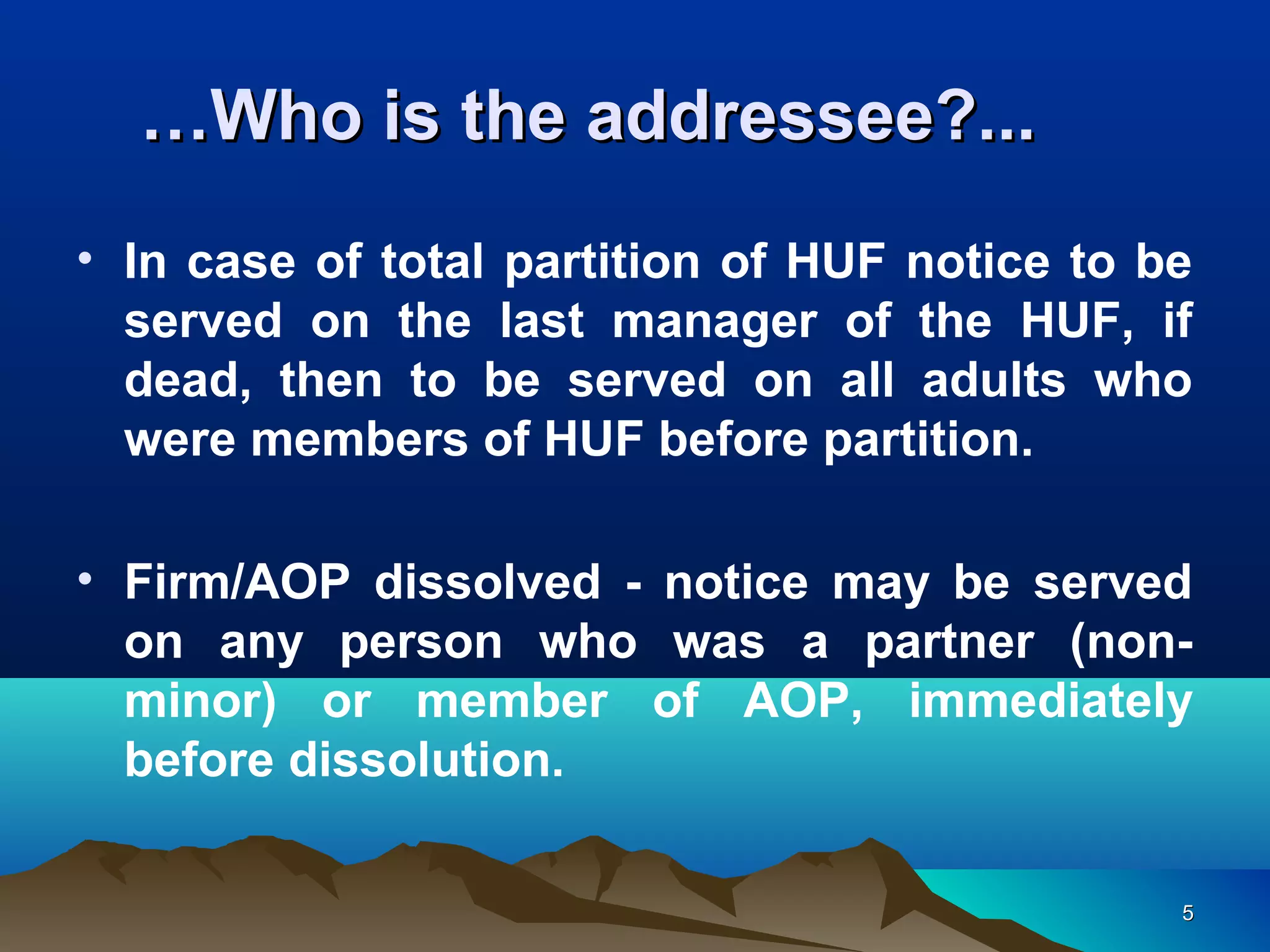

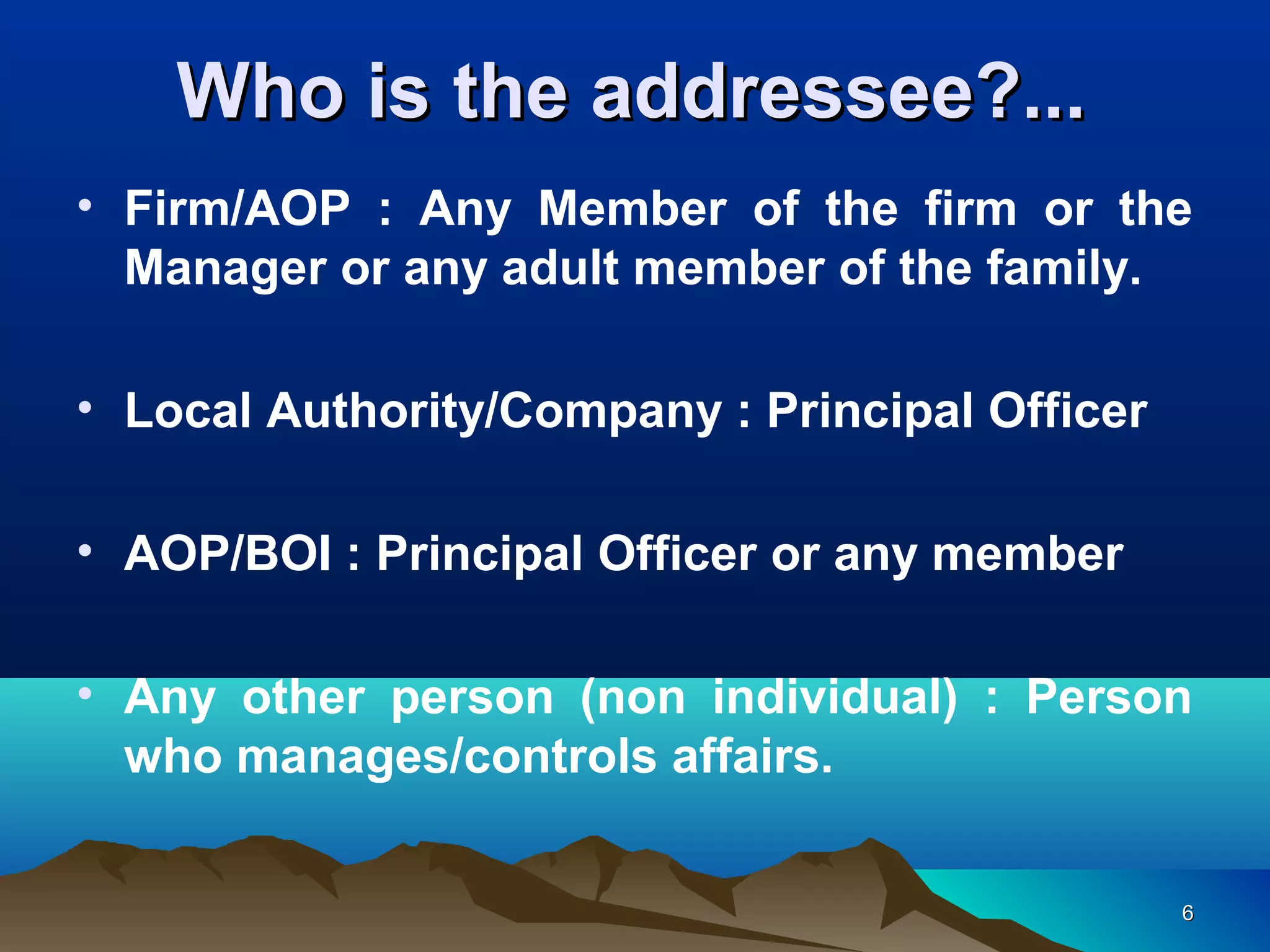

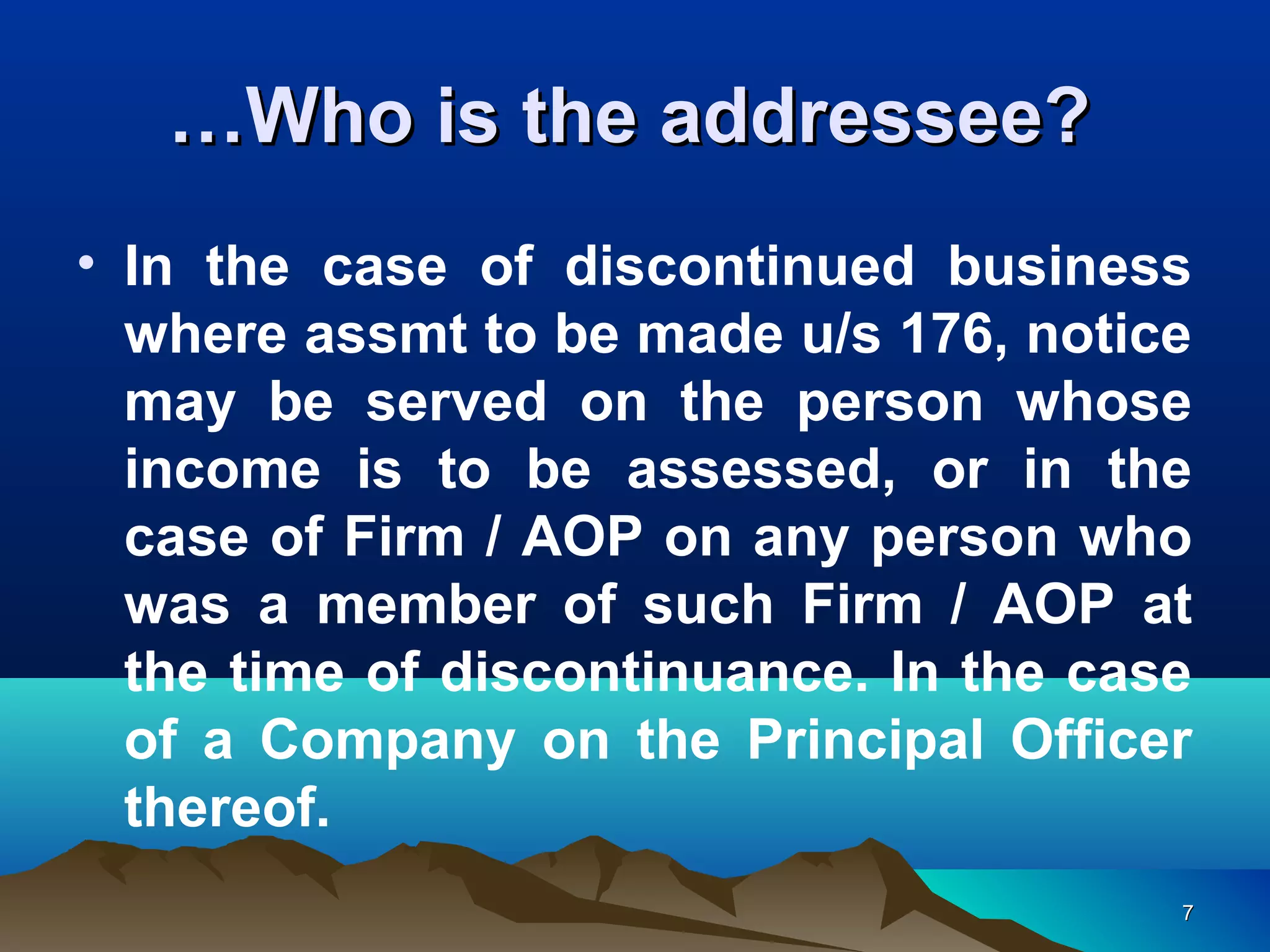

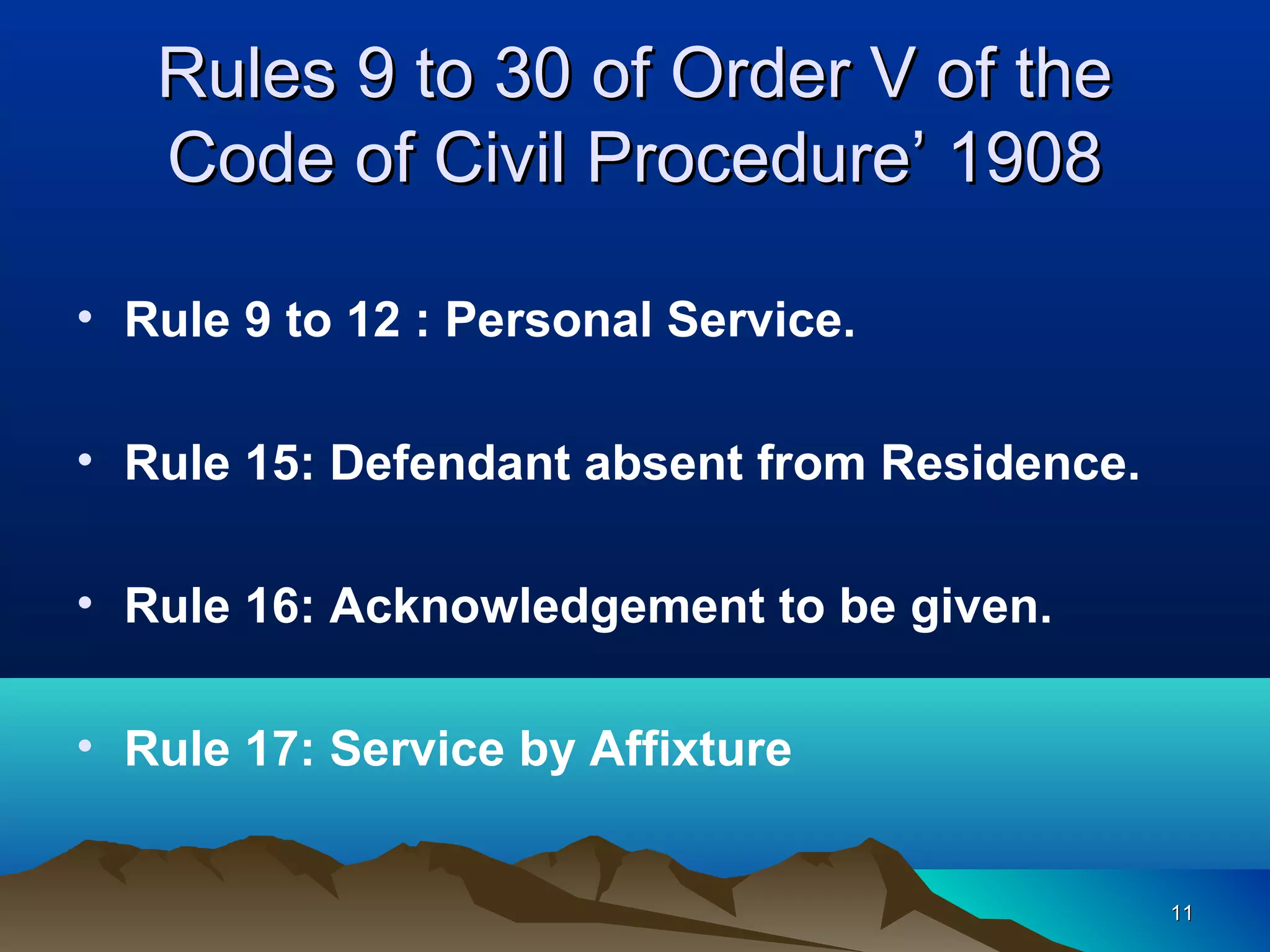

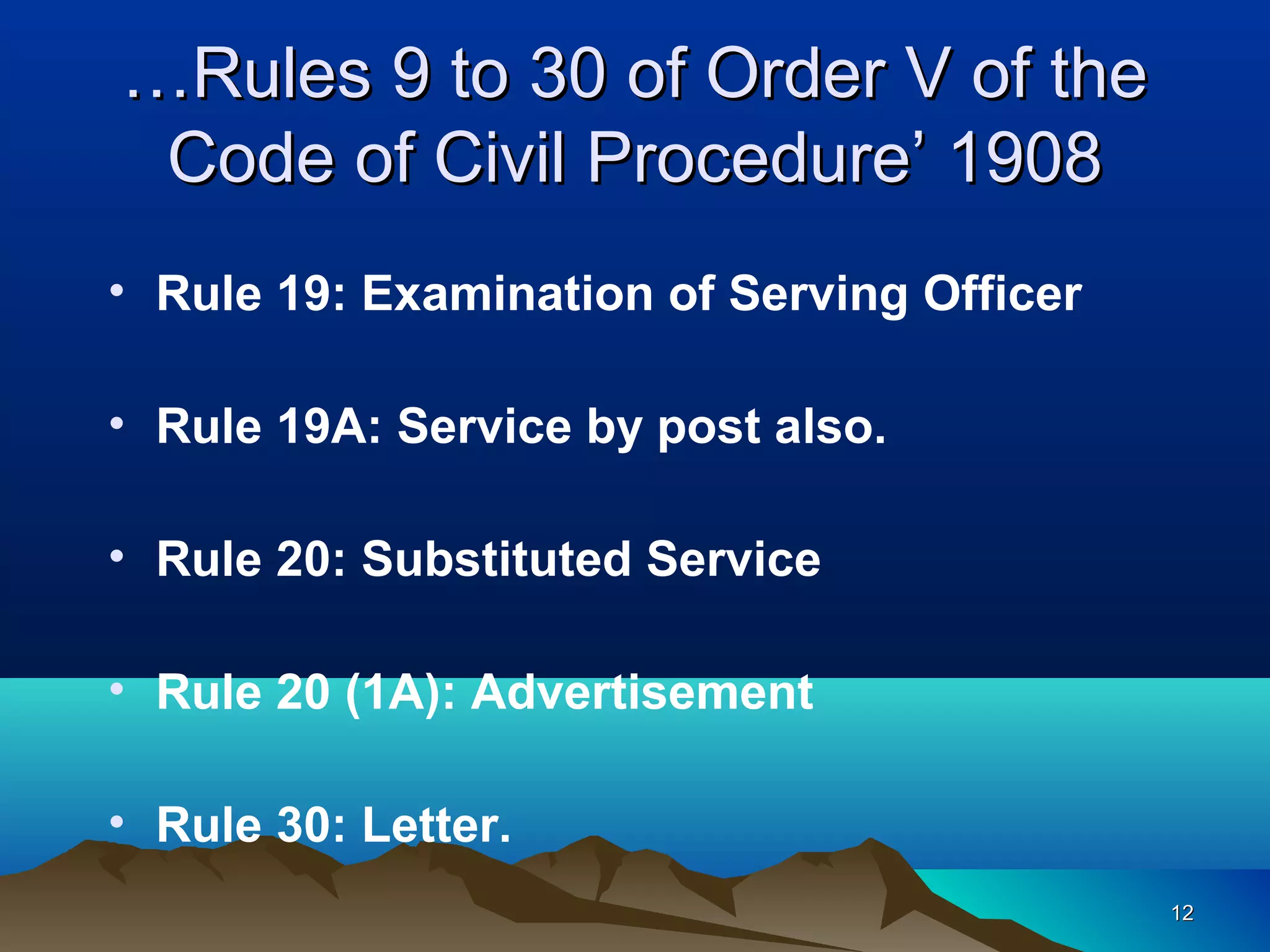

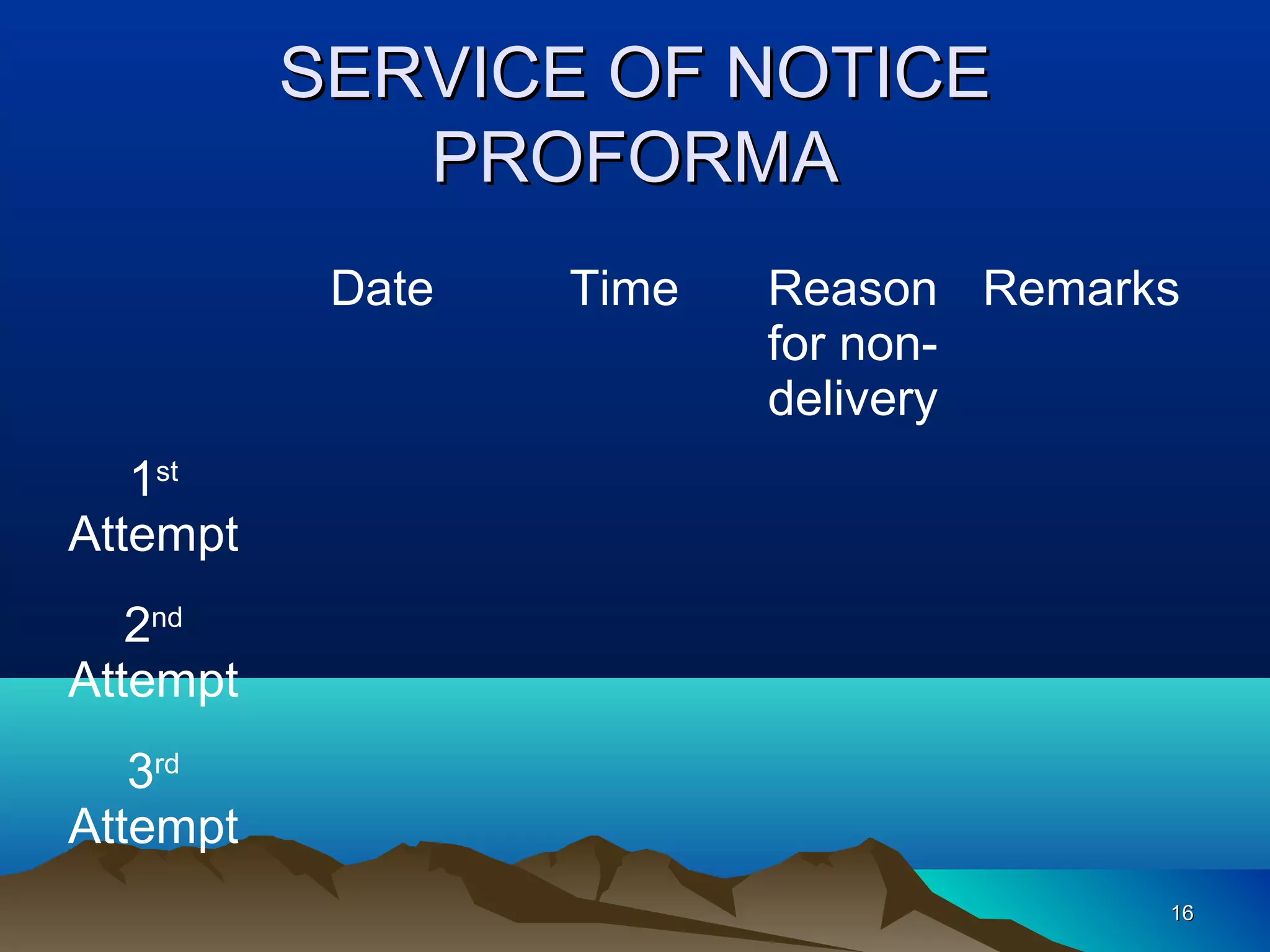

2) It outlines the key provisions for serving a notice such as serving by post, rules for personal service, substituted service, and who notices should be addressed to depending on the type of recipient like an individual, HUF, firm, or company.

3) The Code of Civil Procedure of 1908 is the basis for rules regarding service of notices under the Income Tax Act of 1961, especially Order V relating to summons.