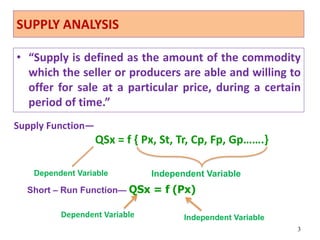

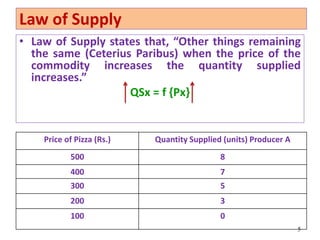

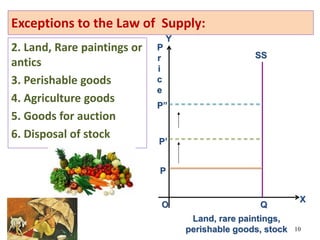

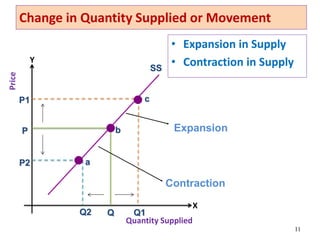

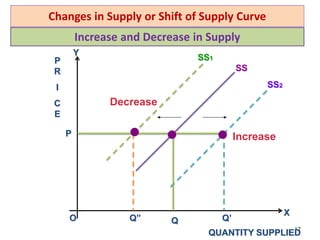

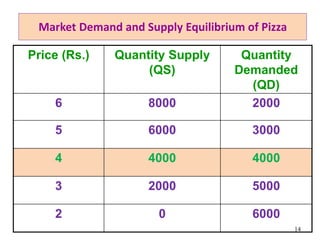

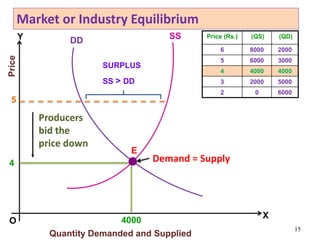

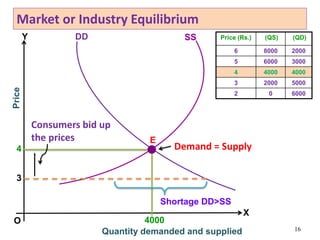

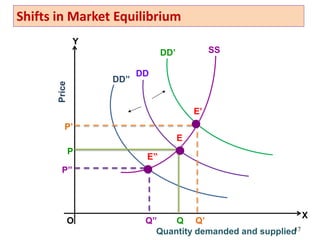

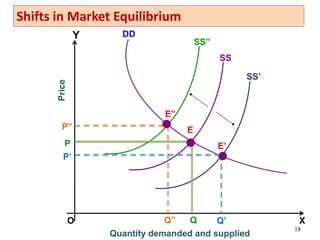

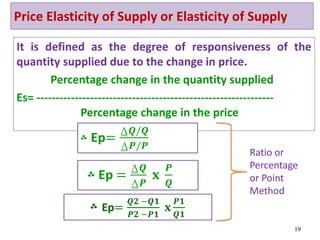

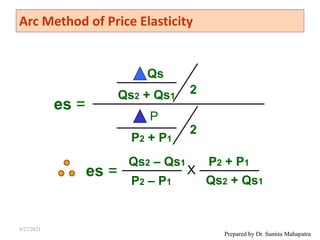

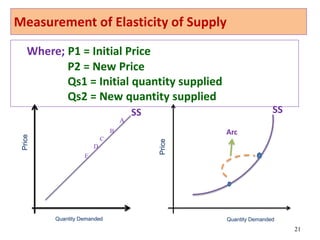

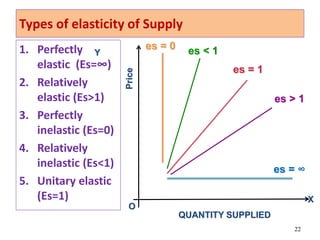

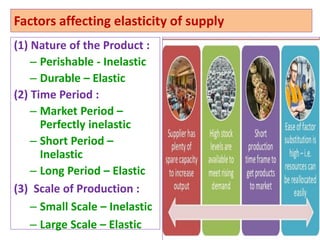

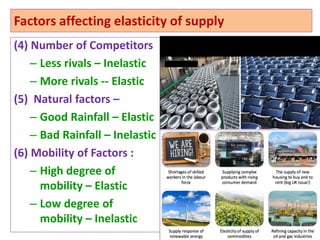

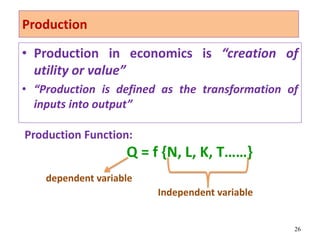

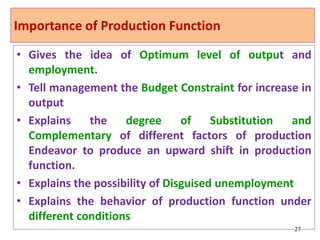

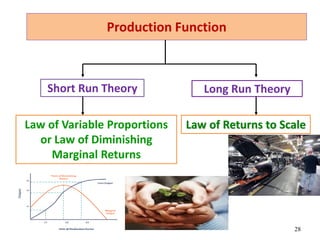

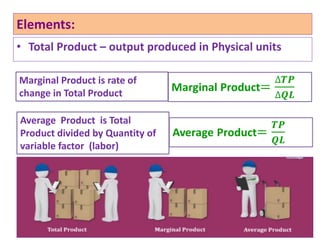

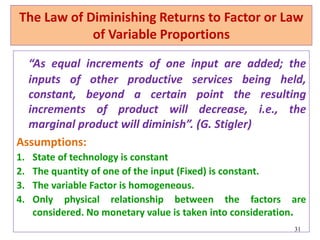

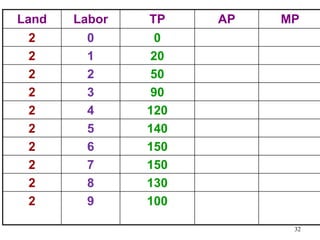

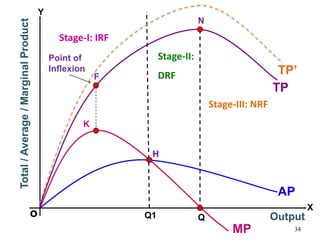

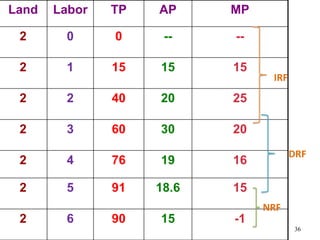

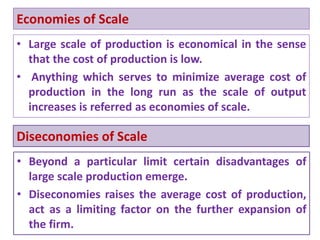

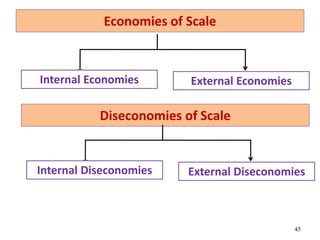

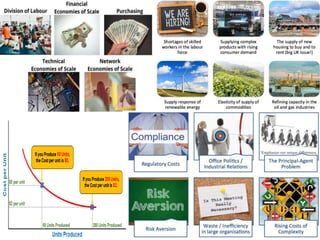

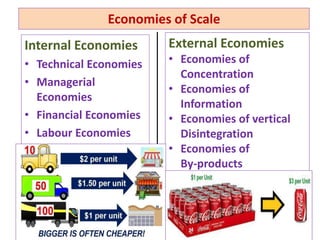

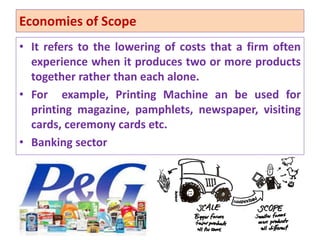

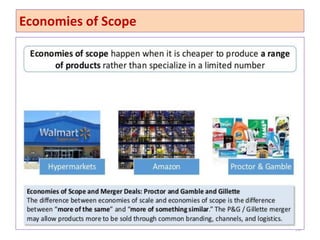

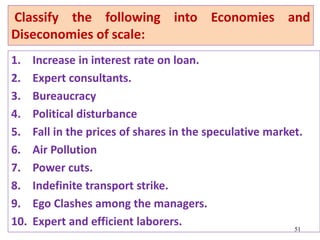

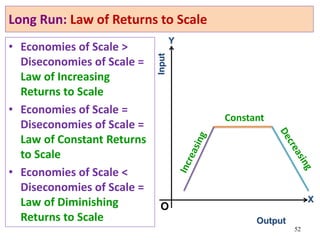

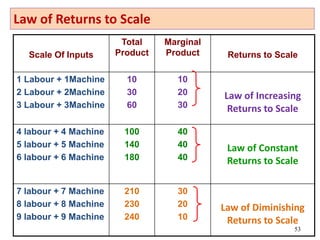

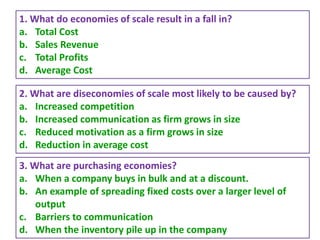

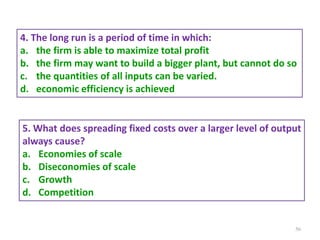

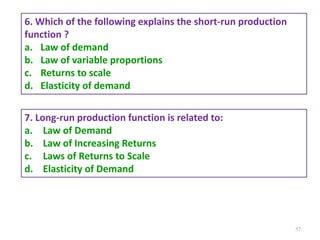

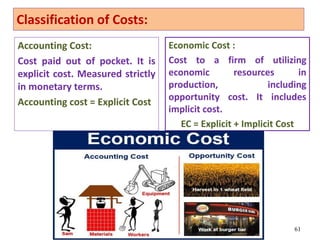

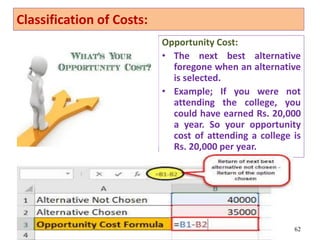

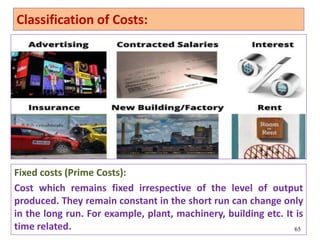

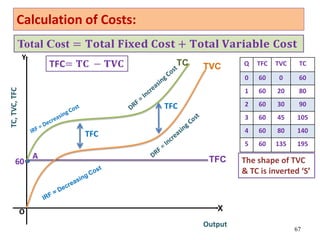

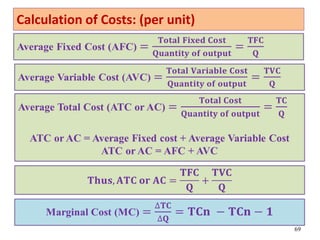

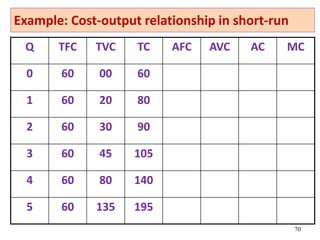

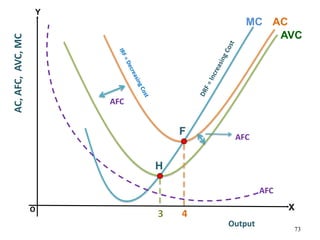

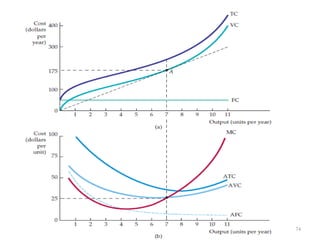

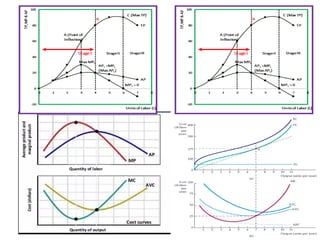

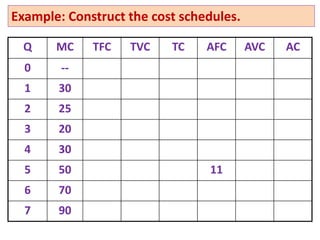

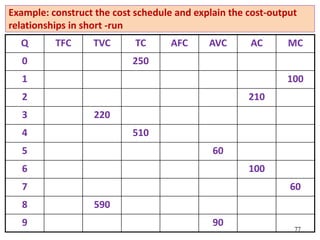

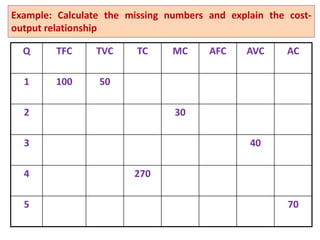

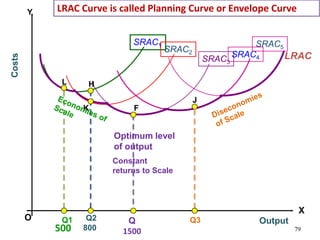

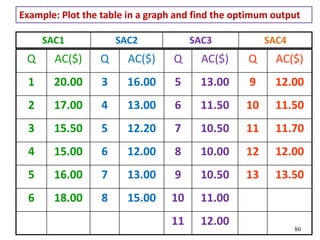

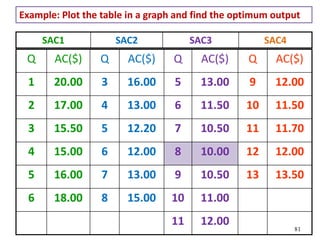

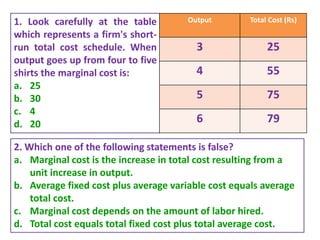

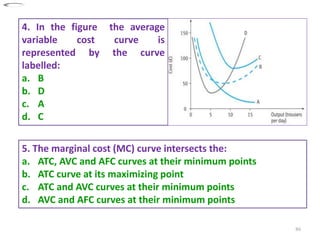

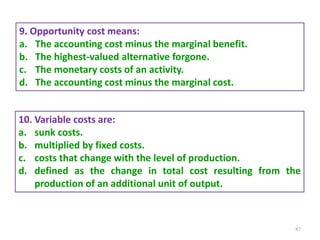

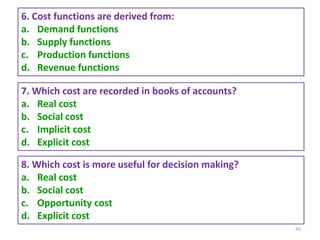

This document summarizes key concepts related to supply, production, and cost analysis. It discusses supply analysis including the law of supply and factors that determine elasticity of supply. It also covers market equilibrium and changes in equilibrium. On production, it introduces the meaning of production and production functions. Regarding costs, it outlines different types of costs including private vs social costs, accounting vs economic costs, and short-run vs long-run costs. It also discusses economies of scale and cost-output relationships over the short-run and long-run.