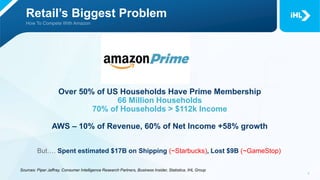

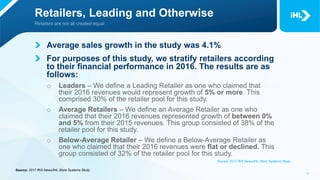

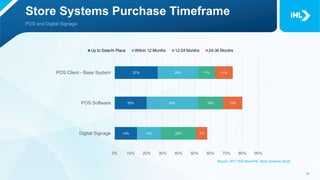

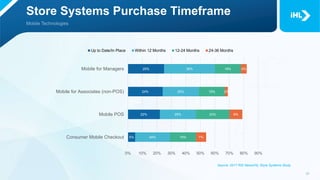

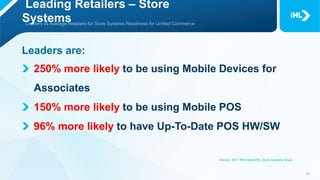

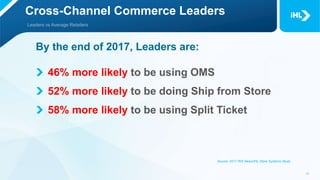

The document discusses the challenges CIOs face in refocusing IT budgets towards digital innovation in retail and hospitality sectors. It highlights significant shifts in retail sales dynamics, including the increasing dominance of online sales and the need for retailers to invest in unified commerce and technology solutions to compete effectively. Key findings show that leading retailers are more likely to adopt advanced technologies and strategies that enhance customer experience and operational efficiency.