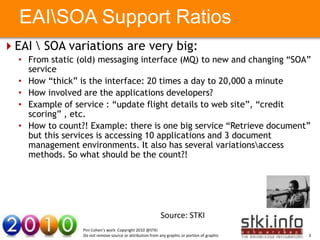

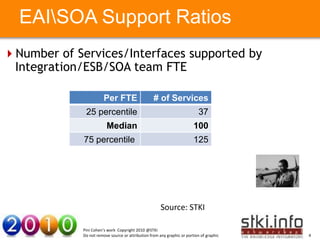

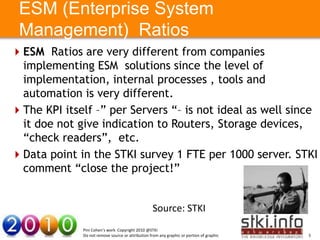

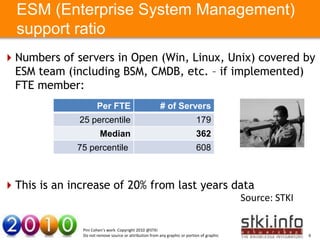

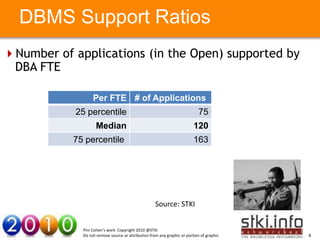

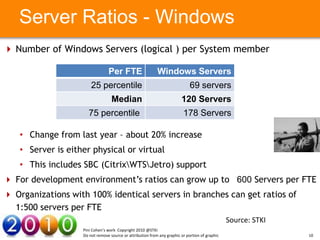

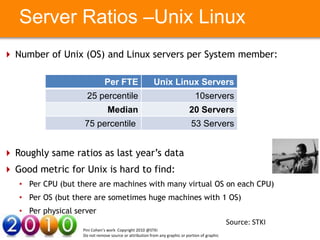

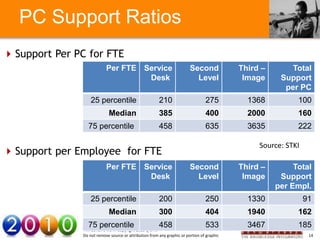

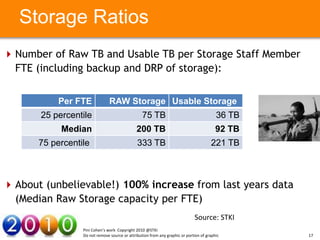

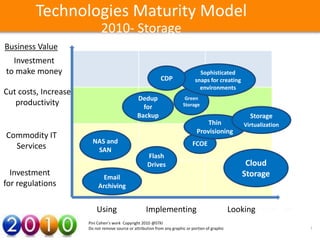

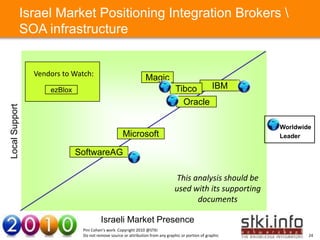

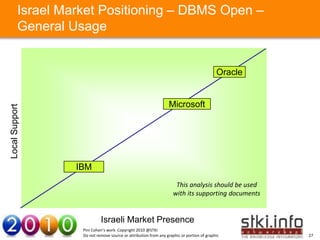

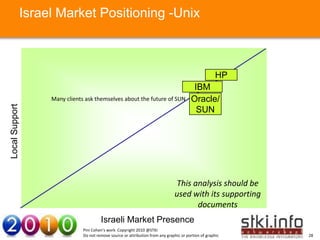

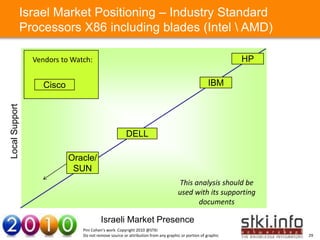

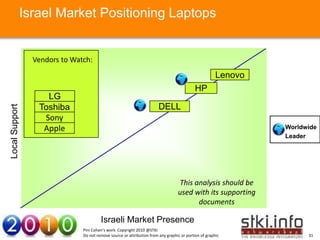

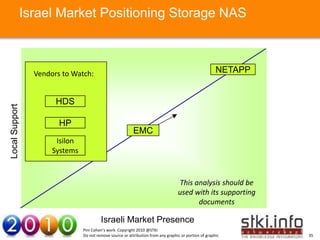

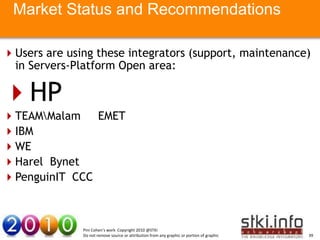

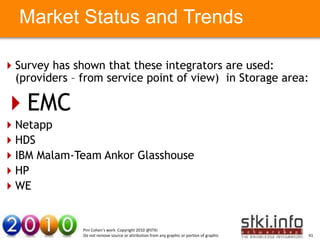

The document provides an overview of various metrics related to architecture and infrastructure, including staffing ratios, maturity models, vendor positioning, and support for enterprise systems management and databases. Key findings indicate significant discrepancies in support ratios across different system types, particularly for EAI/SOA, DBMS, and server management. The document also highlights market positioning for technology vendors and recommended integrators in the industry.