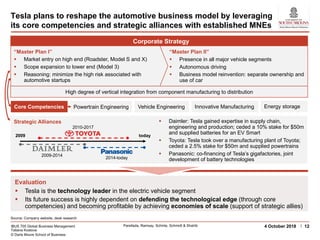

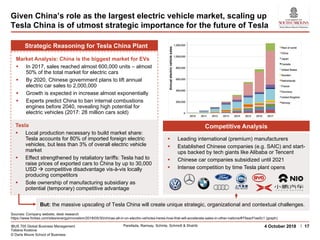

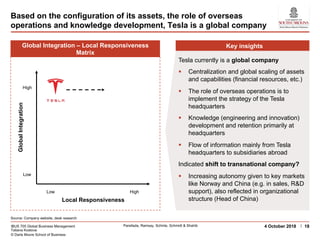

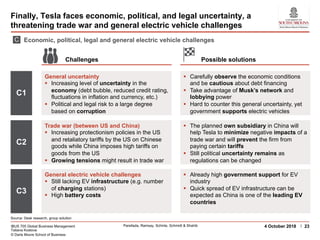

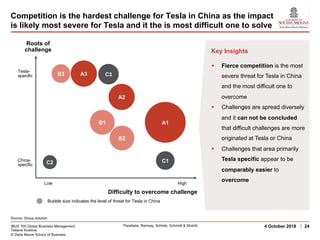

The document discusses Tesla's strategic approach to expanding its operations in China, emphasizing the critical importance of the Chinese electric vehicle market. It outlines the need for Tesla to navigate China's unique economic, political, and cultural landscape, as well as various challenges, including competition and regulatory issues. The company has plans for significant investment in a new production facility, which reflects its commitment to scaling up its presence in this vital market.

![IBUS 705 Global Business Management

Tatiana Kostova

© Darla Moore School of Business

Parellada, Ramsay, Schinle, Schmidt & Shahib 104 October 2018

Tesla is an American company which specializes in electric vehicles,

battery energy storage and solar panel manufacturing

Source: Company website, desk research, NASDAQ

3 4

7

12

-0 -1 -1 -2-5

0

5

10

15

2014 2015 2016 2017

Revenue EBIT

Inter-

national

> Production centralized in US

> Operations in ~ 30 countries

worldwide

Foundation > 2003

Employees > 37,543 (as of December 2017)

HQ > Palo Alto, CA (“Silicon Valley”)

Manage-

ment

> Elon Musk (CEO)

> Jeffrey B. Straubel (CTO)

> Deepak Ahuja (CFO)

Mission > “Accelerate the world’s transition

to sustainable energy

Product

Portfolio

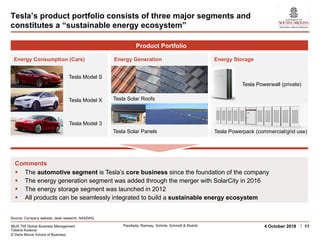

> Energy consumption (cars)

> Energy generation (solar cells)

> Energy storage (batteries)

CAGR Revenue:

38%

Overview Revenue and EBIT development [$ bn]

History

§ 2003: Silicon Valley engineers Martin Eberhard

and Marc Tarpenning found “Tesla Motors”

§ 2004: Elon musk invests in Tesla

§ 2008: Tesla launches the Tesla Roadster

§ 2008: Tesla issues convertible bonds to avoid

bankruptcy

§ 2010: Tesla goes public, raises $226.1 million

(13.3 million shares at $17 per share)

§ 2017: Company renamed into “Tesla Inc.” to

reflect corporate strategy and product portfolio](https://image.slidesharecdn.com/teslainchinateam7presentation-181019201856/85/Suggestions-Tesla-in-China-10-320.jpg)