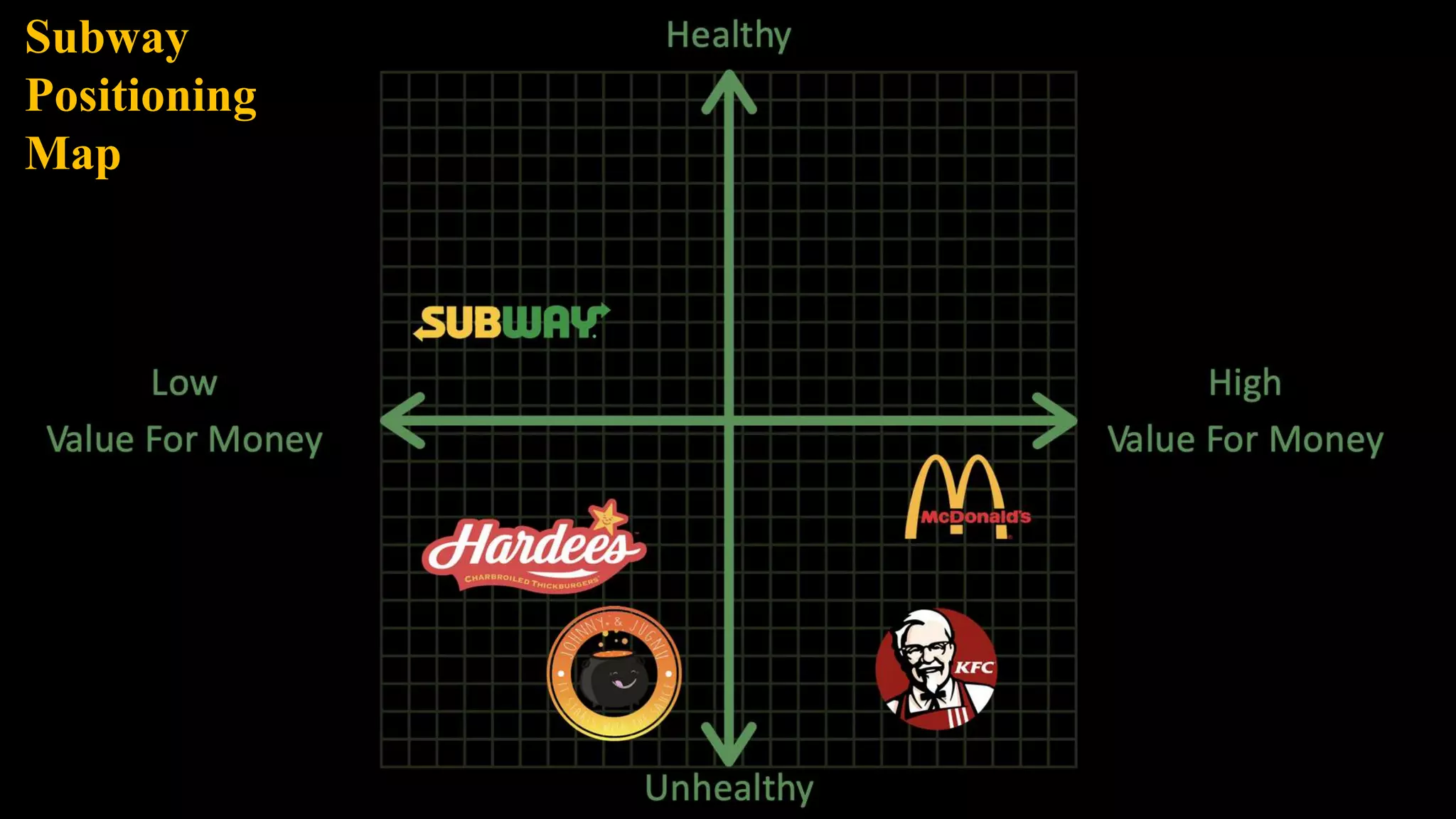

Subway, a submarine sandwich chain, aims to become the top quick-service restaurant worldwide, currently ranked third. The brand emphasizes customizability and health in its product offerings while facing challenges with its perceived value for money and competition from McDonald's. Recommendations include menu expansion, increased advertising, and a focus on healthier alternatives to maintain its 'healthy' brand image.