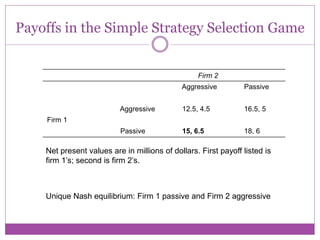

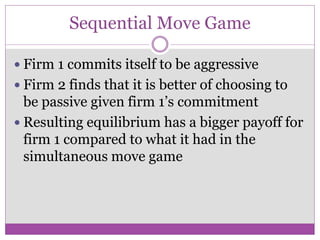

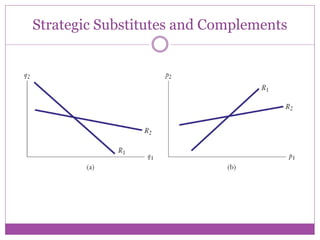

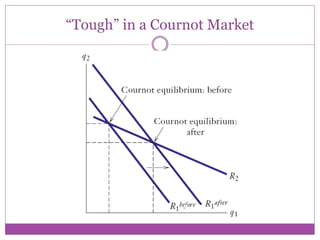

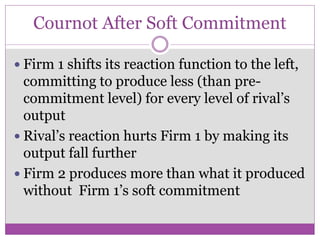

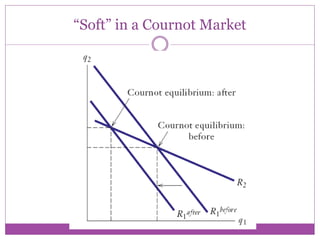

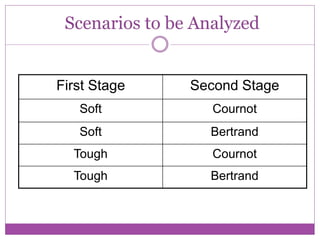

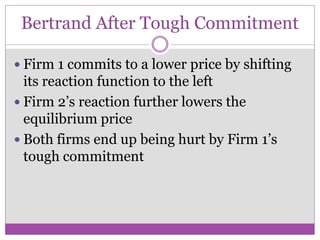

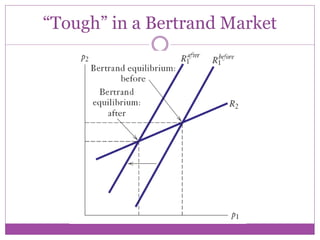

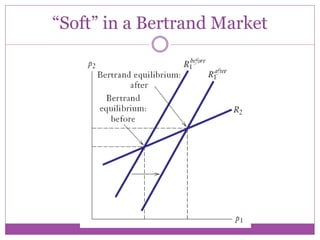

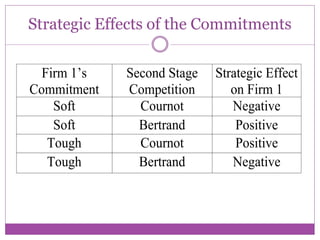

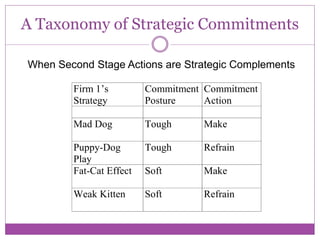

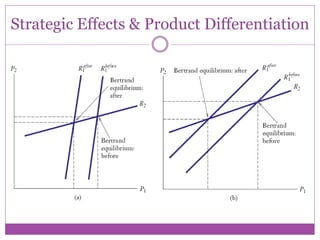

This document summarizes key points from Chapter 9 of the textbook "Economics of Strategy" regarding strategic commitment. It discusses how strategic commitments can impact competition by altering rivals' expectations. Commitments are most effective when they are visible, understandable, and credible. Firms must consider whether their actions and those of competitors are strategic substitutes or complements. The value of commitments depends on their direct effects and strategic effects, and commitments can create flexibility or preserve future options depending on the context.