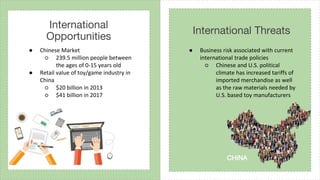

This document analyzes the history and strategies of Toys R Us. It discusses that Toys R Us was founded in 1948 and became the largest toy retailer, but filed for bankruptcy in 2017. The strategic plan proposes expanding product lines to include all types of toys and demographics, updating outdated technology, and focusing on unique store experiences and e-commerce. While competition is strong, opportunities remain in international markets and reinventing the customer experience through technology.