Embed presentation

Downloaded 10 times

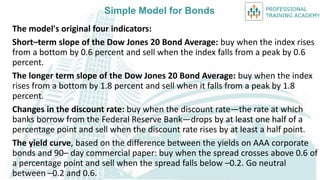

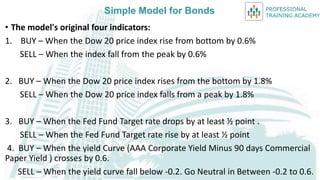

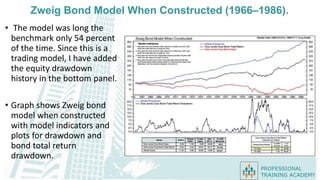

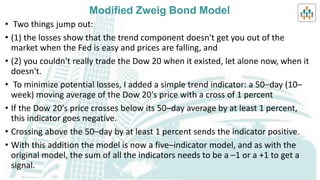

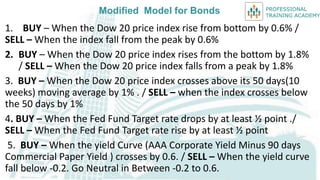

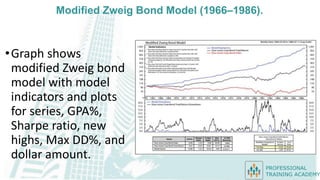

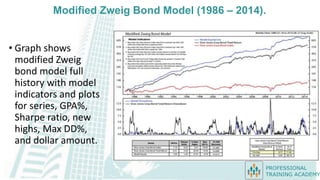

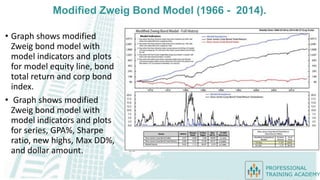

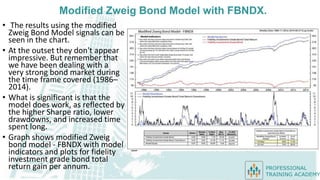

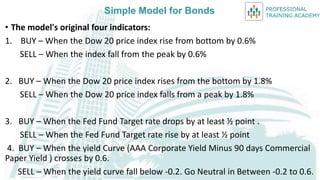

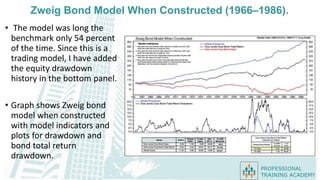

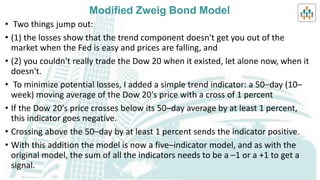

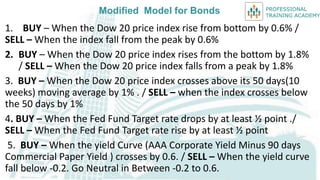

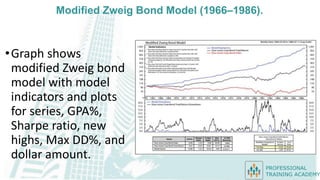

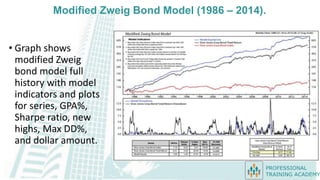

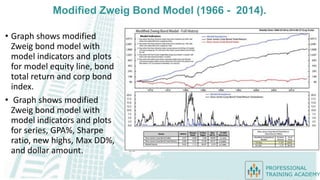

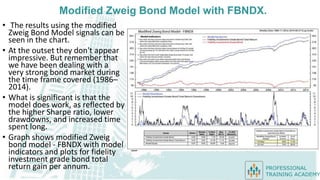

The document describes modifications made to the original Zweig Bond Model. The original model used 4 indicators to generate buy and sell signals for bonds. The modified model adds a 5th indicator: a 50-day moving average crossover of the Dow Jones 20 Bond Average price with a 1% threshold. This helps avoid losses when prices are falling as the Fed eases. The modified model is backtested from 1966-1986, 1986-2014, and over the full period, showing improved results over the original model and buy-and-hold strategies. The modified model is also applied to the Fidelity Investment Grade Bond Fund and SPDR Barclays High Yield Bond ETF.