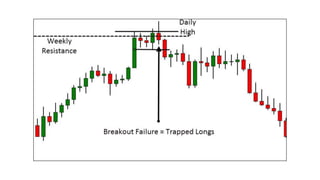

The document discusses the concept of trapped traders, specifically those stuck in losing positions, and how their fear-induced exits can create profitable trading opportunities. It details strategies for capitalizing on the market movements caused by these traders, including methods for identifying failure tests, understanding complex pullbacks, and employing stop placement. By recognizing the signs of trapped traders, traders can position themselves to benefit from the ensuing price actions in the market.