This document summarizes a discussion on using financial ratios to predict business failure. It includes:

- An overview of Professor Beaver's 1966 study on using ratios to predict failures and strengths of his methodology.

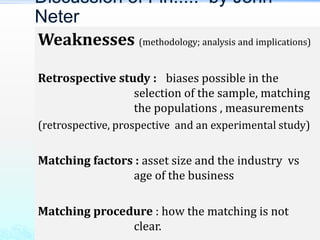

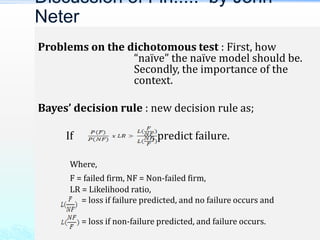

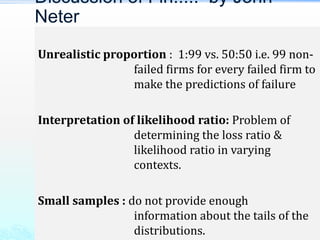

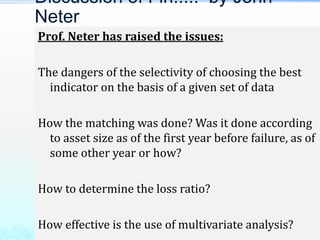

- Comments from Professor Neter raising issues with Beaver's study, including potential biases and problems with dichotomous predictions.

- A discussion of Beaver's study by Professor Mears, who concludes ratios are useful but not absolute predictors of failure.

- Beaver's reply to Professor Neter, acknowledging limitations but arguing ratios provide useful information to change decision behavior.