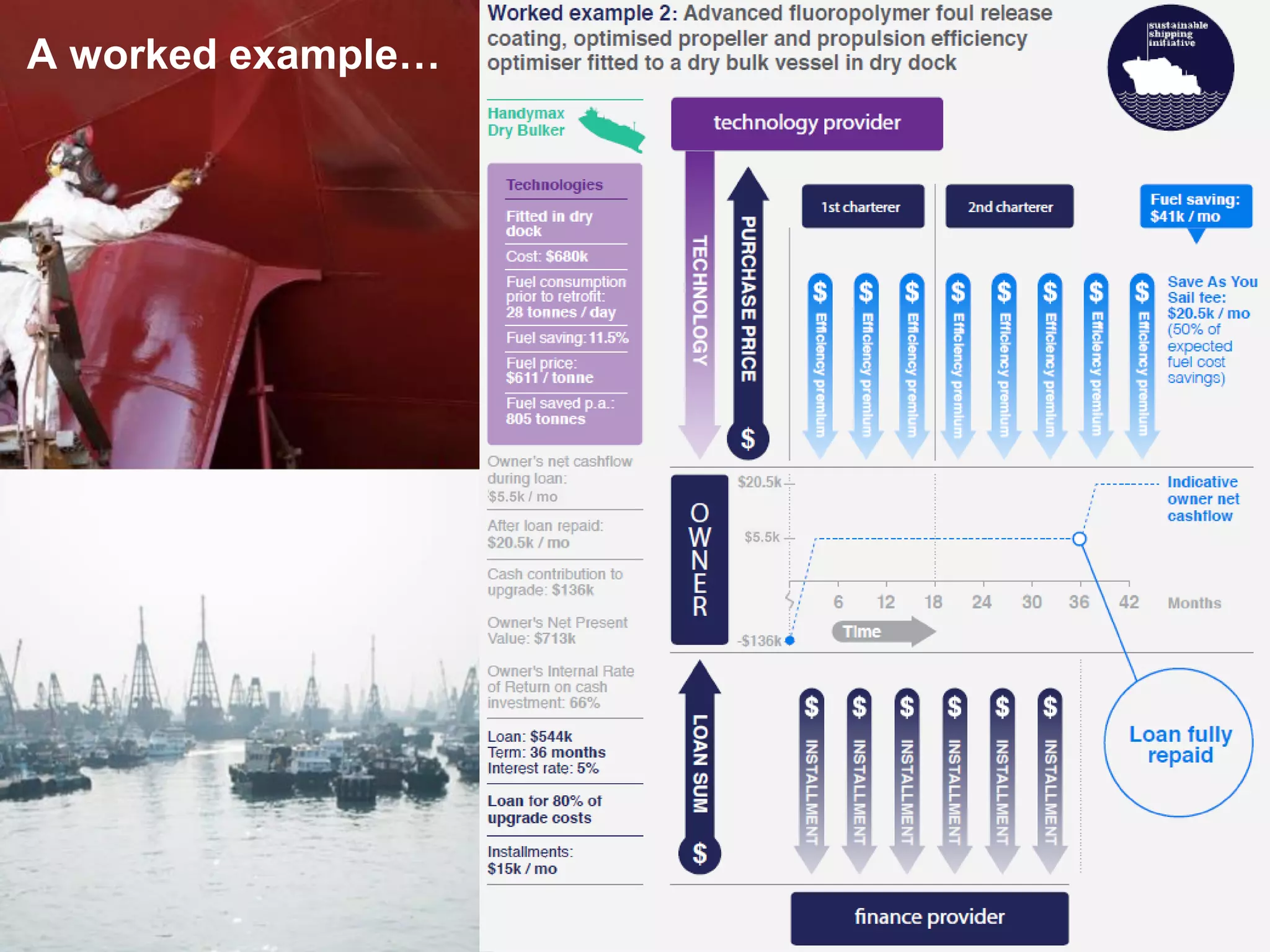

The Save As You Sail (SAYS) financing package enables both ship owners and charterers to benefit from efficiency upgrades. Members from different organizations collaborated to develop SAYS to address barriers like split incentives and lack of flexible financing options for retrofitting in the short-term time charter market. SAYS provides owners with loans to cover 80% of retrofit costs, while charterers pay a portion of estimated fuel savings to owners as an "efficiency premium" through successive charters. This provides transparent savings understanding and risk reduction for both parties from retrofit performance guarantees. Widespread adoption of SAYS through this innovative financing solution could significantly reduce shipping emissions through large-scale retrofitting.