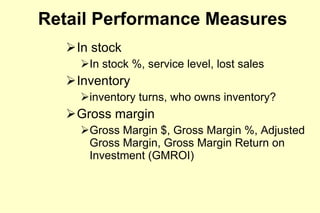

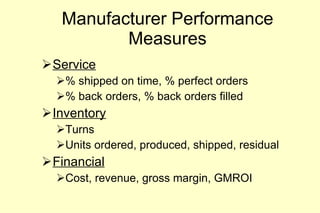

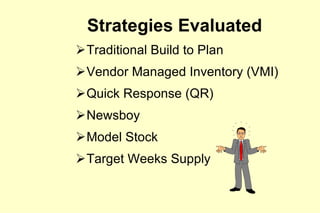

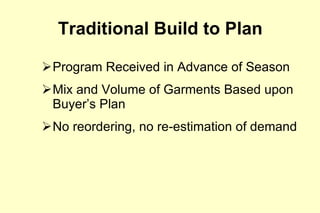

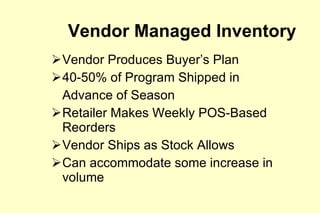

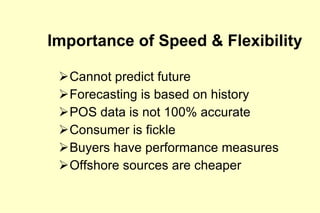

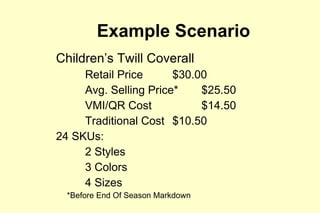

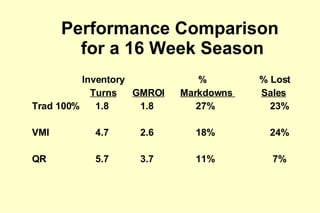

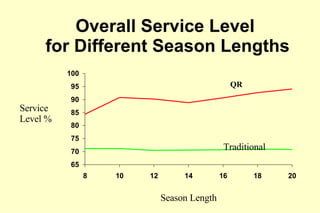

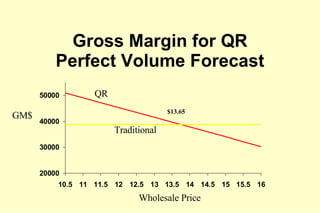

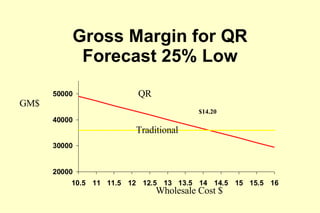

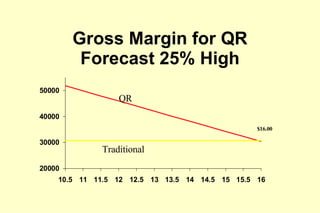

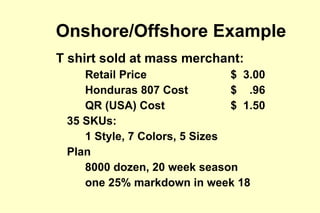

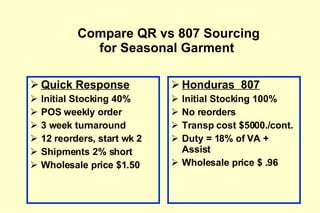

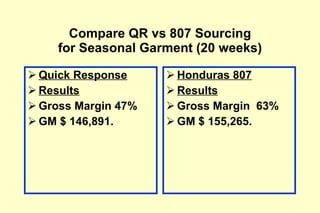

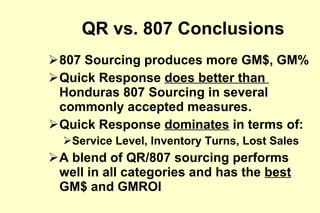

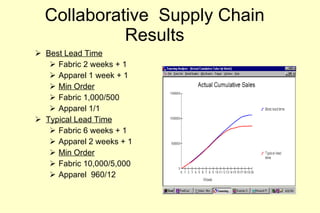

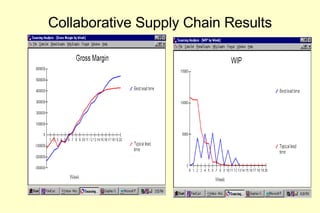

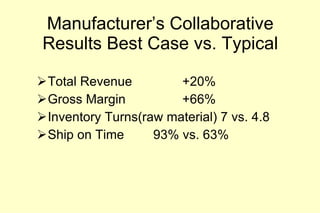

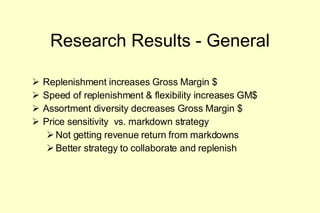

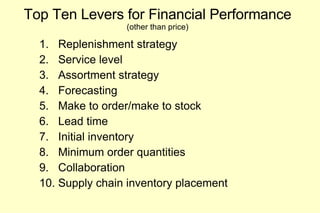

Jim Lovejoy presented research on analyzing sourcing and manufacturing strategies to improve financial performance for retailers. The presentation compared different sourcing strategies like traditional build-to-plan, vendor managed inventory, and quick response. It showed that strategies like quick response and blended sourcing can improve metrics like gross margin, inventory turns, and service level compared to traditional sourcing. The presentation also identified collaboration within the supply chain as a key lever to reduce costs and lead times.

![Thank you! Questions? Jim Lovejoy [TC] 2 919-380-2184 Russ King, NC State University 919-515-5186](https://image.slidesharecdn.com/ss-case-studies-1223536740442714-8/85/Ss-Case-Studies-41-320.jpg)