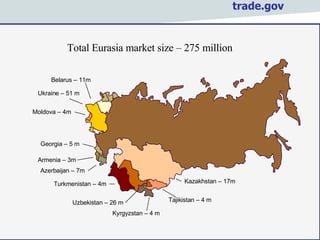

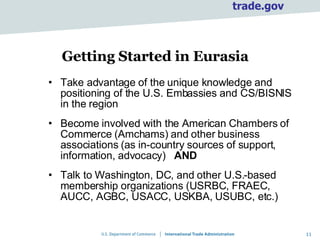

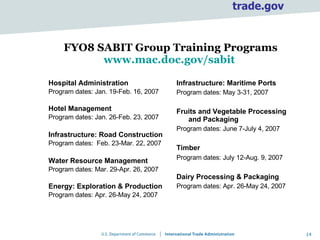

The document discusses opportunities and challenges for businesses entering markets in Eurasia. It provides an overview of the market size and characteristics of countries in the region. Challenges include corruption, administrative barriers, and inconsistent legislation. The U.S. Department of Commerce offers services to help businesses navigate these issues and access trade financing, including international trade experts, assistance resolving trade complaints, and training programs.

![MAC Eurasia Desk Officers Belarus, Ukraine, and Moldova Christine Lucyk (202-482-2018, [email_address] ) Russia Matthew Edwards (202-482-2354, [email_address] ) or Jay Thompson (202-482-2511, [email_address] ) Armenia, Azerbaijan, Georgia, Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, Uzbekistan Danica Starks (202-482-3952, [email_address] ) or Ellen House (202-482-0360, [email_address] )](https://image.slidesharecdn.com/house-1223621137441866-8/85/House-15-320.jpg)

![Commercial Service in Eurasia Ukraine www.buyusa.gov/ukraine/en/ Kyiv: Richard Steffens, Senior Commercial Officer Tel: 380-44-490-4018 [email_address] Kazakhstan www.buyusa.gov/kazakhstan/en/ Almaty: Stuart Schaag, Senior Commercial Officer Tel: 7-727-250-4920 Stuart.schaag@mail.doc.gov Russia www.buyusa.gov/russia/en/ Moscow: Ms. Beryl Blecher, Senior Commercial Officer Tel: 7-495-737-5030 [email_address] St. Petersburg: Keith Silver, Principal Commercial Officer Tel: 7-812-326-2560 [email_address] Vladivostok: Irina Konstantinova, Commercial Specialist Tel: 7-4232-499-381 irina.konstantinova@mail.doc.gov](https://image.slidesharecdn.com/house-1223621137441866-8/85/House-17-320.jpg)

![Ellen House, Desk Officer Office of Russia, Ukraine & Eurasia 202-482-0360, [email_address] The U.S. Department of Commerce is here to assist you to search for opportunities, and assist in any market barriers that you may encounter.](https://image.slidesharecdn.com/house-1223621137441866-8/85/House-19-320.jpg)