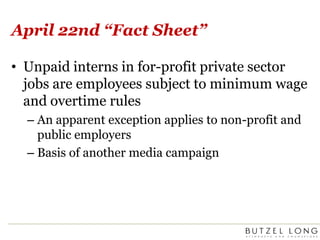

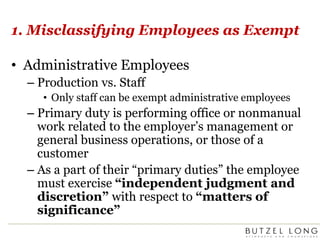

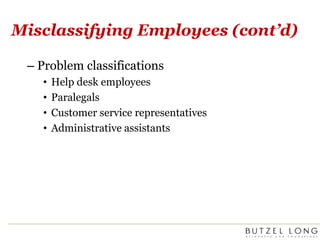

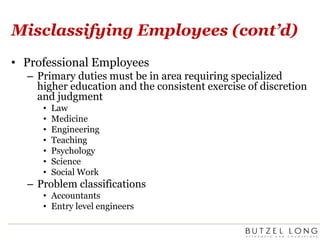

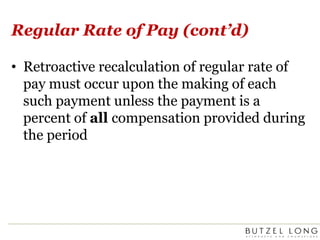

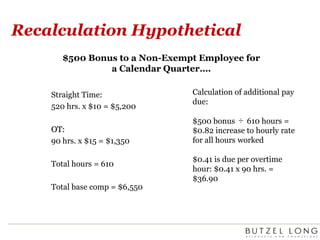

The document outlines key concerns regarding wage and hour compliance, focusing on minimum wage rates in Michigan and federal law, as well as common errors employers make related to employee classification and overtime pay. It emphasizes that many employees, including unpaid interns in private sectors, are entitled to minimum wage and overtime, while detailing the consequences of misclassifying employees and failing to record all hours worked. The document also highlights the importance of ensuring accurate calculation of regular pay rates, especially when bonuses and other premiums are involved.