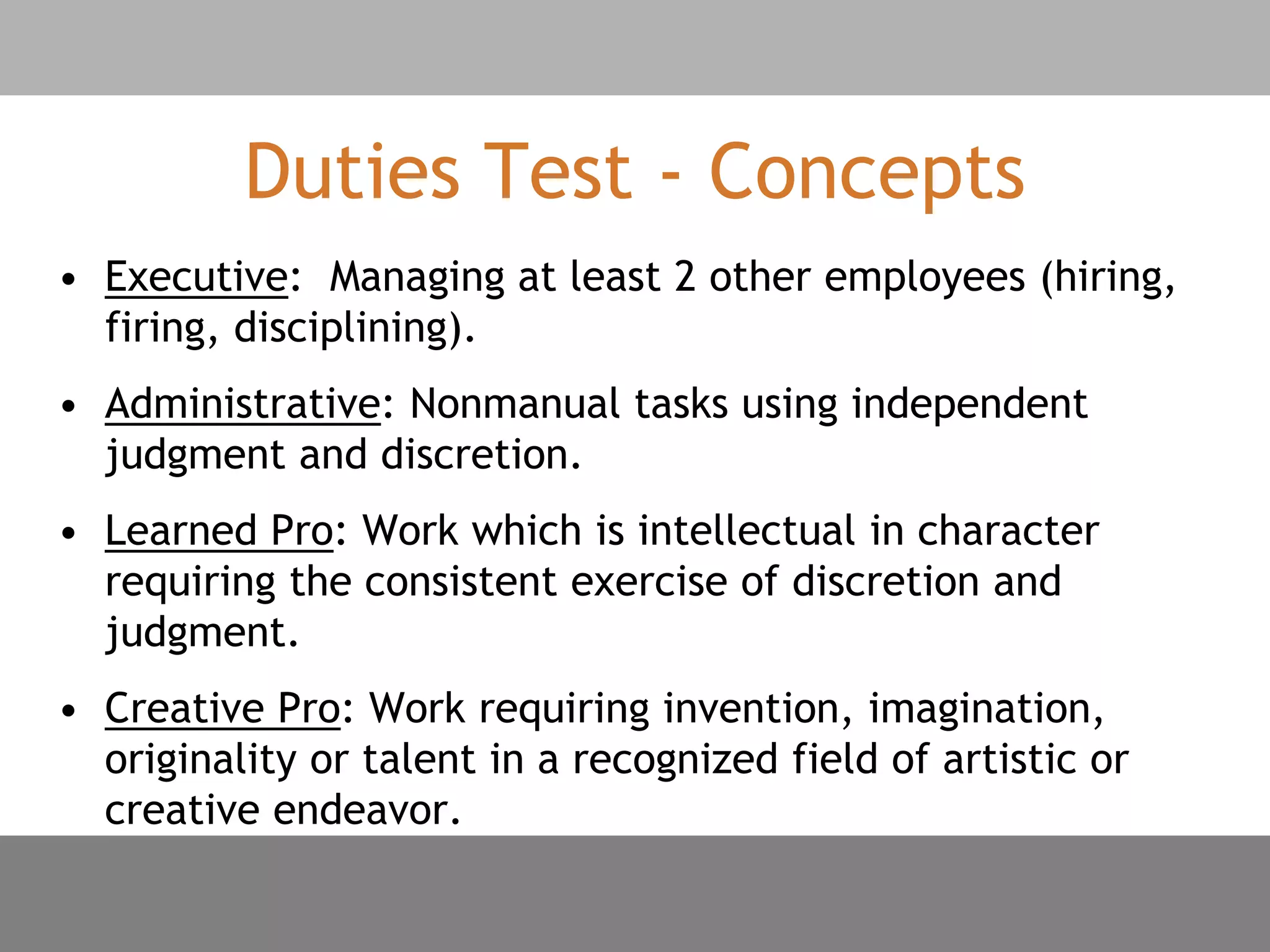

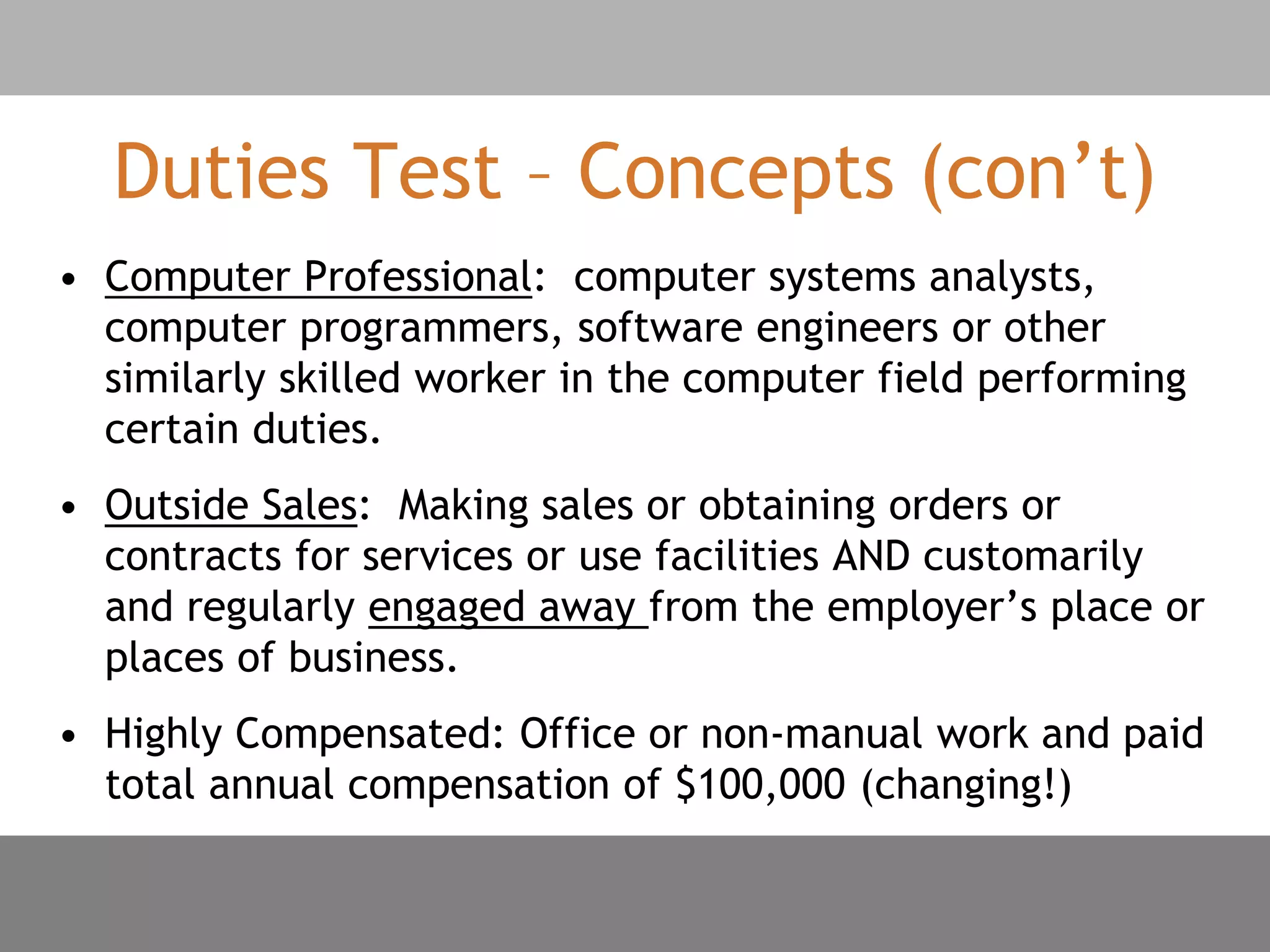

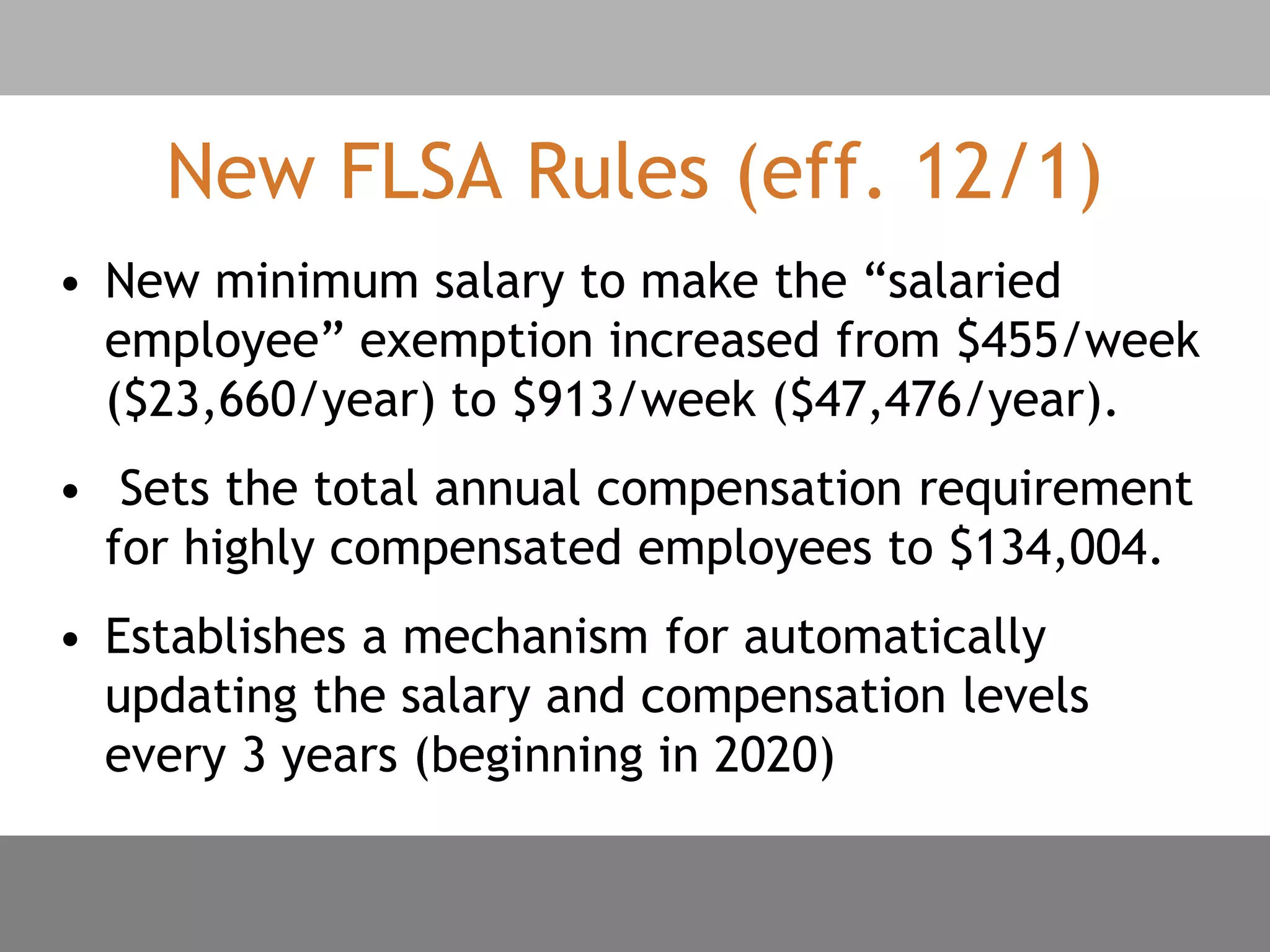

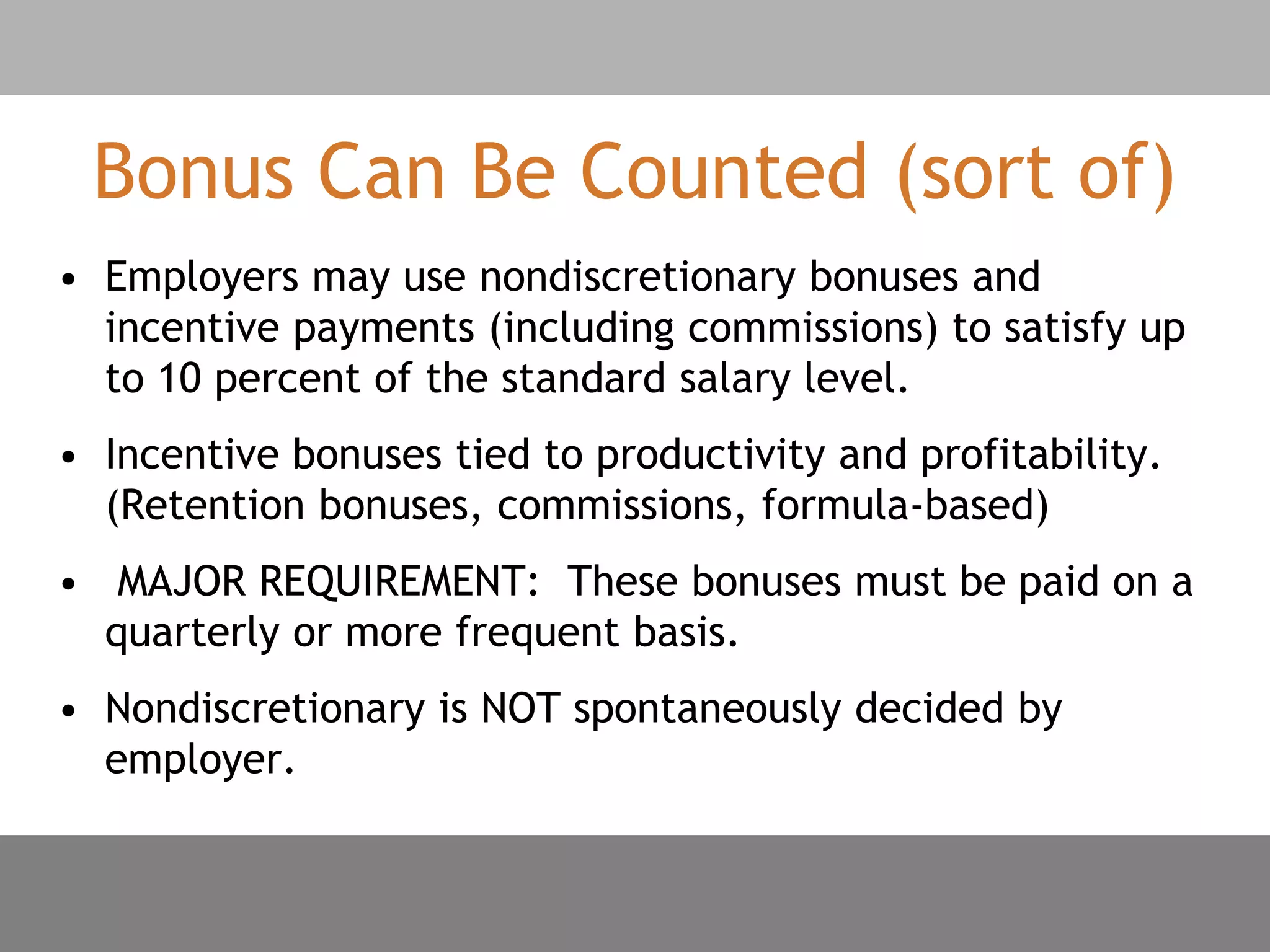

The document discusses the Department of Labor's new overtime exemption rules effective December 1, 2016, which raise the minimum salary threshold for salaried exempt status from $455 to $913 per week. It outlines the impact on approximately 4.2 million workers, who may become eligible for overtime unless salary adjustments are made, and mentions a lawsuit from 21 states challenging these changes. Additionally, it highlights Wisconsin's specific wage and hour rules that may differ from federal regulations.