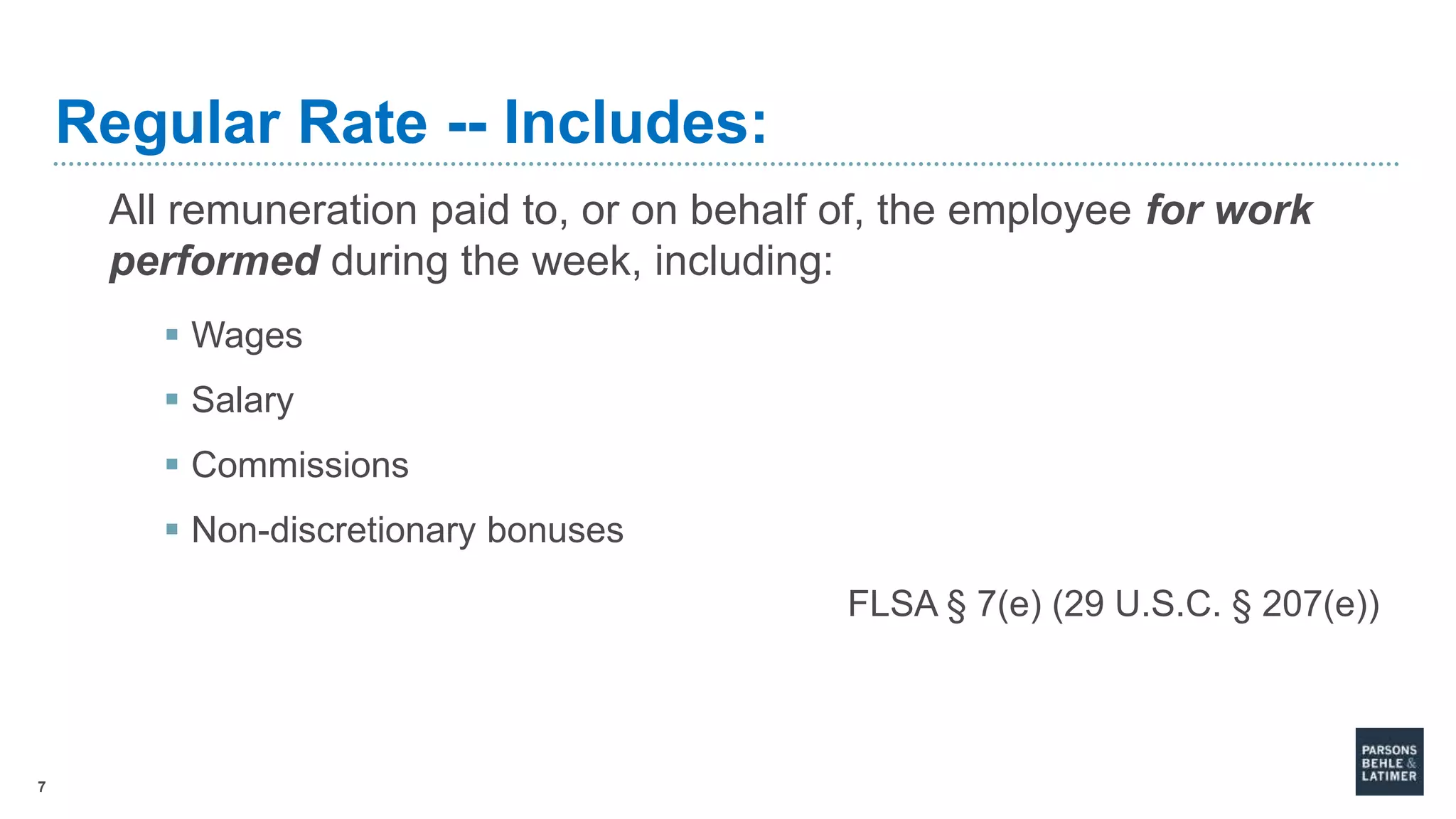

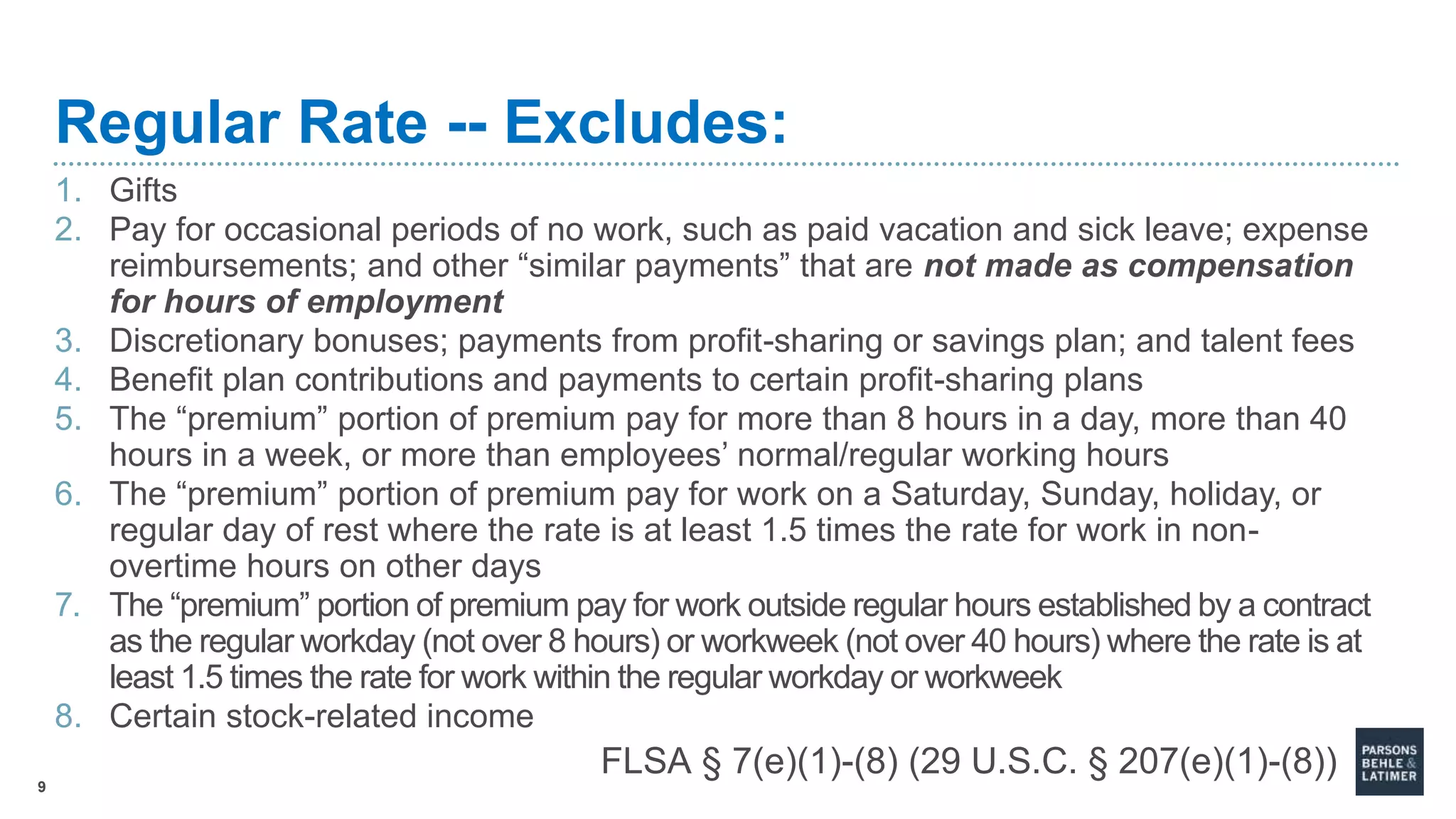

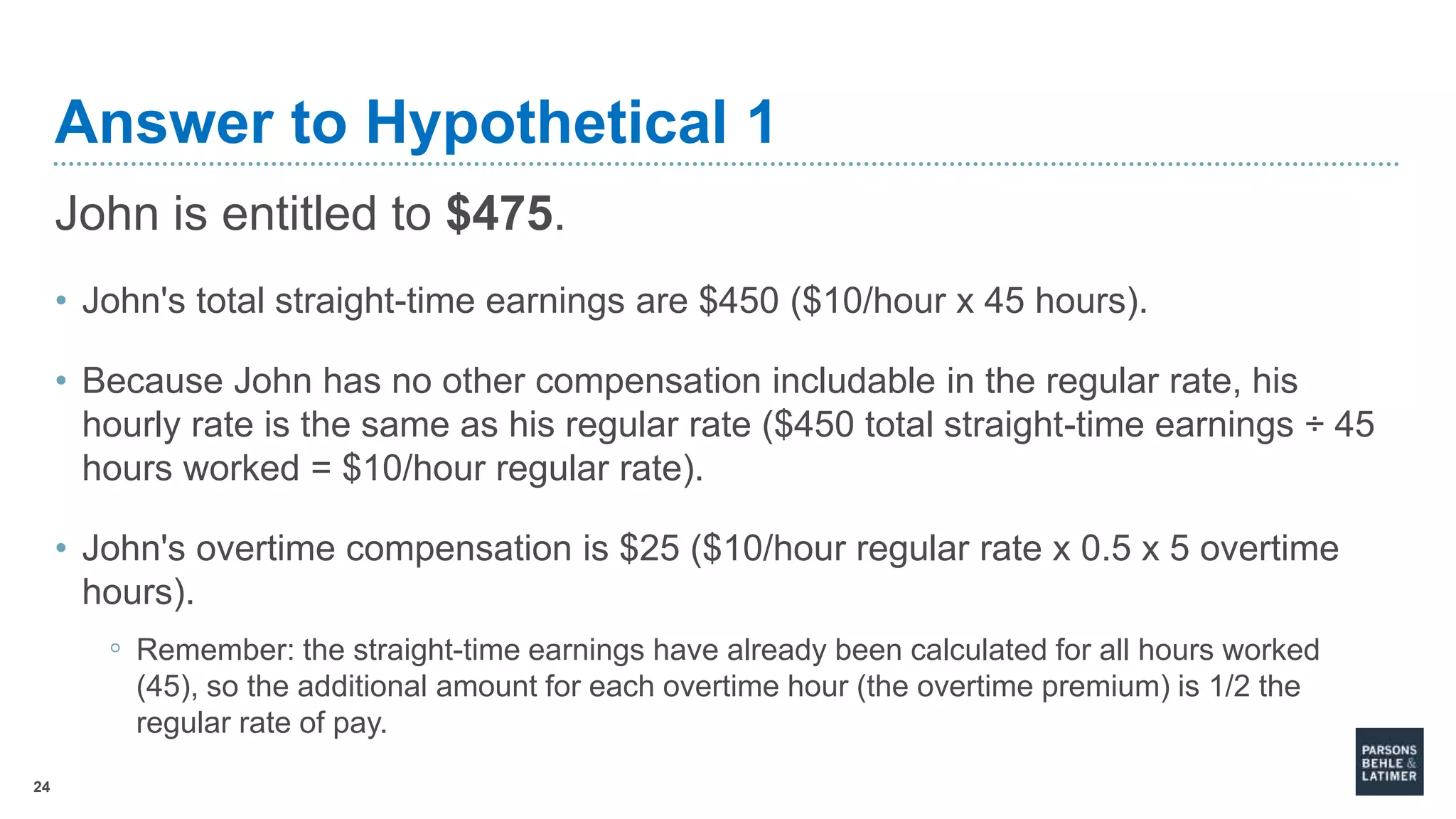

This document summarizes key aspects of calculating overtime pay and regular rates of pay under the Fair Labor Standards Act (FLSA). It provides background on the FLSA, defines regular rate of pay, outlines what payments must and must not be included in the regular rate, and provides examples of how to calculate regular rates and overtime pay in different compensation scenarios. The document is intended for a seminar on employment law and FLSA compliance.

![5

Overtime Pay Requirement

(1) Except as otherwise provided in this section, no

employer shall employ any . . . employees . . . for a

workweek longer than forty hours unless such

employee receives compensation for [all hours over

forty] at a rate not less than one and one-half times

the regular rate at which he is employed.

FLSA § 7(a) (29 U.S.C. § 207(a))](https://image.slidesharecdn.com/2021slcemploymentseminar-flsaregularrateofpay-wagner-211028213306/75/FLSA-and-Regular-Rate-of-Pay-Calculations-5-2048.jpg)