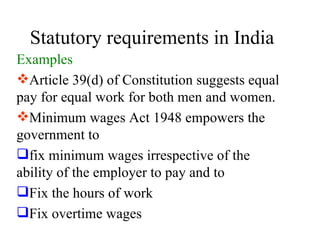

Compensation includes all forms of pay given to employees arising from their employment, including direct financial payments like wages and salaries as well as indirect payments like benefits. Compensation can be time-rated, paid based on time spent, or piece-rated, paid based on units produced. Statutory requirements regulate compensation and include minimum wages, bonus payments, and leave policies. Determining compensation also considers factors like internal and external equity, demand and supply of labor, and organizational policies.

![Statutory requirements in India Payment of bonus Act 1965 requires employers to pay bonus to eligible employees every year. Beedi and Cigar Workers[conditions of employment )Act 1966 requires payment of overtime at double the normal rate[s.18] and One day paid holiday for every six days of work [s.21]](https://image.slidesharecdn.com/compensation-120131011227-phpapp02/85/Compensation-8-320.jpg)

![Statutory requirements in India Section 33 of Mines Act 1952 requires payment of overtime to workmen Working journalists Act 1955 provides for weekly holiday[s.6] over time [s.10] annual holidays [s.13]. Apprentices Act 1961 requires payment of overtime and weekly holiday.](https://image.slidesharecdn.com/compensation-120131011227-phpapp02/85/Compensation-10-320.jpg)

![How to determine equity Conduct a salary survey [formal, informal, government, consultants] to find out external equity Determine the worth of job within the organization by job evaluation by taking into account the compensable factors like efforts required, responsibility, skills, working conditions, Accountability For external equity](https://image.slidesharecdn.com/compensation-120131011227-phpapp02/85/Compensation-16-320.jpg)

![Are any statutory requirements for managerial compensation Total managerial remuneration payable by a public company in a financial year shall not exceed 11% of the net profit If any professional services are rendered, they are to be paid separately If no profits in any year no remuneration payable except with prior approval of central government The 11% limit is inclusive of Rent free accommodation Any other free amenities Any expenditure incurred on behalf of directors. Directors are not eligible for any tax free remuneration or allowances [section 198-200 Companies Act 1956] The remuneration of MD shall not exceed 5% of the net profit [s.309]](https://image.slidesharecdn.com/compensation-120131011227-phpapp02/85/Compensation-27-320.jpg)