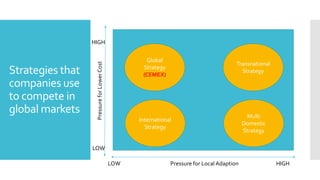

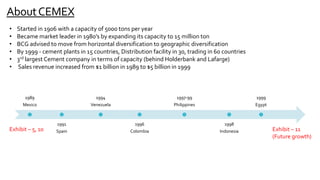

CEMEX globalized its operations through a series of acquisitions between 1989 and 1999, expanding from Mexico into Spain, Venezuela, Colombia, the Philippines, Indonesia, and Egypt. This allowed it to mitigate risk through diversification and benefit from economies of scale. CEMEX used a transnational strategy, treating the world as a single market while allowing local responsiveness. It followed a rigorous process for identifying acquisition targets, conducting due diligence, and integrating new operations through post-merger teams. This helped CEMEX outperform competitors on metrics like EBIT and leverage its low-cost production globally.

![About Industry

• Used as a binding agent

• Production process remain unchanged with no major innovation (considered mature) [exhibit 1]

• Production facility near raw material quarries

• High transportation cost limited sale to nearby areas (1/3rd of total delivered cost) [exhibit 2]

• Demand related to GDP

• Other factors : Rainfall, Population density,Warm climate, coastline length and government expenditure

• Bulk sales sensitive to GDP growth, interest rate and other macroeconomic factors

• Retail sales tends to be less cyclical and offered opportunity for branding

• Leadership pricing strategy to avoid overcapacity

• 6 major international players controlled 500 million ton of capacity. (12% concentration ratio) [exhibit 3,4,5]

• Major acquisition happened at the bottom of the local economic cycle](https://image.slidesharecdn.com/smcemexfinal1-170317220040/85/Sm-cemex-final_1-3-320.jpg)