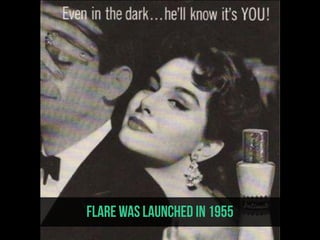

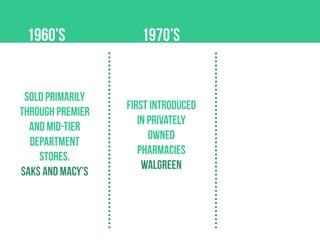

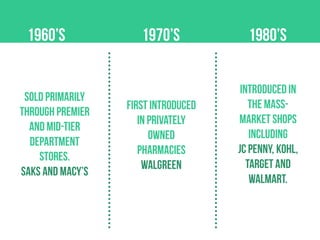

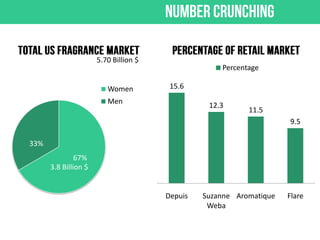

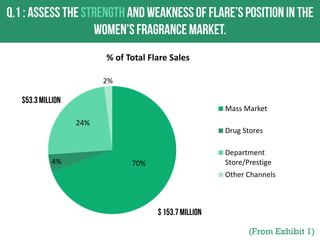

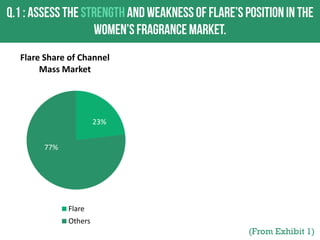

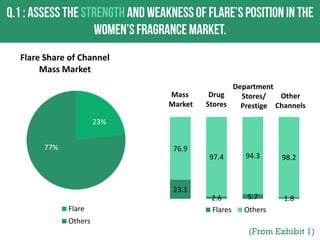

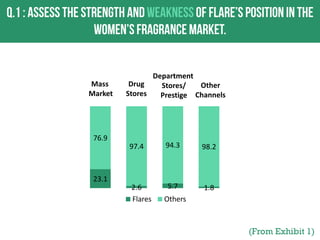

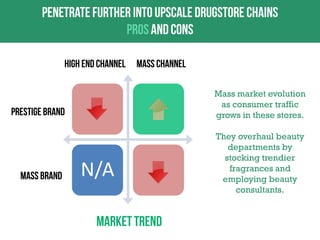

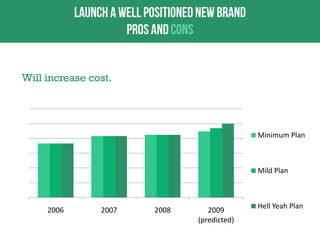

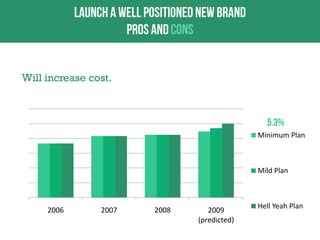

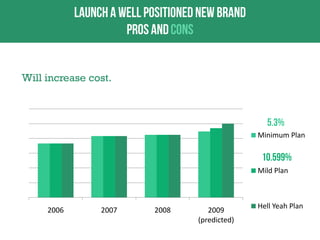

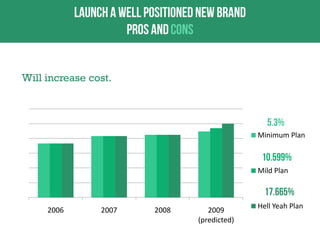

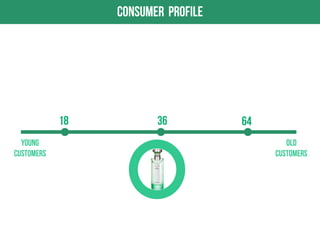

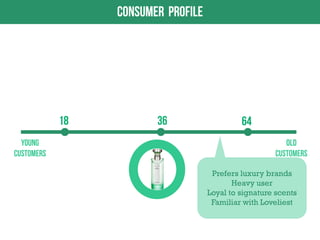

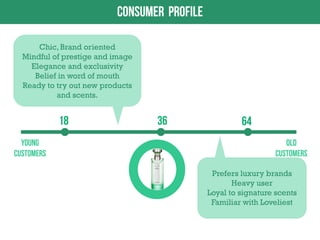

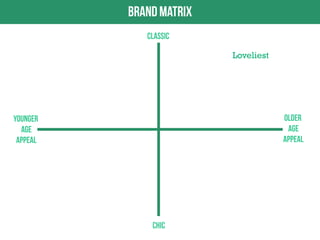

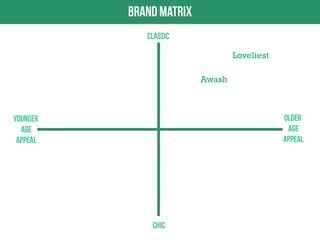

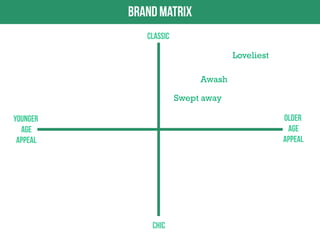

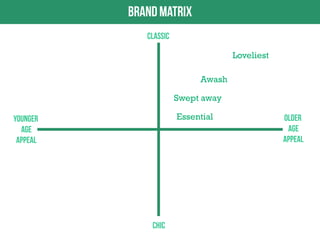

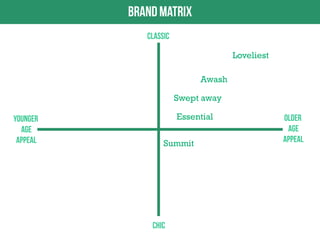

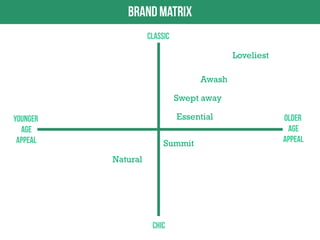

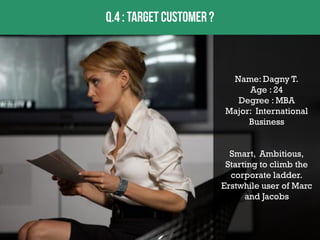

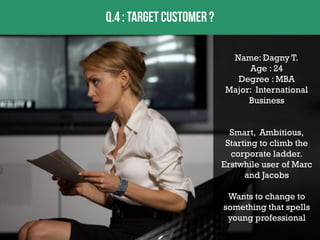

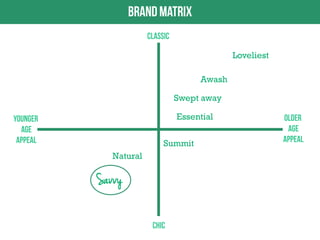

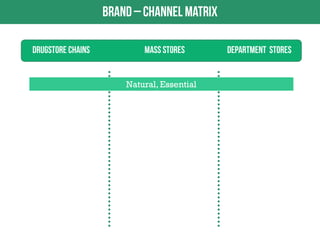

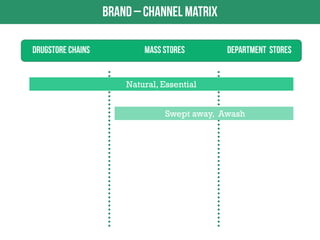

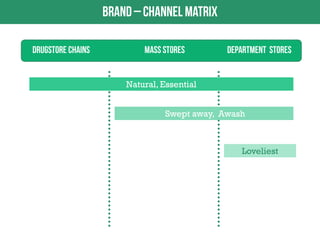

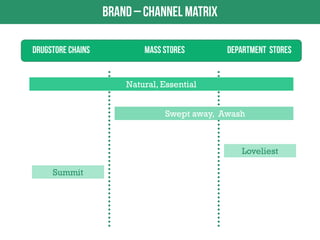

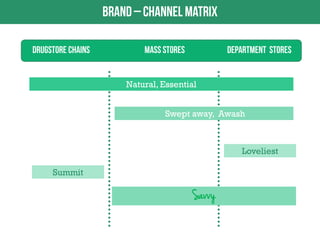

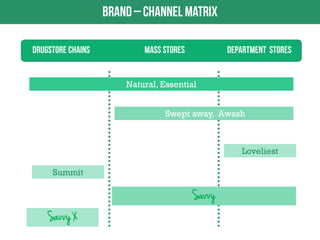

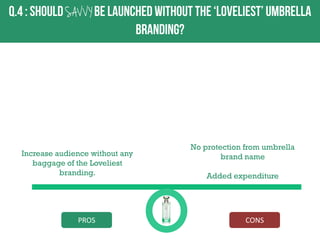

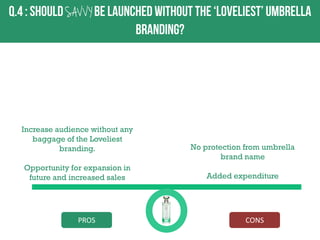

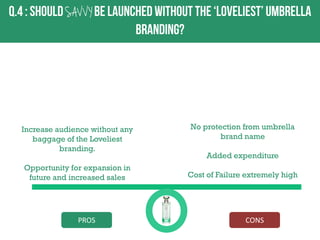

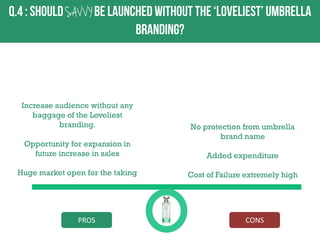

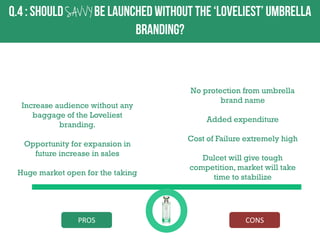

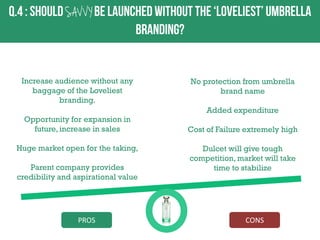

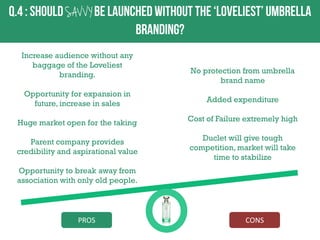

Flare is a leading fragrance brand dominated in sales through mass channels under its umbrella 'Loveliest' brand. However, its sales do not mirror overall market trends in prestige stores, drugstores, and online. It also mainly appeals to women aged 34+. The document discusses diversifying Flare's portfolio through new brands targeting younger audiences to increase sales and market share. It proposes the 'Savvy' plan to launch new brands despite risks of high costs and failure given competition.