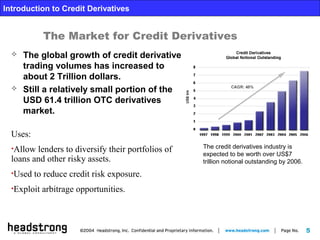

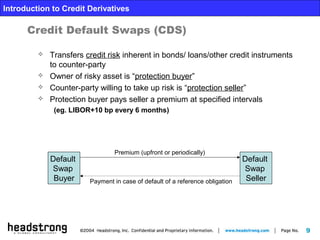

This document provides an introduction to credit derivatives. It defines credit risk and credit deterioration risk as the risks of financial loss due to a borrower defaulting or their credit quality decreasing. Credit derivatives allow investors to transfer these risks. The global market for credit derivatives has grown significantly. Common credit derivative products include credit default swaps, which transfer default risk, total rate of return swaps, which transfer both credit and price risk, and credit spread products. The document discusses the key features and uses of these different credit derivative products.