- First American Bank is considering using a credit default swap to help mitigate Charles Bank International's credit risk in providing a $50 million loan to CapEx Unlimited, a telecommunications company.

- Through the CDS, CBI would make periodic fee payments to First American Bank in exchange for credit protection on the loan to CapEx. This would transfer some of the credit risk from CBI to First American Bank.

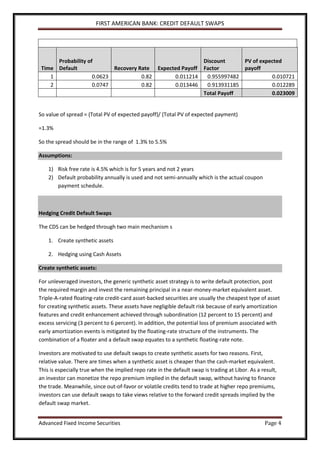

- There are various ways to calculate the appropriate spread for the CDS, including using historical default data or bond prices of comparable companies. The estimated spread would likely be between 1.3-5.5%.