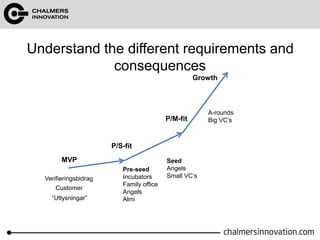

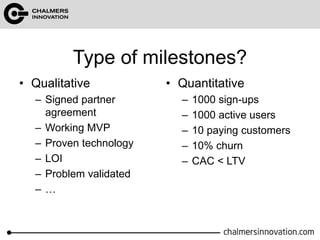

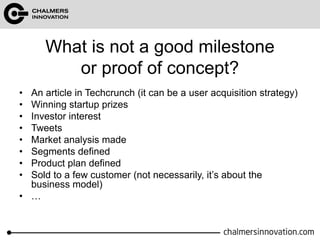

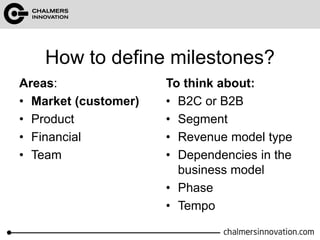

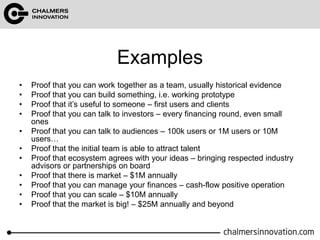

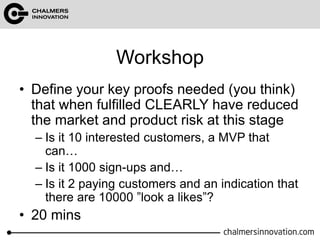

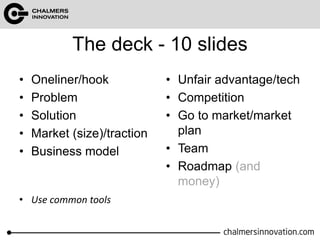

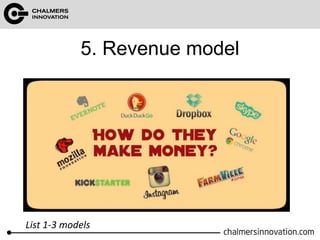

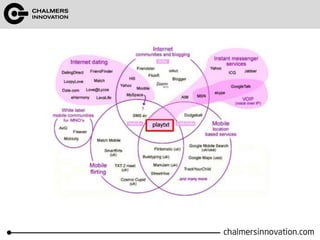

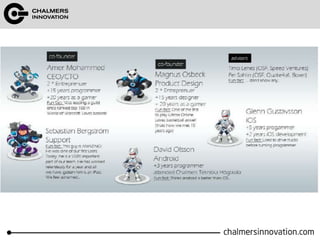

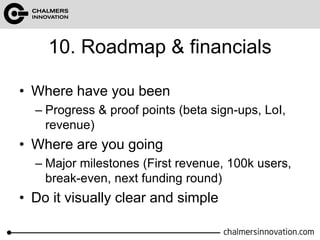

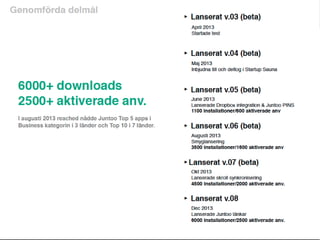

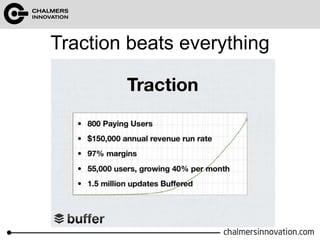

The document discusses milestones and pitch decks for startups seeking investment. It provides examples of qualitative and quantitative milestones that could demonstrate proof of concept, such as having a minimum number of users, paying customers, or revenue. The document also outlines the key components of an effective pitch deck, including problem/solution, market opportunity and traction, business model, competition, and team. Investors are looking for milestones that clearly reduce risks and proof that the startup can gain traction in the market.