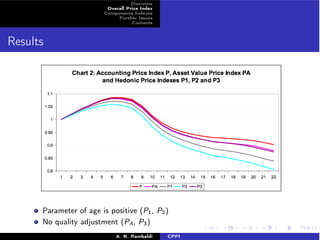

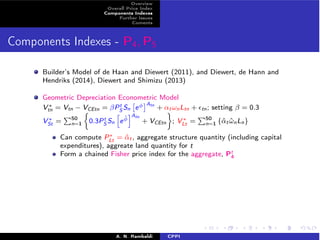

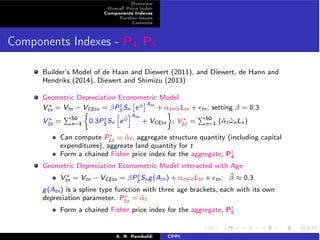

This document summarizes an approach to constructing commercial property price indexes for Tokyo using three methods: an accounting-based index, a repeat sales index, and time-dummy hedonic indexes. It also describes constructing separate indexes for the land and structure components. The accounting-based approach estimates capital stocks using assessed values. The time-dummy hedonic models include variables for land, structure, age, and fixed effects. Results show the age parameter is positive and no-fixed effects models do not adjust for quality. Separate land and structure indexes are constructed using a geometric depreciation model and one allowing depreciation to vary with age. Issues for further research include justifying the capital expenditures depreciation rate and handling early

![Overview

Overall Price Index

Components Indexes

Further Issues

Coments

Overall Price Index - P

A national income accounting approach: Construct capital stock estimates by

deflating investments and then adding up depreciated real investments made in

prior periods.

Vtn = VLtn + VStn + VCEtn

Value = Price ⇥ Quantity

Land: VLtn = PLtnLn; n = 1, . . . , 50

Structure: VLtn = PSt

⇥

0.3Sn(1 − !S )Atn

⇤

;

PSt = construction price index for Tokyo;

0.3 is cost of a SqMt of new commercial property in millions of Yen;

!S = 0.005 quarterly depreciation rate

Capital Expenditures: VCEtn = PStQCEtn

QCEtn = [(1 − !CE )QCE,t−1,n] + real average CEtn; t = 2, . . . , 22

Starting Stock = depreciated investment for 5 years; !CE = 0.10

A. N. Rambaldi CPPI](https://image.slidesharecdn.com/i6n1obglrrkcmqzvc8kv-signature-6de5ee34a7e0a8be608105cfc95b1f55459403214875a488c94e063931d3b0c1-poli-140830080216-phpapp02/85/Session-7-b-d-s-rambaldi-10-320.jpg)

![Overview

Overall Price Index

Components Indexes

Further Issues

Coments

Overall Price Index - P

A national income accounting approach: Construct capital stock estimates by

deflating investments and then adding up depreciated real investments made in

prior periods.

Vtn = VLtn + VStn + VCEtn

Value = Price ⇥ Quantity

Land: VLtn = PLtnLn; n = 1, . . . , 50

Structure: VLtn = PSt

⇥

0.3Sn(1 − !S )Atn

⇤

;

PSt = construction price index for Tokyo;

0.3 is cost of a SqMt of new commercial property in millions of Yen;

!S = 0.005 quarterly depreciation rate

Capital Expenditures: VCEtn = PStQCEtn

QCEtn = [(1 − !CE )QCE,t−1,n] + real average CEtn; t = 2, . . . , 22

Starting Stock = depreciated investment for 5 years; !CE = 0.10

Solve for the price of land

A. N. Rambaldi CPPI](https://image.slidesharecdn.com/i6n1obglrrkcmqzvc8kv-signature-6de5ee34a7e0a8be608105cfc95b1f55459403214875a488c94e063931d3b0c1-poli-140830080216-phpapp02/85/Session-7-b-d-s-rambaldi-11-320.jpg)

![Overview

Overall Price Index

Components Indexes

Further Issues

Coments

Overall Price Index - P

A national income accounting approach: Construct capital stock estimates by

deflating investments and then adding up depreciated real investments made in

prior periods.

Vtn = VLtn + VStn + VCEtn

Value = Price ⇥ Quantity

Land: VLtn = PLtnLn; n = 1, . . . , 50

Structure: VLtn = PSt

⇥

0.3Sn(1 − !S )Atn

⇤

;

PSt = construction price index for Tokyo;

0.3 is cost of a SqMt of new commercial property in millions of Yen;

!S = 0.005 quarterly depreciation rate

Capital Expenditures: VCEtn = PStQCEtn

QCEtn = [(1 − !CE )QCE,t−1,n] + real average CEtn; t = 2, . . . , 22

Starting Stock = depreciated investment for 5 years; !CE = 0.10

Solve for the price of land

Construct overall chained Fisher price index by forming aggregate price and

quantity for each quarter, P

A. N. Rambaldi CPPI](https://image.slidesharecdn.com/i6n1obglrrkcmqzvc8kv-signature-6de5ee34a7e0a8be608105cfc95b1f55459403214875a488c94e063931d3b0c1-poli-140830080216-phpapp02/85/Session-7-b-d-s-rambaldi-12-320.jpg)