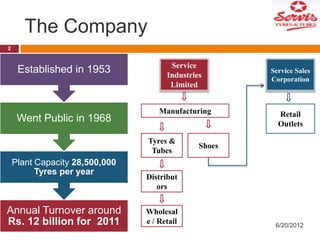

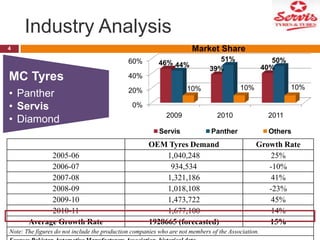

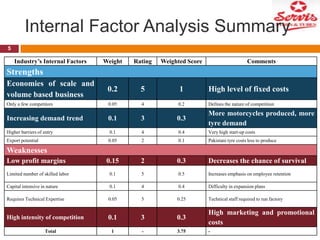

This document presents a business strategy project for Service Industries Limited, a Pakistani tire and shoe manufacturer. The company was established in 1953 and went public in 1968. It has an annual turnover of around 12 billion Pakistani rupees for 2011. The objective of the project is to devise a strategy to gain and maintain a sustainable competitive advantage for the company. Analyses of the tire industry, company, opportunities, threats, and strategic factors are presented. The recommended new strategy focuses on product differentiation, reducing internal costs, developing export markets, strategic alliances with automakers, and penetration pricing to gain market share.