Embed presentation

Downloaded 490 times

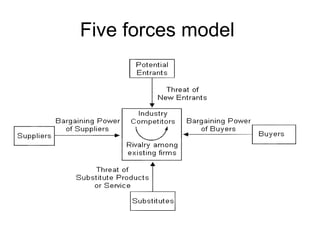

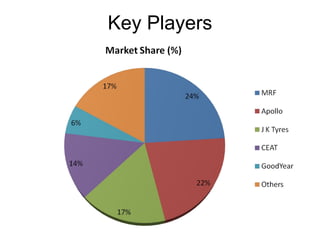

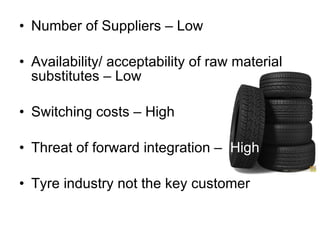

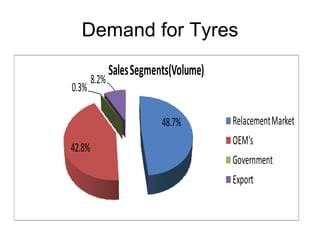

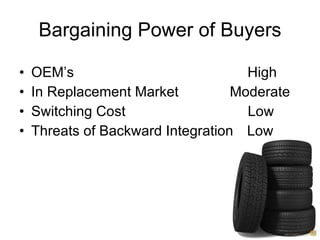

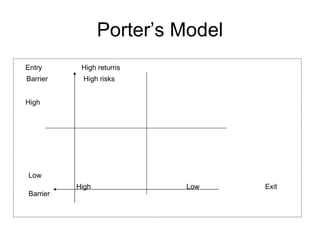

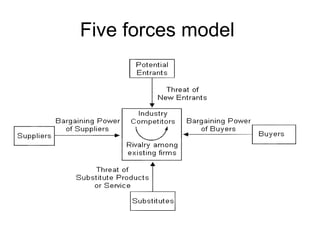

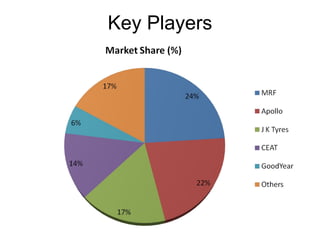

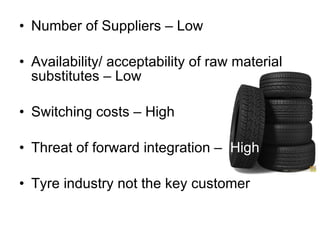

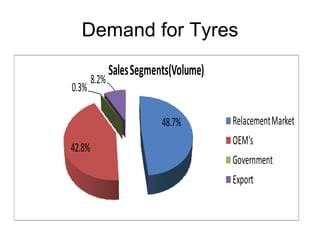

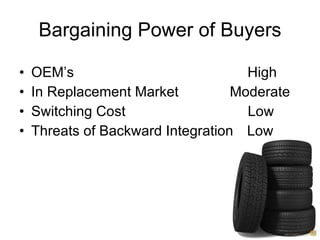

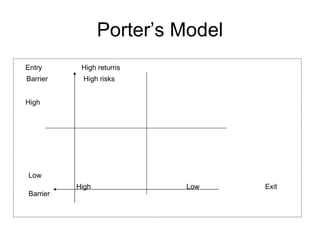

The document discusses the tyre manufacturing industry in India using Porter's Five Forces model. It notes that the industry faces high competition, cost pressures, and increasing raw material costs despite growing demand. The top 5 companies control over 80% of production. Bargaining power of suppliers is high due to few suppliers and lack of substitutes, while buyers have moderate-to-high power. Potential entrants face very high barriers to entry due to the capital intensive nature and risks. Threat of substitutes is currently low but increasing.