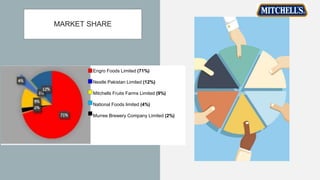

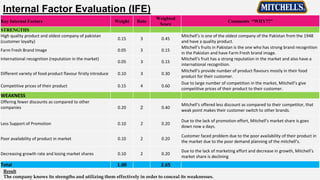

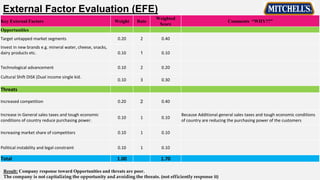

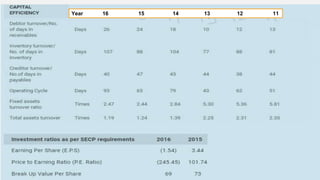

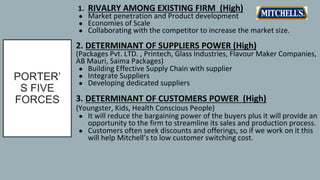

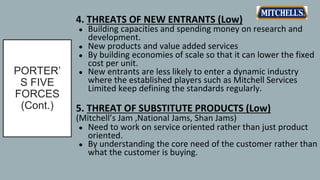

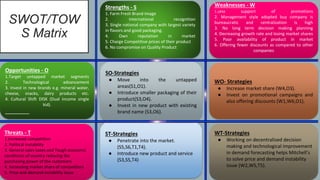

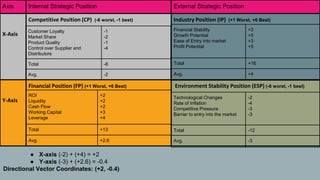

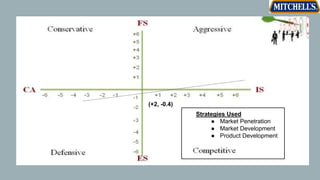

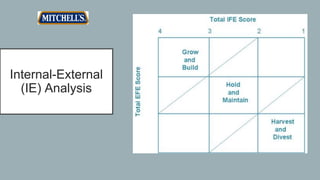

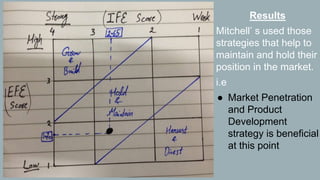

Mitchell's Fruit Farms Limited is a leading producer of fruit products in Pakistan. The presentation provides an analysis of Mitchell's business including its products, leadership, competitors, market share, internal and external factors, financial performance, and strategies. Key recommendations include using market penetration strategies to maintain market position, introducing smaller product packs to meet changing customer needs, improving customer satisfaction through quality and discounts, enhancing technology, and adopting decentralized decision-making.