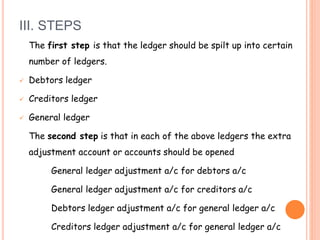

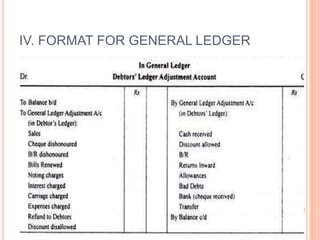

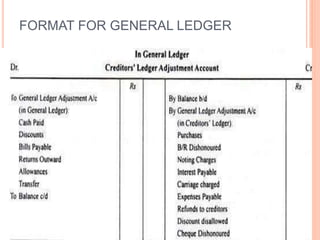

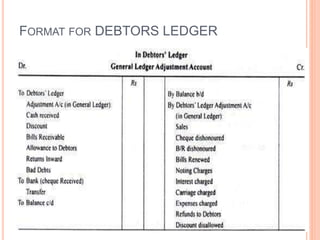

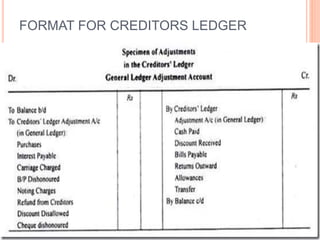

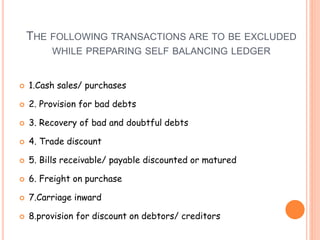

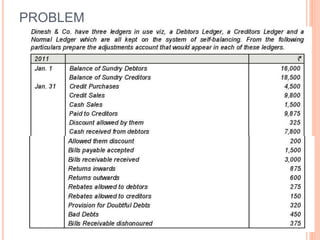

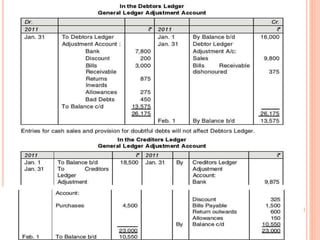

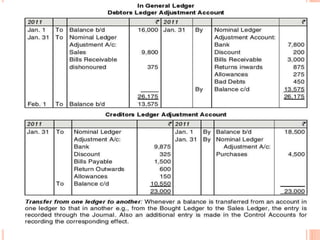

The document discusses self-balancing ledgers. Under a self-balancing system, separate trial balances can be prepared for individual ledgers like the debtors ledger and creditors ledger. This is done by opening adjustment accounts that allow entries to balance between the individual ledgers and the general ledger. The system localizes errors, facilitates division of work, and allows for interim accounts to be prepared. The document outlines the steps to implement a self-balancing system including splitting the ledger and opening adjustment accounts between ledgers.