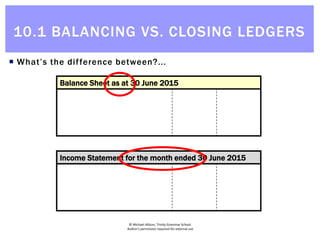

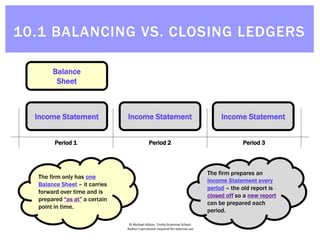

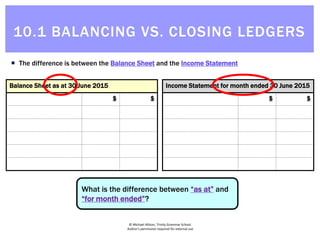

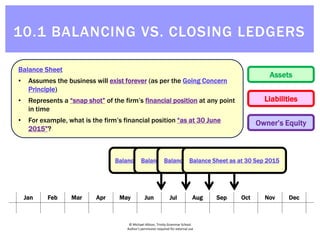

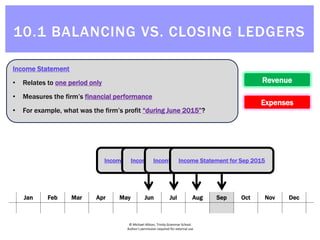

The document discusses the differences between balancing accounts and closing ledgers. Balancing accounts leaves account balances to carry forward to the next period, while closing ledgers transfers account balances to financial reports to "close off" the period. The Balance Sheet presents a snapshot of financial position as at a point in time, while the Income Statement aggregates revenues and expenses for a specific period, such as a month. Closing ledger accounts is necessary to accurately prepare these distinct financial statements for a given period and then start fresh for the next period.

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

Up until now, at the end of the period we have balanced all accounts…

Assets…

Cash at Bank [A]

1 Jun Balance 10000 30 Jun Cash Payments 18000

30 Jun Cash Receipts 20000 30 Jun Balance 12000

30000 30000

1 Jul Balance 12000

Cash at Bank [A]

1 Jun Balance 10000 30 Jun Cash Payments 18000

30 Jun Cash Receipts 20000 30 Jun Balance 12000

30000 30000

1 Jul Balance 12000

Cash at Bank [A]

1 Jun Balance 10000 30 Jun Cash Payments 18000

30 Jun Cash Receipts 20000 30 Jun Balance 12000

30000 30000

1 Jul Balance 12000

Cash at Bank [A]

1 Jun Balance 10000 30 Jun Cash Payments 18000

30 Jun Cash Receipts 20000 30 Jun Balance 12000

30000 30000

1 Jul Balance 12000

Cash at Bank [A]

1 Jun Balance 10000 30 Jun Cash Payments 18000

30 Jun Cash Receipts 20000 30 Jun Balance 12000

30000 30000

1 Jul Balance 12000

10.1 BALANCING VS. CLOSING LEDGERS](https://image.slidesharecdn.com/10-150514052205-lva1-app6892/85/10-1-Balancing-vs-Closing-ledgers-4-320.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

Up until now, at the end of the period we have balanced all accounts…

Liabilities…

Creditors Control [L]

30 Jun Cash at Bank 6000 1 Jun Balance 3000

30 Jun Balance 11000 30 Jun Stock Control 14000

17000 17000

1 Jul Balance 11000

Creditors Control [L]

30 Jun Cash at Bank 6000 1 Jun Balance 3000

30 Jun Balance 11000 30 Jun Stock Control 14000

17000 17000

1 Jul Balance 11000

Creditors Control [L]

30 Jun Cash at Bank 6000 1 Jun Balance 3000

30 Jun Balance 11000 30 Jun Stock Control 14000

17000 17000

1 Jul Balance 11000

Creditors Control [L]

30 Jun Cash at Bank 6000 1 Jun Balance 3000

30 Jun Balance 11000 30 Jun Stock Control 14000

17000 17000

1 Jul Balance 11000

Creditors Control [L]

30 Jun Cash at Bank 6000 1 Jun Balance 3000

30 Jun Balance 11000 30 Jun Stock Control 14000

17000 17000

1 Jul Balance 11000

10.1 BALANCING VS. CLOSING LEDGERS](https://image.slidesharecdn.com/10-150514052205-lva1-app6892/85/10-1-Balancing-vs-Closing-ledgers-5-320.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

Up until now, at the end of the period we have balanced all accounts…

Owner’s Equity…

Capital [OE]

1 Jun Balance 72000

30 Jun Balance 82000 30 Jun Cash at Bank 10000

82000 82000

1 Jul Balance 82000

Capital [OE]

1 Jun Balance 72000

30 Jun Balance 82000 30 Jun Cash at Bank 10000

82000 82000

1 Jul Balance 82000

Capital [OE]

1 Jun Balance 72000

30 Jun Balance 82000 30 Jun Cash at Bank 10000

82000 82000

1 Jul Balance 82000

Capital [OE]

1 Jun Balance 72000

30 Jun Balance 82000 30 Jun Cash at Bank 10000

82000 82000

1 Jul Balance 82000

Capital [OE]

1 Jun Balance 72000

30 Jun Balance 82000 30 Jun Cash at Bank 10000

82000 82000

1 Jul Balance 82000

10.1 BALANCING VS. CLOSING LEDGERS](https://image.slidesharecdn.com/10-150514052205-lva1-app6892/85/10-1-Balancing-vs-Closing-ledgers-6-320.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

Up until now, at the end of the period we have balanced all accounts…

Revenue…

Sales [R]

30 Jun Cash at Bank 35000

30 Jun Balance 53000 30 Jun Debtors Control 18000

53000 53000

1 Jul Balance 53000

Sales [R]

30 Jun Cash at Bank 35000

30 Jun Balance 53000 30 Jun Debtors Control 18000

53000 53000

1 Jul Balance 53000

Sales [R]

30 Jun Cash at Bank 35000

30 Jun Balance 53000 30 Jun Debtors Control 18000

53000 53000

1 Jul Balance 53000

Sales [R]

30 Jun Cash at Bank 35000

30 Jun Balance 53000 30 Jun Debtors Control 18000

53000 53000

1 Jul Balance 53000

Sales [R]

30 Jun Cash at Bank 35000

30 Jun Balance 53000 30 Jun Debtors Control 18000

53000 53000

1 Jul Balance 53000

10.1 BALANCING VS. CLOSING LEDGERS](https://image.slidesharecdn.com/10-150514052205-lva1-app6892/85/10-1-Balancing-vs-Closing-ledgers-7-320.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

Up until now, at the end of the period we have balanced all accounts…

Expenses…

Advertising [E]

30 Jun Cash at Bank 4000

30 Jun Stock Control 1000 30 Jun Balance 5000

5000 5000

1 Jul Balance 5000

Advertising [E]

30 Jun Cash at Bank 4000

30 Jun Stock Control 1000 30 Jun Balance 5000

5000 5000

1 Jul Balance 5000

Advertising [E]

30 Jun Cash at Bank 4000

30 Jun Stock Control 1000 30 Jun Balance 5000

5000 5000

1 Jul Balance 5000

Advertising [E]

30 Jun Cash at Bank 4000

30 Jun Stock Control 1000 30 Jun Balance 5000

5000 5000

1 Jul Balance 5000

Advertising [E]

30 Jun Cash at Bank 4000

30 Jun Stock Control 1000 30 Jun Balance 5000

5000 5000

1 Jul Balance 5000

10.1 BALANCING VS. CLOSING LEDGERS](https://image.slidesharecdn.com/10-150514052205-lva1-app6892/85/10-1-Balancing-vs-Closing-ledgers-8-320.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

Then, the balances of each account have been put into the Trial Balance…

Trial Balance as at 30 June 2015

$ $

Cash at bank [A] 12000 GST clearing [L] 1400

Debtors control [A] 4210 Creditors control [L] 11000

Stock control [A] 21380 Bank loan [L] 6000

Delivery vehicle [A] 83000 Capital [OE] 82000

Shop fittings [A] 10000 Discount revenue [R] 200

Discount expense [E] 120 Sales [R] 53000

Cost of sales [E] 3120

Drawings [-OE] 1230

Wages [E] 7600

Rent [E] 5940

Advertising [E] 5000

153600 153600

Trial Balance as at 30 June 2015

$ $

Cash at bank [A] 12000 GST clearing [L] 1400

Debtors control [A] 4210 Creditors control [L] 11000

Stock control [A] 21380 Bank loan [L] 6000

Delivery vehicle [A] 83000 Capital [OE] 82000

Shop fittings [A] 10000 Discount revenue [R] 200

Discount expense [E] 120 Sales [R] 53000

Cost of sales [E] 3120

Drawings [-OE] 1230

Wages [E] 7600

Rent [E] 5940

Advertising [E] 5000

153600 153600

Trial Balance as at 30 June 2015

$ $

Cash at bank [A] 12000 GST clearing [L] 1400

Debtors control [A] 4210 Creditors control [L] 11000

Stock control [A] 21380 Bank loan [L] 6000

Delivery vehicle [A] 83000 Capital [OE] 82000

Shop fittings [A] 10000 Discount revenue [R] 200

Discount expense [E] 120 Sales [R] 53000

Cost of sales [E] 3120

Drawings [-OE] 1230

Wages [E] 7600

Rent [E] 5940

Advertising [E] 5000

153600 153600

Trial Balance as at 30 June 2015

$ $

Cash at bank [A] 12000 GST clearing [L] 1400

Debtors control [A] 4210 Creditors control [L] 11000

Stock control [A] 21380 Bank loan [L] 6000

Delivery vehicle [A] 83000 Capital [OE] 82000

Shop fittings [A] 10000 Discount revenue [R] 200

Discount expense [E] 120 Sales [R] 53000

Cost of sales [E] 3120

Drawings [-OE] 1230

Wages [E] 7600

Rent [E] 5940

Advertising [E] 5000

153600 153600

Trial Balance as at 30 June 2015

$ $

Cash at bank [A] 12000 GST clearing [L] 1400

Debtors control [A] 4210 Creditors control [L] 11000

Stock control [A] 21380 Bank loan [L] 6000

Delivery vehicle [A] 83000 Capital [OE] 82000

Shop fittings [A] 10000 Discount revenue [R] 200

Discount expense [E] 120 Sales [R] 53000

Cost of sales [E] 3120

Drawings [-OE] 1230

Wages [E] 7600

Rent [E] 5940

Advertising [E] 5000

153600 153600

10.1 BALANCING VS. CLOSING LEDGERS](https://image.slidesharecdn.com/10-150514052205-lva1-app6892/85/10-1-Balancing-vs-Closing-ledgers-9-320.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

Then each of these

accounts will go into

one of two reports:

1. Balance Sheet:

Assets

Liabilities

Owner’s Equity

2. Income Statement

Revenues

Expenses

Trial Balance as at 30 June 2015

$ $

Cash at bank [A] 12000 GST clearing [L] 1400

Debtors control [A] 4210 Creditors control [L] 11000

Stock control [A] 21380 Bank loan [L] 6000

Delivery vehicle [A] 83000 Capital [OE] 82000

Shop fittings [A] 10000 Discount revenue [R] 200

Discount expense [E] 120 Sales [R] 53000

Cost of sales [E] 3120

Drawings [-OE] 1230

Wages [E] 7600

Rent [E] 5940

Advertising [E] 5000

153600 153600

Trial Balance as at 30 June 2015

$ $

Cash at bank [A] 12000 GST clearing [L] 1400

Debtors control [A] 4210 Creditors control [L] 11000

Stock control [A] 21380 Bank loan [L] 6000

Delivery vehicle [A] 83000 Capital [OE] 82000

Shop fittings [A] 10000 Discount revenue [R] 200

Discount expense [E] 120 Sales [R] 53000

Cost of sales [E] 3120

Drawings [-OE] 1230

Wages [E] 7600

Rent [E] 5940

Advertising [E] 5000

153600 153600

Trial Balance as at 30 June 2015

$ $

Cash at bank [A] 12000 GST clearing [L] 1400

Debtors control [A] 4210 Creditors control [L] 11000

Stock control [A] 21380 Bank loan [L] 6000

Delivery vehicle [A] 83000 Capital [OE] 82000

Shop fittings [A] 10000 Discount revenue [R] 200

Discount expense [E] 120 Sales [R] 53000

Cost of sales [E] 3120

Drawings [-OE] 1230

Wages [E] 7600

Rent [E] 5940

Advertising [E] 5000

153600 153600

Trial Balance as at 30 June 2015

$ $

Cash at bank [A] 12000 GST clearing [L] 1400

Debtors control [A] 4210 Creditors control [L] 11000

Stock control [A] 21380 Bank loan [L] 6000

Delivery vehicle [A] 83000 Capital [OE] 82000

Shop fittings [A] 10000 Discount revenue [R] 200

Discount expense [E] 120 Sales [R] 53000

Cost of sales [E] 3120

Drawings [-OE] 1230

Wages [E] 7600

Rent [E] 5940

Advertising [E] 5000

153600 153600

Trial Balance as at 30 June 2015

$ $

Cash at bank [A] 12000 GST clearing [L] 1400

Debtors control [A] 4210 Creditors control [L] 11000

Stock control [A] 21380 Bank loan [L] 6000

Delivery vehicle [A] 83000 Capital [OE] 82000

Shop fittings [A] 10000 Discount revenue [R] 200

Discount expense [E] 120 Sales [R] 53000

Cost of sales [E] 3120

Drawings [-OE] 1230

Wages [E] 7600

Rent [E] 5940

Advertising [E] 5000

153600 153600

Trial Balance as at 30 June 2015

$ $

Cash at bank [A] 12000 GST clearing [L] 1400

Debtors control [A] 4210 Creditors control [L] 11000

Stock control [A] 21380 Bank loan [L] 6000

Delivery vehicle [A] 83000 Capital [OE] 82000

Shop fittings [A] 10000 Discount revenue [R] 200

Discount expense [E] 120 Sales [R] 53000

Cost of sales [E] 3120

Drawings [-OE] 1230

Wages [E] 7600

Rent [E] 5940

Advertising [E] 5000

153600 153600

10.1 BALANCING VS. CLOSING LEDGERS](https://image.slidesharecdn.com/10-150514052205-lva1-app6892/85/10-1-Balancing-vs-Closing-ledgers-10-320.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

But balancing all accounts at the end of the period is wrong

WHY?Assets…

Cash at Bank [A]

1 Jun Balance 10000 30 Jun Cash Payments 18000

30 Jun Cash Receipts 20000 30 Jun Balance 12000

30000 30000

1 Jul Balance 12000

Revenue…

Sales [R]

30 Jun Cash at Bank 35000

30 Jun Balance 53000 30 Jun Debtors Control 18000

53000 53000

1 Jul Balance 53000

10.1 BALANCING VS. CLOSING LEDGERS](https://image.slidesharecdn.com/10-150514052205-lva1-app6892/85/10-1-Balancing-vs-Closing-ledgers-11-320.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

The accounts in the Balance Sheet must be balanced as they will continue

into next period

Cash at Bank [A]

1 Jun Balance 10000 30 Jun Cash Payments 18000

30 Jun Cash Receipts 20000 30 Jun Balance 12000

30000 30000

1 Jul Balance 12000

Cash at Bank [A]

1 Jun Balance 10000 30 Jun Cash Payments 18000

30 Jun Cash Receipts 20000 30 Jun Balance 12000

30000 30000

1 Jul Balance 12000

Cash at Bank [A]

1 Jun Balance 10000 30 Jun Cash Payments 18000

30 Jun Cash Receipts 20000 30 Jun Balance 12000

30000 30000

1 Jul Balance 12000

Cash at Bank [A]

1 Jun Balance 10000 30 Jun Cash Payments 18000

30 Jun Cash Receipts 20000 30 Jun Balance 12000

30000 30000

1 Jul Balance 12000

Cash at Bank [A]

1 Jun Balance 10000 30 Jun Cash Payments 18000

30 Jun Cash Receipts 20000 30 Jun Balance 12000

30000 30000

1 Jul Balance 12000

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Balance Sheet as at 30 June 2015

The firm’s cash balance of

$12,000 will continue into the

future

10.1 BALANCING VS. CLOSING LEDGERS](https://image.slidesharecdn.com/10-150514052205-lva1-app6892/85/10-1-Balancing-vs-Closing-ledgers-15-320.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

The accounts in the Income Statement are relevant to one period only

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Sales [R]

30 Jun Cash at Bank 35000

30 Jun Balance 53000 30 Jun Debtors Control 18000

53000 53000

1 Jul Balance 53000

Income Statement for June 2015

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

The $53,000 of sales

relates only to June

The $53,000 of sales are NOT

relevant to future periods…

Sales [R]

30 Jun Cash at Bank 35000

30 Jun Balance 53000 30 Jun Debtors Control 18000

53000 53000

1 Jul Balance 53000

Sales [R]

30 Jun Cash at Bank 35000

30 Jun Balance 53000 30 Jun Debtors Control 18000

53000 53000

1 Jul Balance 53000

So there is no need to balance

this ledger into future

periods…

The sales in June are

NOT related to the sales

in July

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

The sales in July are NOT

related to the sales in

August

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

The sales in August are

NOT related to the sales

in September

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

10.1 BALANCING VS. CLOSING LEDGERS](https://image.slidesharecdn.com/10-150514052205-lva1-app6892/85/10-1-Balancing-vs-Closing-ledgers-16-320.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

So every account must be either:

Balanced

The balance of the account at the end of

the period is carried forward into next

period.

Vs

Closed

The balance of the account is reset to zero

at the end of the period

Assets

Liabilities

Owner’s Equity

Cash at Bank [A]

1/6 Balance 10000 30/6 Cash Pay. 18000

30/6 Cash Rec. 20000 30/6 Balance 12000

30000 30000

1/7 Balance 12000

Sales [R]

30/6 Cash at Bank 35000

30/6 53000 30/6 Debtors Cont. 18000

53000 53000

Cash at Bank [A]

1/6 Balance 10000 30/6 Cash Pay. 18000

30/6 Cash Rec. 20000 30/6 Balance 12000

30000 30000

1/7 Balance 12000

Cash at Bank [A]

1/6 Balance 10000 30/6 Cash Pay. 18000

30/6 Cash Rec. 20000 30/6 Balance 12000

30000 30000

1/7 Balance 12000

Cash at Bank [A]

1/6 Balance 10000 30/6 Cash Pay. 18000

30/6 Cash Rec. 20000 30/6 Balance 12000

30000 30000

1/7 Balance 12000

Cash at Bank [A]

1/6 Balance 10000 30/6 Cash Pay. 18000

30/6 Cash Rec. 20000 30/6 Balance 12000

30000 30000

1/7 Balance 12000

Sales [R]

30/6 Cash at Bank 35000

30/6 53000 30/6 Debtors Cont. 18000

53000 53000

Sales [R]

30/6 Cash at Bank 35000

30/6 53000 30/6 Debtors Cont. 18000

53000 53000

Sales [R]

30/6 Cash at Bank 35000

30/6 53000 30/6 Debtors Cont. 18000

53000 53000

Revenue

Expenses

Drawings

10.1 BALANCING VS. CLOSING LEDGERS](https://image.slidesharecdn.com/10-150514052205-lva1-app6892/85/10-1-Balancing-vs-Closing-ledgers-17-320.jpg)

![© Michael Allison, Trinity Grammar School.

Author’s permission required for external use

The difference between balancing and closing…

June July

Cash at Bank [A]

1/6 Balance 10000 30/6 Cash Pay. 18000

30/6 Cash Rec. 20000 30/6 Balance 12000

30000 30000

1/7 Balance 12000

Sales [R]

30/6 Cash at Bank 35000

30/6 53000 30/6 Debtors Cont. 18000

53000 53000

Balancing

Closing

Cash at Bank [A]

1/7 Balance 12000

Sales [R]

30/6 Cash at Bank 35000

30/6 53000 30/6 Debtors Cont. 18000

53000 53000

10.1 BALANCING VS. CLOSING LEDGERS](https://image.slidesharecdn.com/10-150514052205-lva1-app6892/85/10-1-Balancing-vs-Closing-ledgers-18-320.jpg)