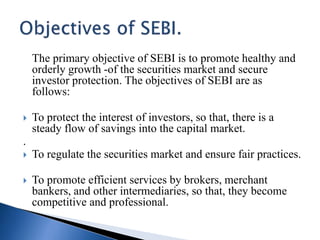

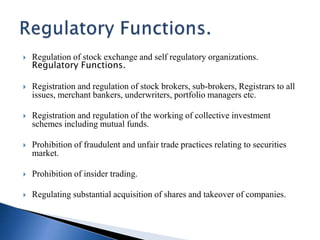

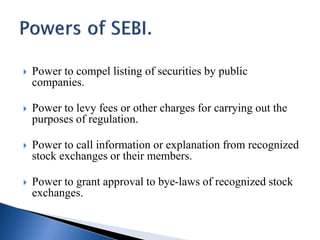

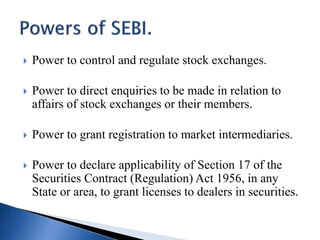

SEBI was constituted in 1988 as a non-statutory body and was given statutory powers in 1992 through the SEBI Act. It acts as the regulator for the securities market in India and aims to protect investors and ensure the orderly and fair development of securities markets. SEBI has regulatory and developmental functions like registering market intermediaries, prohibiting unfair trade practices, promoting investor education and conducting research. It oversees stock exchanges, collects fees and charges, and has powers to regulate market participants and activities.