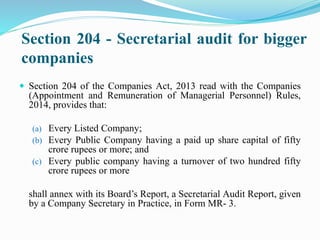

Section 204 of the Companies Act 2013 mandates secretarial audits for listed companies, public companies with a paid up capital of over Rs. 50 crore or turnover over Rs. 250 crore. A secretarial audit verifies compliance with company law and other applicable laws, conducted by an independent company secretary. Non-compliance can result in fines from Rs. 1-5 lakh. Secretarial audits ensure management compliance and prevent penal liability. Fraud reporting and penalties for false statements are also outlined. Benefits include due diligence, risk avoidance, and regulatory assurance of compliance.

![Introduction

Secretarial Audit is a process of checking and verifying the records

and documents of the company and to check whether the company is

in compliance with the provisions of Companies Act, 2013 and other

applicable laws.

The Secretarial Audit Report aims at confirming compliance by the

company with all the applicable provisions of the applicable laws

and pointing out non-compliances and recommendations for better

compliance.

The compliances are verified and checked by an independent

professional [a company secretary in practice] to ensure that the

company has complied with all the legal, secretarial and procedural

requirements as required under various applicable laws.](https://image.slidesharecdn.com/secretarialauditppt-150222050451-conversion-gate02/85/Secretarial-audit-ppt-2-320.jpg)

![Appointment of Secretarial auditor

The Secretarial Auditor would be required to be appointed in

the board meeting of the Company and the remuneration of the

Auditor will also be determined in the aforementioned board

meeting [Section 179(3)].

Company is required to file the certified true copy of the

resolution passed in the aforementioned board meeting with the

Registrar of Companies as an attachment in e-form MGT – 14.

However, prior to the appointment, the Company would be

required to obtain the consent of the Secretarial Auditor.](https://image.slidesharecdn.com/secretarialauditppt-150222050451-conversion-gate02/85/Secretarial-audit-ppt-5-320.jpg)

![Duties of Secretarial auditor – Fraud

Reporting [Sec 143(12)(14)]

If Company Secretary in Practice, during conduct of Secretarial Audit, has

sufficient reason to believe that an offence involving fraud is being committed or

has been committed against the company by officers or employees of the

company, he shall report the same to the Central Government immediately but not

later than 60 days of his knowledge with a copy to the Board / Audit Committee

seeking their reply within 45 days;

Board / Audit Committee to reply in writing the steps taken to address the fraud;

The Auditor to forward his report and reply of the Board / Audit Committee with

his Comments to the Central Government within 15 days of reply by Board / Audit

Committee;

The Report shall be in Form ADT – 4.](https://image.slidesharecdn.com/secretarialauditppt-150222050451-conversion-gate02/85/Secretarial-audit-ppt-13-320.jpg)