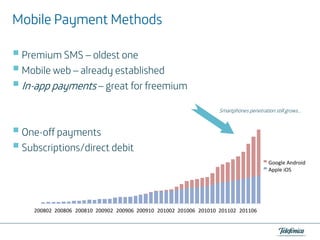

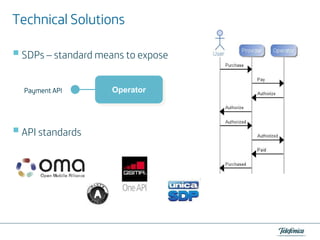

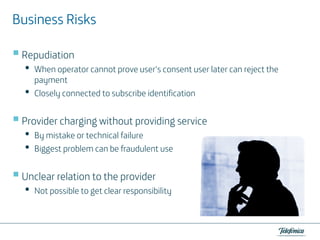

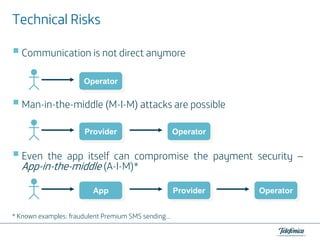

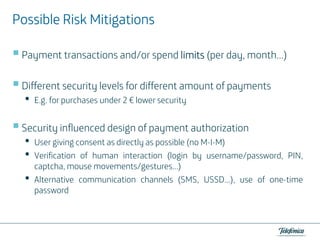

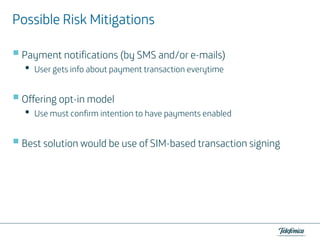

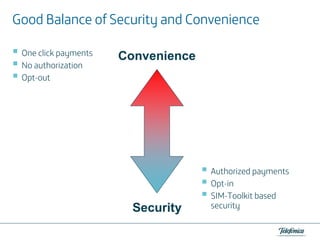

This document summarizes mobile payments from Telefónica Czech Republic's perspective. It discusses Telefónica's experience with mobile payment services in Czech Republic over the past 10 years. It also outlines opportunities for mobile network operators to engage in mobile payments. Some technical solutions and risks are described, along with recommendations to balance security and convenience for users. The document concludes mobile payments can help operators return to the value chain and offset declining content revenues.