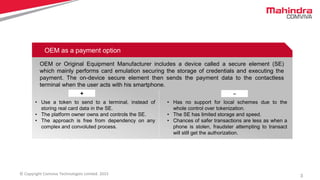

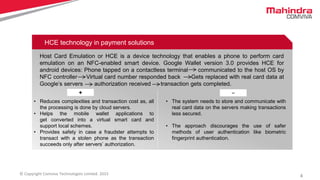

The document compares two payment options for banks: OEM (Original Equipment Manufacturer) and HCE (Host Card Emulation), highlighting the benefits and drawbacks of each. OEM utilizes a secure element for payments, providing more security but with less flexibility, while HCE allows for easier deployment of mobile payments but has security vulnerabilities due to reliance on cloud processing. Ultimately, banks must choose the option that aligns best with their operational needs and customer requirements.