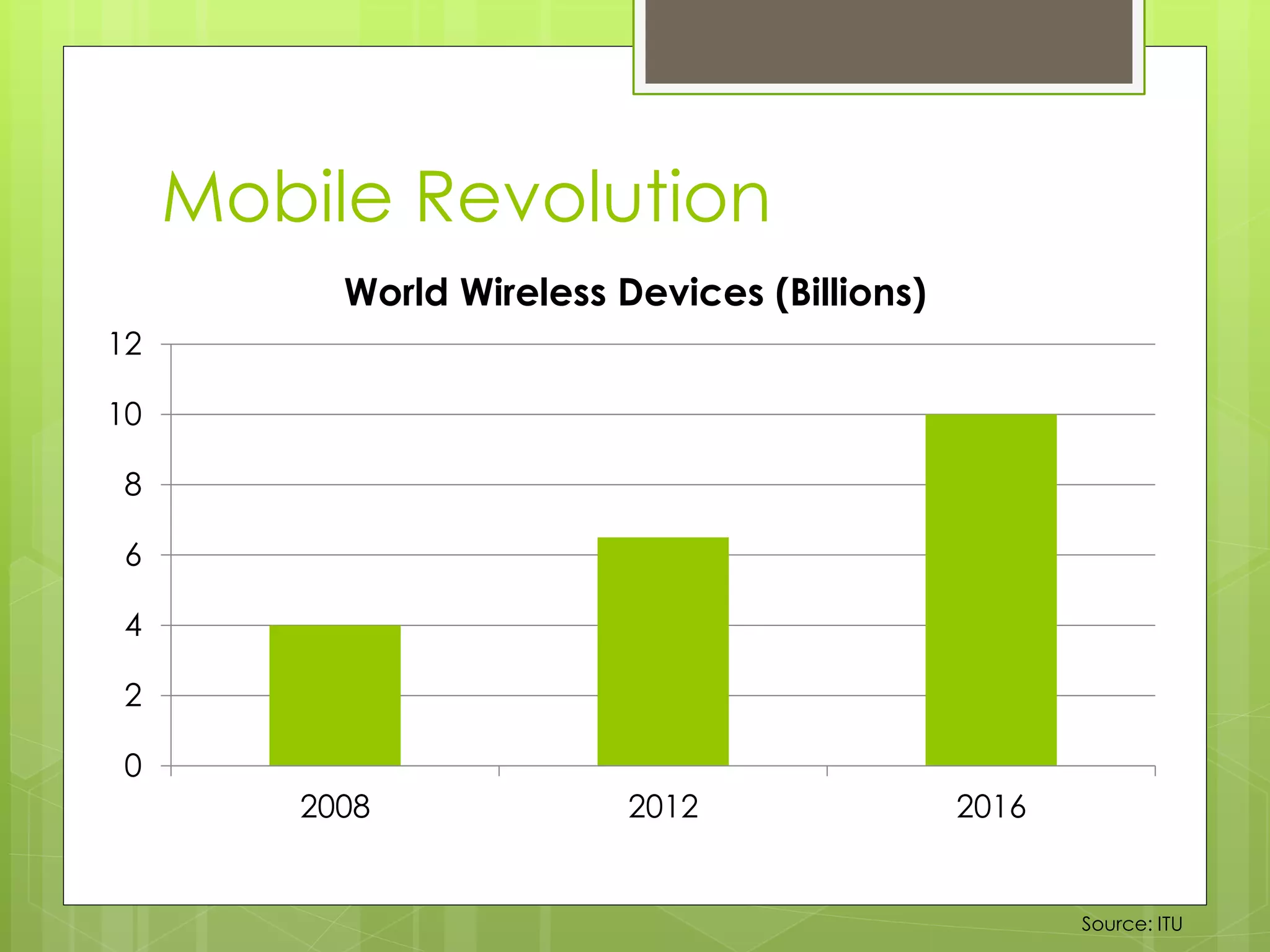

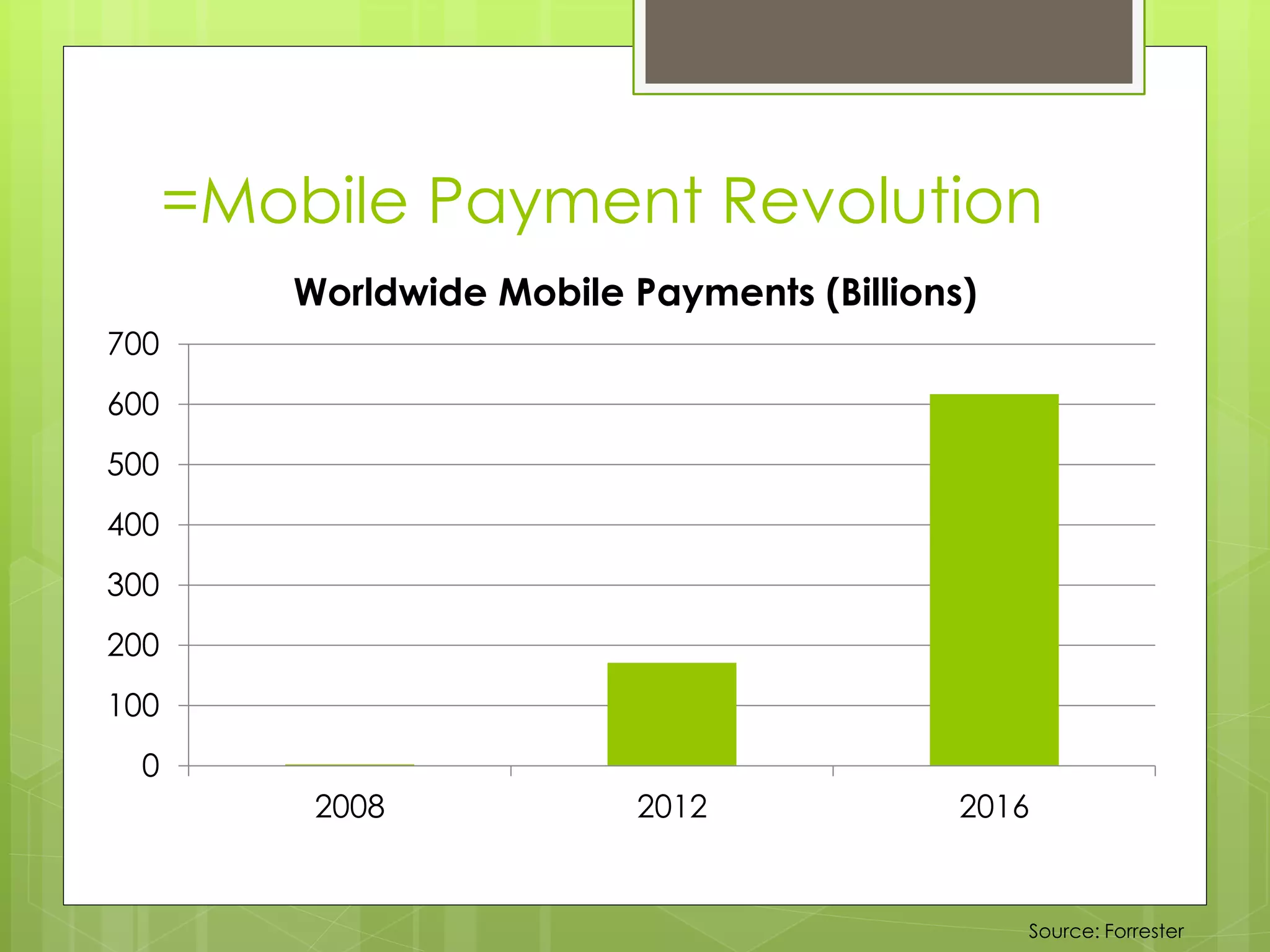

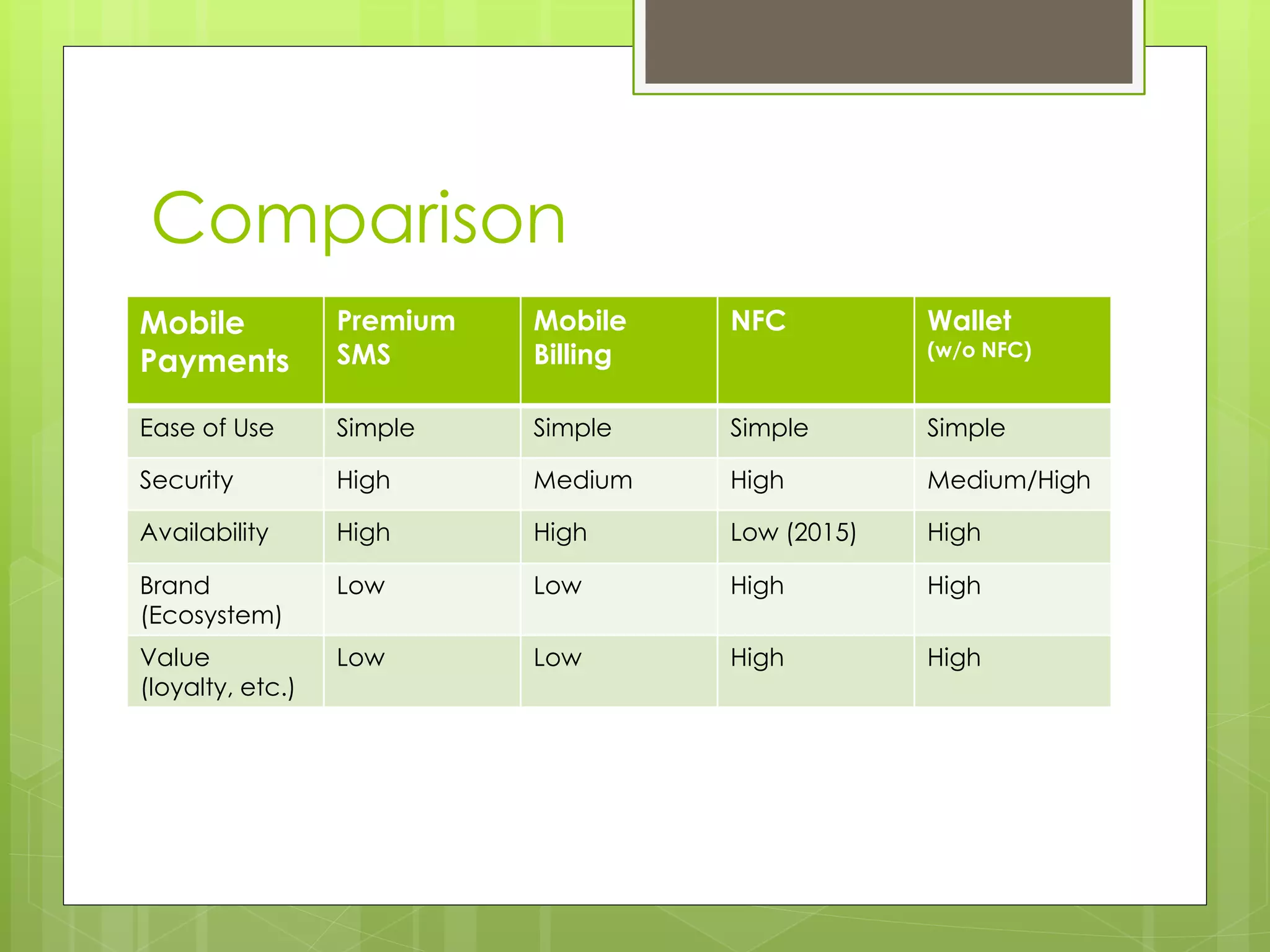

The document discusses the growth of mobile payments and emerging mobile payment platforms. It notes that as the number of wireless devices increases to outnumber wired devices, everything digital will become mobile including payments and commerce. It then summarizes some of the major mobile payment methods like premium SMS, mobile billing, NFC, and electronic wallets. Key platforms that could see success are discussed like ISIS Mobile Wallet, Google Wallet, and PayPal. The document concludes that financial transactions are undergoing massive changes due to the mobile revolution and that there will be multiple winners in the mobile payments space.