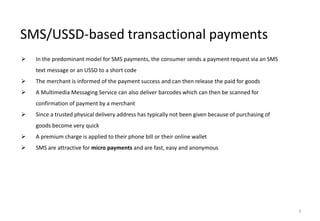

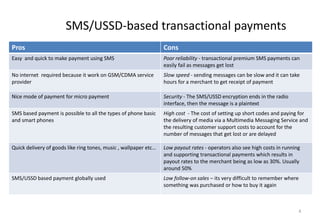

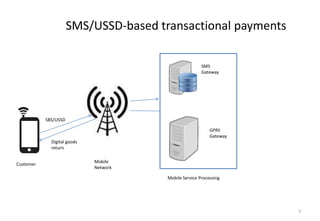

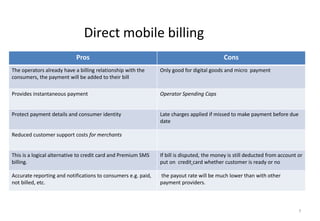

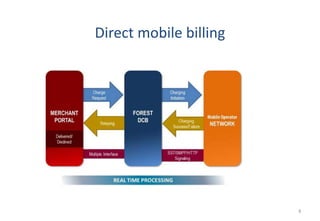

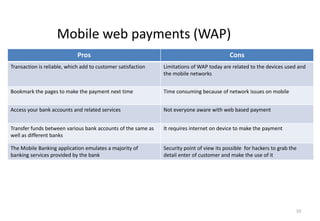

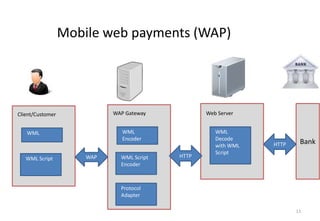

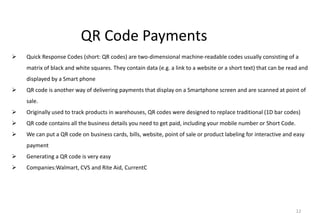

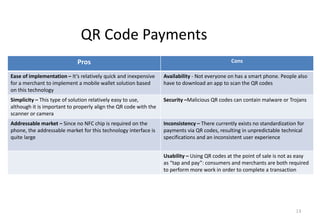

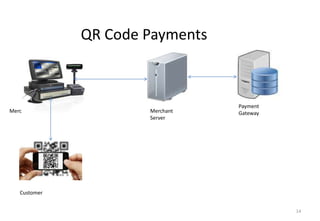

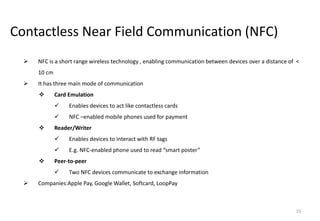

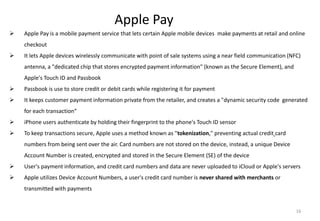

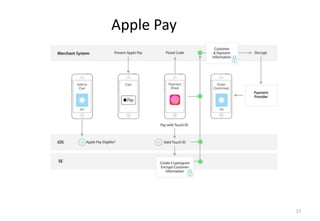

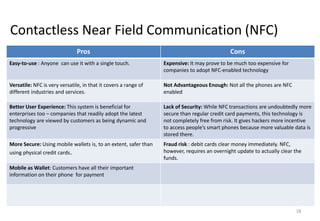

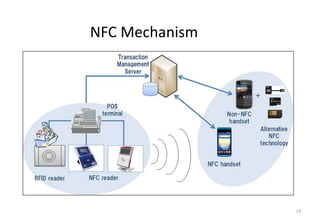

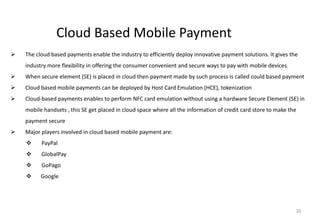

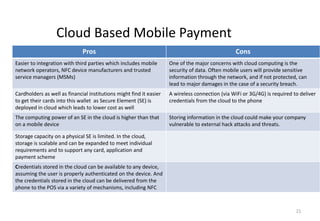

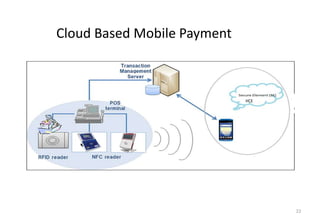

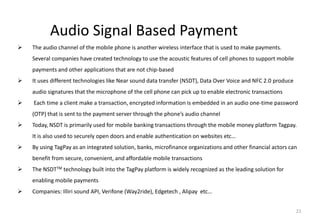

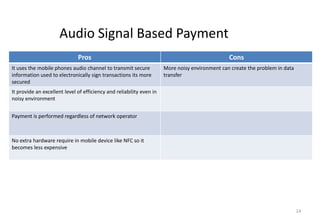

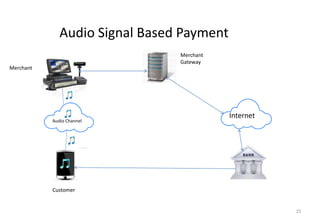

The document outlines various mobile payment methods, including SMS/USSD-based payments, direct mobile billing, mobile web payments, QR code payments, contactless NFC, cloud-based payments, and audio signal-based payments. Each method has distinct advantages and disadvantages, such as security, ease of use, and cost implications. Overall, the document provides insights into the mechanics, pros, and cons of these payment systems in the evolving digital economy.