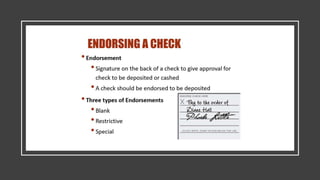

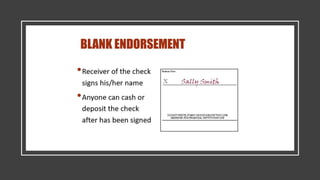

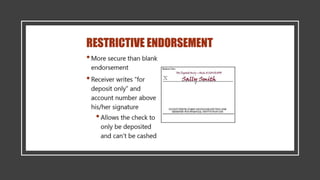

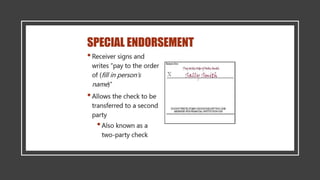

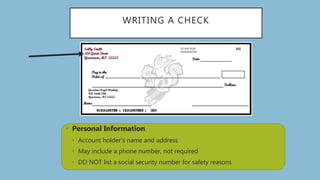

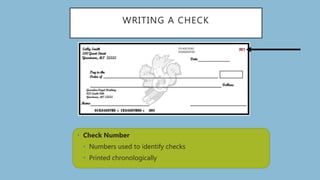

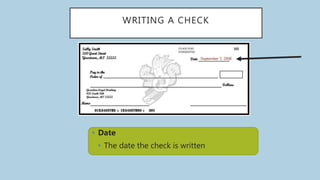

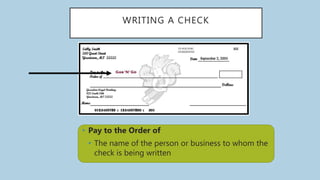

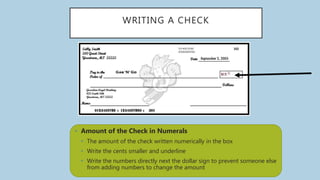

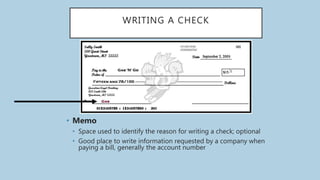

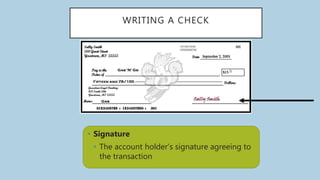

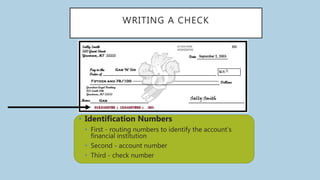

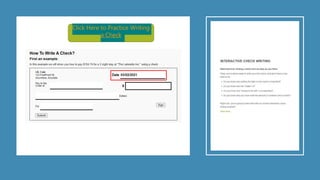

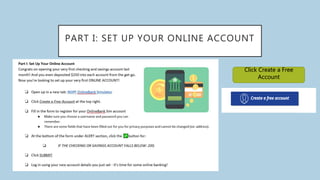

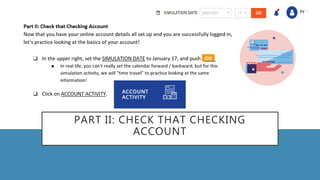

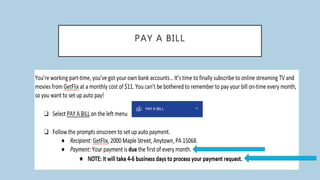

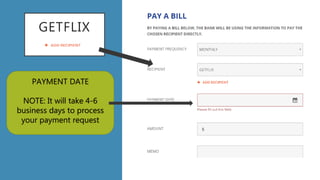

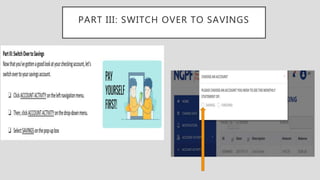

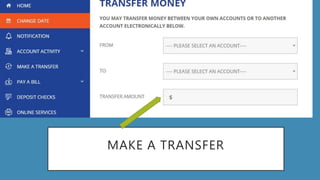

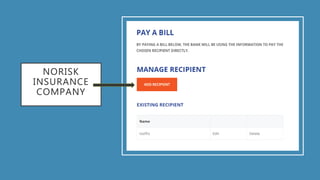

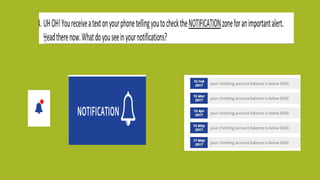

This document provides information about online banking and related activities. It discusses how consumers commonly use online banking for bill pay and direct deposit. It also outlines how to navigate an online bank account, including signing up, checking balances, paying bills through transfers between accounts. The document includes instructions for mobile deposits by taking photos of checks and endorsements with a mobile device. It also details how to properly write a check, including personal information, check numbers, dates, payee, amounts in words and numbers, signatures and identification numbers. An interactive activity at the end walks through setting up an online account and common tasks like paying bills and transfers between accounts.