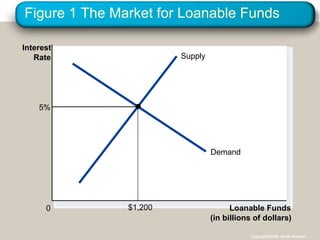

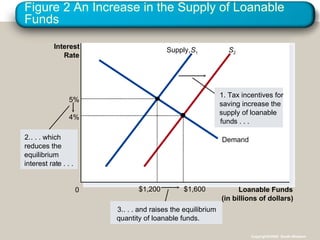

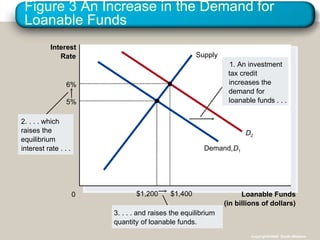

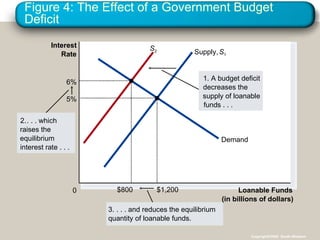

The financial system consists of institutions that match savers and investors. It includes financial markets like the stock and bond markets, where savers can directly provide funds to borrowers, as well as financial intermediaries like banks and mutual funds, where savers can indirectly provide funds. Government policies around taxes, spending, and deficits can impact saving, investment, and interest rates in the market for loanable funds by shifting the supply of or demand for funds.