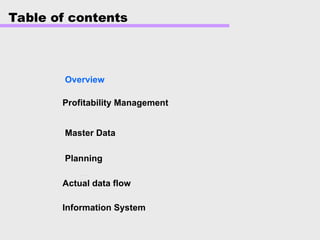

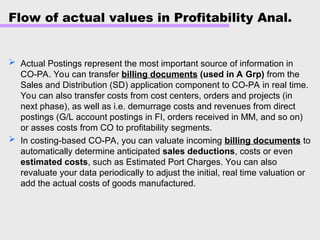

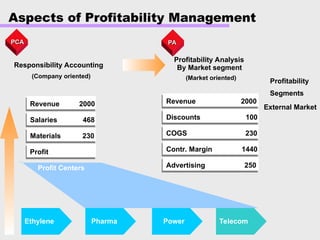

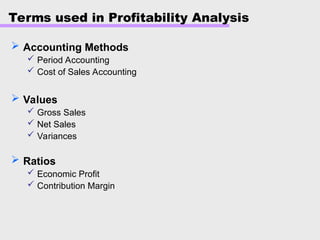

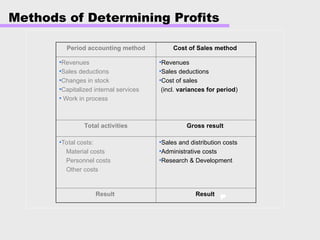

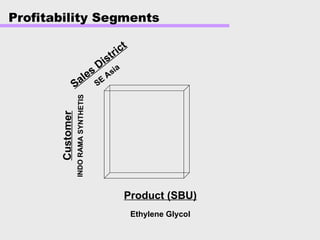

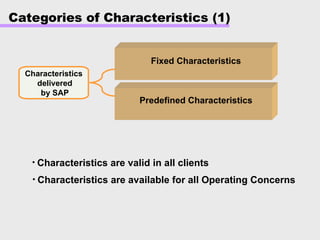

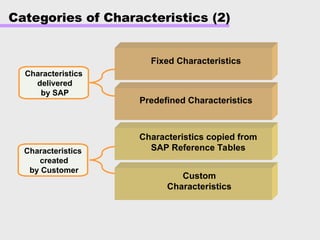

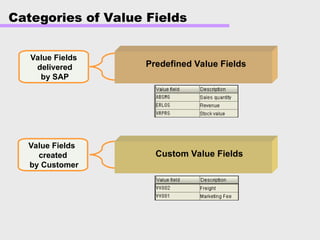

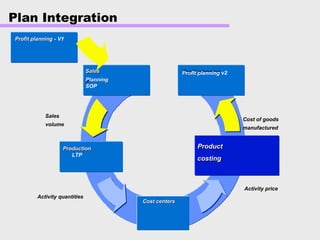

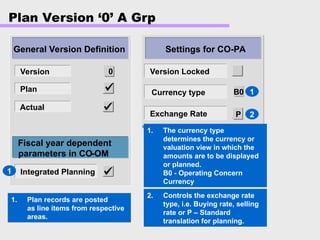

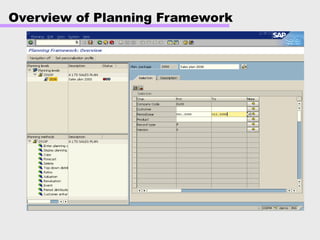

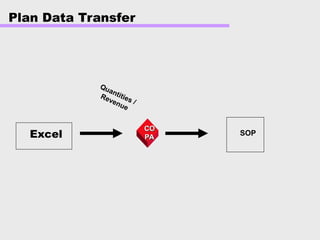

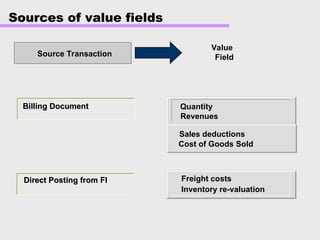

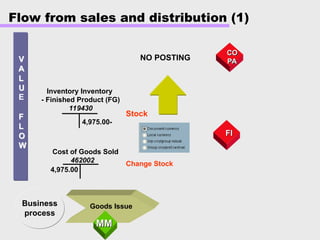

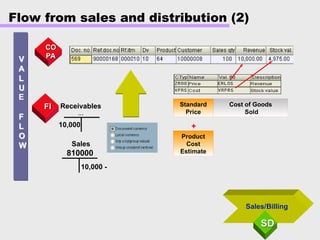

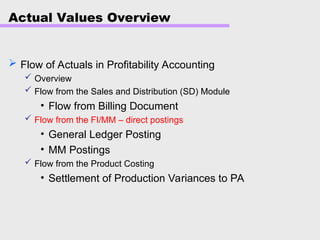

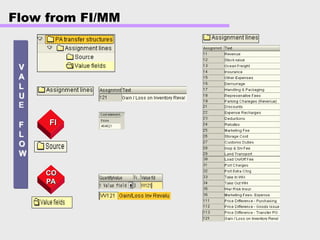

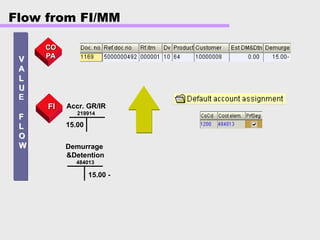

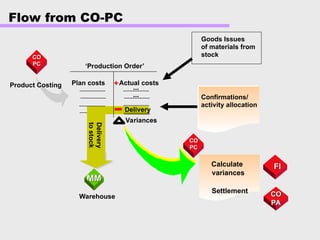

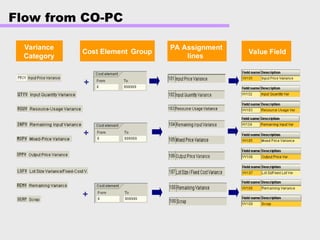

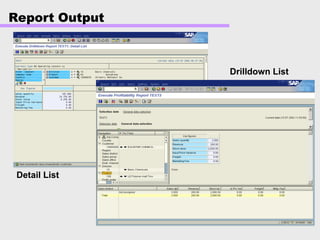

The document outlines the objectives and functionalities of profitability analysis in SAP, emphasizing understanding co-pa structures, actual data flow, and planning. It details the methods of profitability management, the importance of actual postings from various components, and the analysis of market segments' profitability. Additionally, it describes the flow of actual values from modules like sales and distribution, as well as the planning aspects related to co-pa.