This document provides an overview of the CIN Knowledge Bank, which is a handbook for quick CIN implementation. It includes sections on frequently asked questions, user exits, business events, customization, pricing, configurable messages, transaction data, security, and important notes. The document was created by SAP Labs India as a draft on November 20, 2001.

![CIN Knowledge Bank

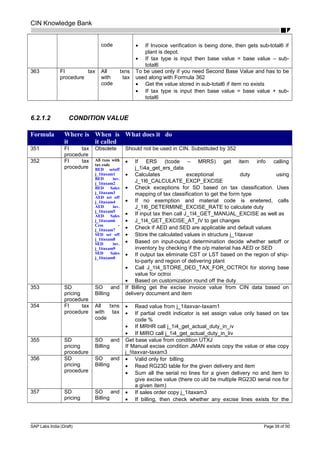

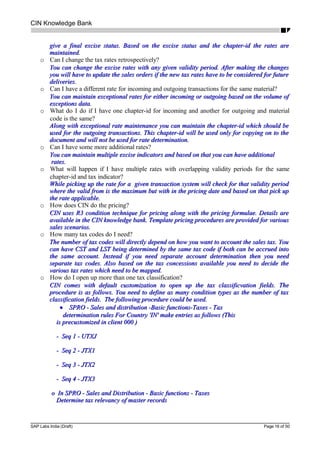

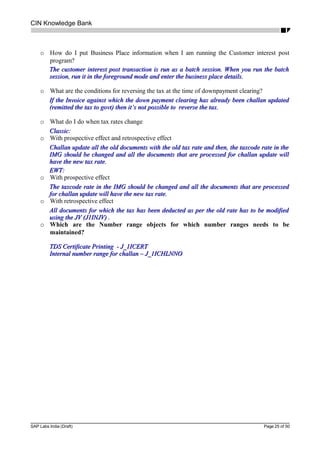

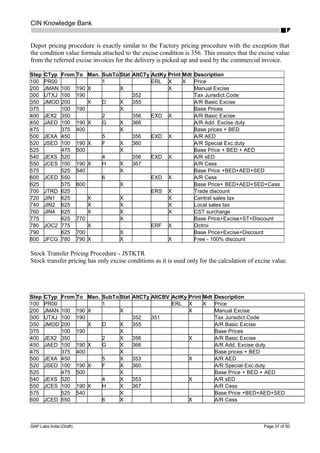

625 575 600 X Base Price+ BED+AED+SED+Cess

780 JOC1 625 ERF X Octroi accural

MM Pricing

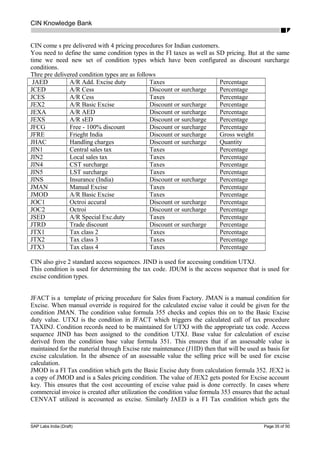

CIN provides a customized procedure for import processing J_IMP

Step Cntr CTyp From To Man. Reqt SubTo Stat Accrls Print Description

001 01 P000 1 X Gross Price

001 02 P001 005 1 X Gross Price

005 00 001 002 9 Gross value

010 01 R000 001 X X Discount % on Gross

010 02 R001 X X Discount/Quantity

010 03 R002 X X Absolute discount

010 04 KR00 X X Header Disc.(Value)

010 05 K000 X Contrct HeaderDisc %

010 06 R003 X X Discount % on Net

016 00 X Net incl. disc.

017 00 JEXC 5 X Manual Excise Value

019 00 016 X Net incl. disc.- 2

021 01 NAVS 019 X Non-Deductible Tax

022 00 019 021 3 Net incl. tax

024 00 JCDB 022 FR3 X Basic customs duty

025 00 JCV1 022 024 ` FR3 X CVD Percentage

026 00 JCDS 022 025 FR3 X Special customs duty

028 00 FRB1 FR1 X Freight (Value)

035 01 SKTO 019 017 X Cash Discount

040 00 2 Actual Value

070 00 GRWR 019 008 C X Statistical Value

All the customs duty conditions have been configured as delivery cost conditions with separate

accounting keys.

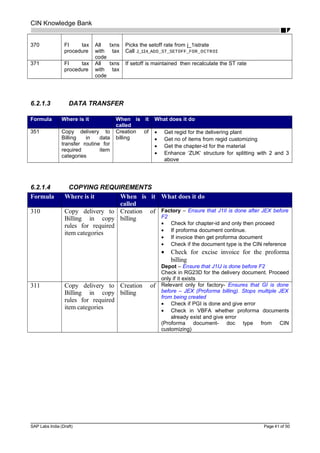

6.2 CIN Formulae

6.2.1.1 CONDITION BASE VALUE

Formula Where is it When is it

called

What does it do

351 SD pricing

procedure

SO, Billing

(once for

each item]

• Checks if assessable value or NDP is maintained for the

item in CIN

• Set Assessable value or NDP in that sequence as the base

value

361 MM pricing

procedure

PO, IV if

delivery

cost exists

[once for

each item]

Calls the function J_1I4_GET_DEDUC_TAX_FOR_OCTROI

[This function takes the condition value of NAVS plus the

globally stored setoff value.

Setoff value = deductible BED + AED + SED + sales-tax setoff]

362 FI tax

procedure

All txns

with tax

To be used only if you need second Base Value

• Gets the value stored in sub-total6 if item no exists

SAP Labs India (Draft) Page 38 of 50](https://image.slidesharecdn.com/cinknowledgebank-161201084016/85/CIN-knowledge-bank-38-320.jpg)