Samsung Electronics Co. Ltd is South Korea's largest electronics producer. It has four main divisions: Digital Media, Semiconductors, Information & Communications, and Home Appliances. The document provides a 3-year financial ratio analysis of Samsung from 2011-2012. It found that Samsung's profitability, stability, and ability to pay debts improved over this period. Specifically, its return on equity, net profit margin, and gross profit margin increased. Debt levels and expenses as a percentage of sales decreased. The analysis recommends investing in Samsung as it is profitable, stable, and its shares offer a reasonable price-earnings ratio of 6.65 years.

![School of Architecture, Building & Design

Basic Accounting [FNBE0145]

FNBE April Intake

Financial Ratio Analysis on

‘Samsung Electronics Co. Ltd’

Prepared by: Karen Kong Chai Ni (0315480)

Lily Then (0313973)

Lecturer: Chang Jau Ho](https://image.slidesharecdn.com/samsunghistoryrecentdevelopment1-140215004816-phpapp01/75/Samsung-history-recent-development-1-1-2048.jpg)

![6

Ratio Analysis of Business

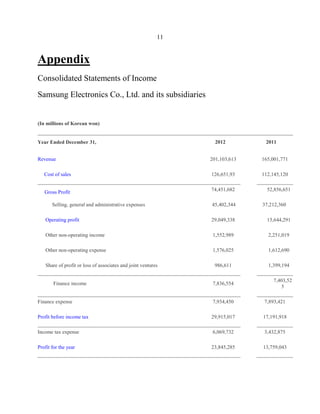

Profitability

2011

2012

Interpretation

Ratios

Net Profit

Margin

(NPM)

During the period 2011 to

[(121480206+101313630)÷

2012, ROE increase from

2] × 100%

15.4% to 26.9%. This means

= (17191918÷111396918)×

100%

= (29915017÷111396918)×

that the owner is setting the

100%

higher return on his capital this

=0.268544 ×100%

year.

26.9%

(17191918÷165001771)×

(29915017÷201103613)×

During the period 2011 to

100%

100%

2012, NPM increase from

=0.10419× 100%

=0.14875× 100%

10.4% to 14.9%. This means

=10.4%

(ROE)

29915017÷

=15.4%

Equity

17191918÷

[(121480206+101313630)÷

2] ×100%

=0.15433× 100%

Return on

=14.9%

that the business is getting

better at controlling expense.

Gross Profit (52856651÷165001771)

(GPM)

During the period 2011 to

×100%

100%

2012, GPM increase from 32%

=0.32133× 100%

=0.37021× 100%

to 37%. This means that the

=32.0%

Margin

(74451682÷201103613)×

=37.0%

business is getting better in

controlling the cost of goods

sold expenses.

Selling

Expense

Ratio(SER)

(18606180÷165001771)

(18606180÷201103613)

During the period 2011 to

×100%

×100%

2012, SER decrease from

=0.11276×100%

=0.09252×100%

11.3% to 9.3%. This means that

=11.3%

=9.3%

the business is getting better in

controlling the selling](https://image.slidesharecdn.com/samsunghistoryrecentdevelopment1-140215004816-phpapp01/85/Samsung-history-recent-development-1-9-320.jpg)

![8

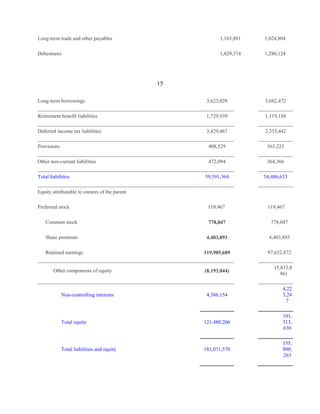

Stability

2011

2012

Interpretation

Ratios

Working

(71502063÷44319014)

(87269017÷46933052)

During the period 2011 to

Capital

=1.61:1

=1.86:1

2012, working capital increase

from 1.61:1 to 1.86:1. This

means that the ability of

business to pay off its current

liabilities with current assest is

getting better. In addition, it

was not satisfy the minimum

working capital 2:1.

(54486633÷155800263)×

(59591364÷181071570)×

During the period 2011 to

100%

100%

2012, total debt decrease from

=0.34972× 100%

=0.32910× 100%

34.9% to 32.9%. This means

=34.9%

Total Debt

=32.9%

that the business’s total debt

level has gone down but the

total level is below the

maximum 50% level.

Stock

365÷[112145120÷{(177474

365÷[126651931÷{(177474

During the period 2011 to

Turnover

13+15716715)÷2}]

13+15716715)÷2}]

2012, stock turnover decrease

=365÷[112145120÷1673206 =365÷[126651931÷1673206 from 54 days to 48 days. This

4]

4]

means that the business sell its

=365÷[6.7024]

=365÷[7.5694]

goods faster.

=54 days

=48 days

Debtor

365÷[165001771÷{(266745

365÷[201103613÷{(266745

During the period 2011 to

Turnover

96+24153028)÷2}]

96+24153028)÷2}]

2012, debtor turnover decrease

=365÷[165001771÷2541381 =365÷[201103613÷2541381 from 56.2 days to 46.1 days.

2]

2]

This means that the business is

=365÷[6.4926]

=365÷[7.9131]

faster in collecting debts.](https://image.slidesharecdn.com/samsunghistoryrecentdevelopment1-140215004816-phpapp01/85/Samsung-history-recent-development-1-11-320.jpg)

![16

Reference

1. 4-traders (2014) Samsung Electronics Co. Ltd. Retrieved from http://www.4traders.com/SAMSUNG-ELECTRONICS-CO-6494906/news/Samsung-ElectronicsCo-Ltd--Samsung-Receives-49-Awards-Across-Multiple-Product-Categories-at-CES17811844/ [Accessed 22 Jan 2014]

2.FUNDINGUNIVERSE (2001) Samsung Electronics Co. Ltd History. Retrieved

from http://www.fundinguniverse.com/company-histories/samsung-electronics-coltd-history/ [Accessed 22 Jan 2014]

3. REUTERS (2012) Samsung Electronics Co. Ltd. Retrieved from

http://www.reuters.com/finance/stocks/005930.KS/key-developments [Accessed

22 Jam 2014]

4. Yahoo! Finance (2014) Samsung Electronics Co. Ltd. Retrieved from

http://uk.finance.yahoo.com/q?s=005930.KS [Accessed 23 Jan 2014]](https://image.slidesharecdn.com/samsunghistoryrecentdevelopment1-140215004816-phpapp01/85/Samsung-history-recent-development-1-19-320.jpg)