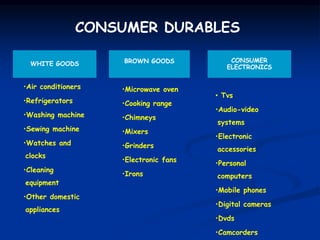

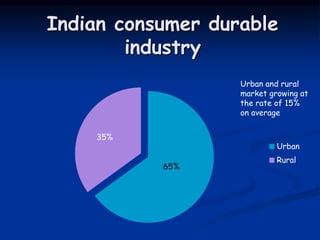

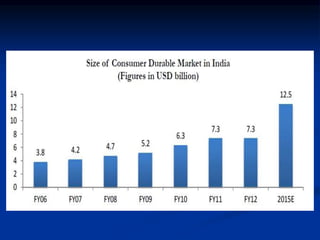

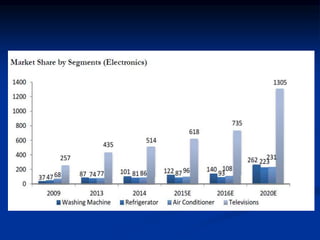

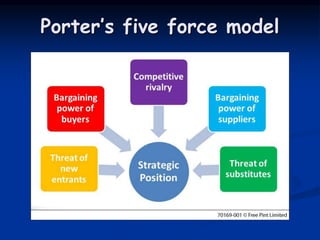

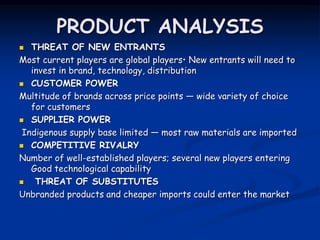

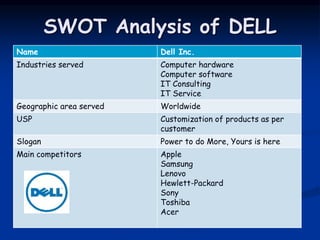

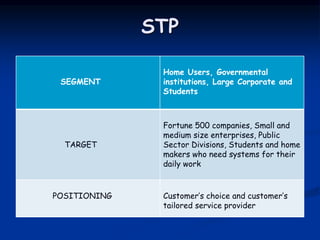

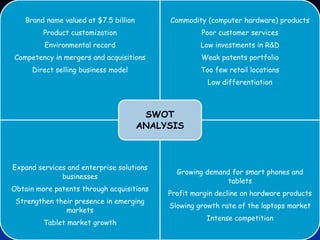

This document provides an overview of the consumer durables industry in India. It begins by defining consumer durables as durable goods that can last over 3 years, such as white goods, brown goods, and consumer electronics. It then discusses the top 5 emerging consumer electronics markets, with China and India as the leading countries. The document outlines the major players in the Indian consumer durables market and provides an analysis of the industry, highlighting growth drivers such as rising incomes and challenges such as new competition. Finally, it presents Porter's Five Forces model and a SWOT analysis of Dell as an example consumer durables company.